Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Our Publications

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

November ISM report shows positive numbers for metal fabrication

PMI increases to 59.3 percent for 27th straight month of manufacturing growth

- By Gareth Sleger

- December 6, 2018

The Institute for Supply Management’s (ISM) most recent report should help ease any premature recession tension in the wake of Wall Street’s rough start to the week. That’s especially true for the metal fabrication industry, which continues to surge on the back of an overall robust economy.

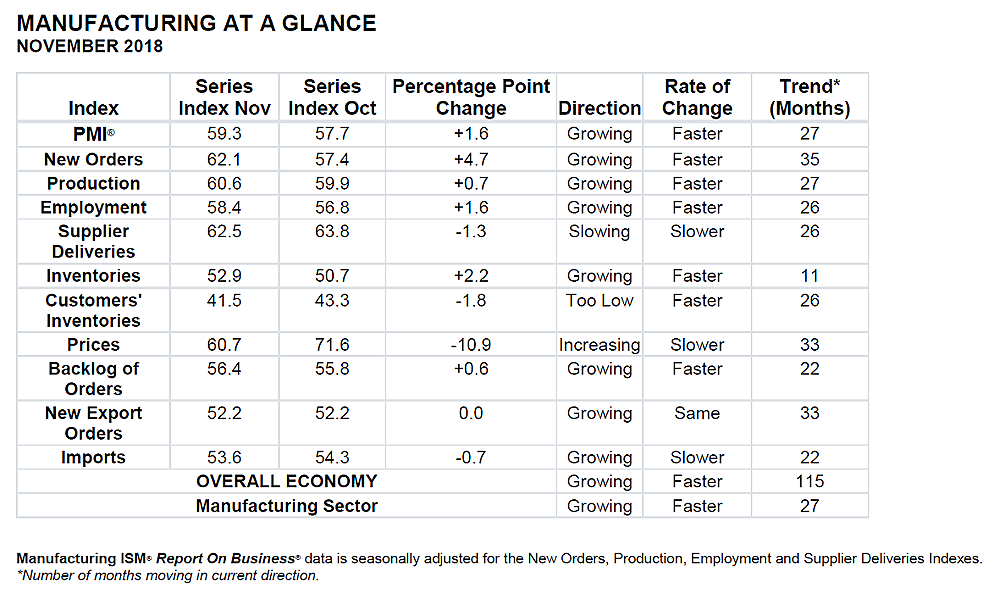

November’s Manufacturing ISM Report on Business released this week reveals that the U.S. economy has grown for 115th straight month and for the 27th consecutive month across manufacturing industries.

Last month’s Composite Manufacturing Purchasing Managers’ Index (PMI) registered at 59.3 percent, a 1.6 percent increase from October and slight bump over the 12-month 59.2 percent average. Any PMI reading more than 50 represents expansion compared to the previous month while a PMI less than 50 means contraction.

New orders (62.1 percent from 57.4 percent), production (60.6 percent from 59.9 percent), and inventories (52.9 percent from 50.7 percent, which shows building activity is increasing into tariff risks early in 2019) are also all up from October. In addition, pricing is at its lowest expansion since June 2017, plunging from 71.6 percent in October to 60.7 percent last month. Supplier deliveries have also dropped from 63.8 percent to 62.5 percent, which actually points out improved shop consumption and inventory growth.

“This indicates growth in manufacturing, led by strong new orders, production output and continued slowing supplier delivery performance,” says Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee. “This is the 26th straight month of slowing supplier deliveries and indicates supply chains’ difficulty in keeping up with production demand. Lead times continue to extend, supply chain labor issues continue to restrict performance, and transportation issues are continuing to limit supplier execution. However, levels are more manageable than in prior periods.”

For metal fabrication companies, it also signifies that the industry’s supply chain remains solid despite the on-going and ever-fluctuating trade war behind President Donald Trump’s steel and aluminum tariffs.

“Production expansion continued in November, and at higher expansion rates compared to October. Transportation variables, labor constraints and tariffs appear to be less impactful, but lead-time expansions persist,” Fiore said in the report.

But while the ISM business survey committee noted that price increases are beginning to soften a bit in metals (steel, aluminum, etc.), the metal fabrication skills gap remains a cause for concern. The fabricated metal products sector reported a decrease in employment.

One anonymous respondent from the fabricated metal products sector had this to say in the IMS report: “A lack of experienced workers is having an impact on production, which impacts sourcing due to the skills gap in the manufacturing trades; particularly computer numeric controlled machinists, but also assemblers and welders. The challenge is meeting customer-delivery requirements for new and repaired equipment.”

Overall, November’s IMS report proves to be mostly promising for the metal fabrication sector, which riding a boom into Q1 of the new year behind advanced automation and additive manufacturing. But 2019 is also shaping up to be a battle on two fronts for the industry: steel/aluminum tariffs and the skills gap.

About the Author

About the Publication

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI