Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Why managing material matters

FMA's "Cost of Doing Business Survey" shows the importance of inventory management

- By Tim Heston

- September 23, 2010

- Article

- Bending and Forming

In the pages of this magazine you’ll likely read the word lean more than once. Many managers out there say they’re giving the ideas behind lean manufacturing a try. Admittedly, the term’s a bit overused these days. Sure, there’s much to be said about the idea, but when you get rid of the window dressing, lean manufacturing is merely a means to an end. At the end of the day, it’s fiscal. Business is about the numbers.

Thing is, it turns out the numbers tell a good story too. Last year the Fabricators & Manufacturers Association conducted a revealing “Cost of Doing Business Survey.” The verdict: Metal fabrication isn’t a bad business. Honest.

Sixty-four metal fabricators submitted data—a tremendous amount of data, really, including gross and operating profits, liquidity measurements, sales and administrative expenses, and labor costs. They provided information on salaries for various job functions, employee turnover rates, average wage increases, medical plans and costs, employee benefits—the list goes on.

The top companies reported an average operating profit of almost 22 percent (median of 17.1 percent), with an average net income of 20 percent. Those aren’t bad margins at all. The most profitable companies tended to be small; the top performers’ average annual revenue was a little less than $13 million. Larger firms in the survey, with $113 million of annual revenue, had operating profit of 8.7 percent. Not surprisingly, these companies reported the greatest difference between gross and operating profit; large firms, after all, cost more to operate. But small size isn’t necessarily an advantage across the board. Firms in the bottom quartile of profitability had annual revenue of only $16.19 million.

Be aware that the survey gathered data from year-end 2008 income statements. For many, conditions really hit bottom sometime in 2009. Still, the survey tells a lot about this industry. Consider inventory turns. Many companies reported holding inventory—be it raw, work-in-process, or finished goods—for about 100 days. The most profitable, however, held on to inventory for only a little more than 50 days. The least profitable held on to inventory for more than 107 days.

The most profitable firms not only have higher inventory turns, but they also have low materials leverage, or the cost of plant-processed materials divided by plant-processed sales. The lower the percentage, the better, and in the survey the top-performing firms reported 33 percent, versus around 40 percent for less profitable firms.

Other telling figures include SG&A (sales, general, and administrative) costs. For the most profitable firms, the median SG&A cost was 12.6 percent of sales. For firms reporting a loss, the median SG&A cost ratio was nearly double that amount, at 22.5 percent.

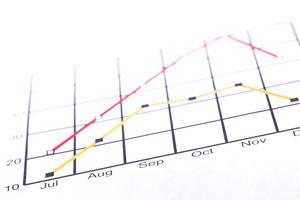

The figures also revealed something about return on assets (ROA), in this survey measured as operating profit divided by total assets. The higher the percentage, the more efficiently a company uses its equipment and other assets to generate profit. The most profitable companies reported a median ROA of 34.6 percent. What’s interesting is that the next quartile of companies, those with good but not stellar profits, reported a median ROA of only 15.6 percent. These fabricators also held on to inventory for almost 100 days—nearly double that of the most profitable firms (see Figure 1).

Here’s the kicker: Direct labor costs between the least and most profitable companies didn’t vary much. The survey asked for direct labor ratios, or the total cost of manufacturing employees divided by plant-processed sales. The most profitable reported a direct labor ratio of 20.7 percent. The quartile of companies reporting an operating profit median of just 4.9 percent also reported the lowest direct labor ratio: 18.2 percent. In other words, high-profit firms actually reported slightly higher direct labor costs than low-profit firms.

The more inventory turns, the better a plant manages what usually is one of the most expensive items on the books: material. And companies that practice lean manufacturing tend to have higher inventory turns. As just one example, Decorated Products, a make-to-order metal label manufacturer (see “Lean inventory complements lean production”), increased its inventory turnover rate from 1.2 to 15 times annually. They did it by decreasing manufacturing time through setup time reduction and by using other lean manufacturing tools.

The company also did it through vendor-managed inventory (VMI) agreements. Decorated holds much of its raw stock on consignment, meaning it pays for material only as it is put into production. The company has reduced its cash cycle time dramatically. In fact, it often pays for a job’s material only 10 business days before receiving payment from the customer for the job, and managers are looking to reduce that window even more.

“Inventory turns are a quick way to measure the time value of money,” explained Shahrukh Irani, associate professor at Ohio State’s Department of Integrated Systems Engineering. “Every dollar you invest on an order accrues interest at some borrowing rate, were you to take it from a bank.” As material sits on the floor as incomplete orders, costs mount “unless you ship that order as fast as you can.”

When it comes to increasing profitability, a big part of the equation seems to be managing material. This happens via strategic material sourcing and by shortening the time it takes to turn raw material into finished product—and lean manufacturing, with its focus on eliminating waste and reducing setup times, tends to accomplish this.

Low inventory doesn’t create business success alone, of course. Strategies like diversifying a customer base, customer service, and value-added engineering can count for a lot, depending on the business. But a big part of the equation remains good inventory management. Companies with a better handle on inventory may spend less getting orders in the door (that is, less on SG&A), have more cash, make better use of their equipment investment (a high ROA ratio), and earn higher profits. All in all, that’s not a bad place to be.

The Fabricators & Manufacturers Association will be releasing its next financial benchmark study in 2011. To obtain the complete FMA 2009 “Cost of Doing Business Survey,” visit www.fmanet.org or call 888-394-4362.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI