Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2015 metal fabrication forecast: Steady as she grows

Fabricators expect continued, though not skyrocketing, growth for next year

- By Tim Heston

- December 8, 2014

- Article

- Shop Management

Doug Olds, vice president of Washington Metal Fabricators, remembers metal fabrication as a different business before the Great Recession. The Washington, Mo., company wouldn’t be in business if it didn’t do some analyses before it made the move toward purchasing equipment or hiring people, of course, but he remembers the whole process being more relaxed, less intense.

Postrecession, this all changed, and Olds feels it’s for the better. “The recession helped us in a very strange way,” he said. “While we took a big hit and a one-year loss, it changed our philosophy on how we do business and how we buy equipment. We’re much stronger now coming out of the recession.”

“For us, the past three years have been almost carbon copies of each other, and that’s a good thing.” So said Scott Vidimos, president of Vidimos Inc., an industrial fabricator in East Chicago, Ind. “It’s about making a reasonable profit at the sales volume we have.”

Brent Cessna of S & B Metal Products, with plants in Ohio and Florida, has a similar story. “We thought we’d have some large projects pop this year, but that hasn’t happened. Still, we’ve stayed steady, and we haven’t lost any ground during the past couple of years. We’re thinking it may be up about 5 percent for 2015.

“Overall, we’re still steady,” continued Cessna, who is general manager at S & B’s Twinsburg, Ohio, plant. “We’re gaining just a little bit of ground, but we’re not losing any ground either.”

These views reflect those of many custom fabricators heading into 2015. It’s steady as she goes, but the ship won’t steer itself, especially considering the choppy seas of the global economy.

Market Trends

Europe continues to struggle, which hurts U.S. exports to that region. “Europe once represented a quarter of all of our exports. Now it’s closer to 9 percent, and it continues dropping.”

So said Chris Kuehl, economic analyst for the Fabricators & Manufacturers Association International® (FMA) and managing director of Armada Corporate Intelligence, Lawrence, Kan.

China too is struggling. The Conference Board recently predicted only 3.9 percent GDP growth for the country next year, which is extremely low, considering the number of people that country needs to employ. “Most are saying it won’t be that bad,” Kuehl said, “but many are predicting about 5.5 percent GDP [for China]. That’s not catastrophic, but that’s half of what it used to be.” Kuehl added that the only export markets looking halfway decent are Mexico and other countries in Latin America.

The dollar continued to strengthen in the fourth quarter, which can hurt exports, but as Kuehl pointed out, it’s not rising because of U.S. policy or, for that matter, any domestic factor; it’s rising because much of the rest of the world just doesn’t look as good as the U.S. right now. “At this point, it’s not the dollar getting stronger; it’s everybody else getting weaker. Put another way, the dollar is getting stronger in spite of itself.”

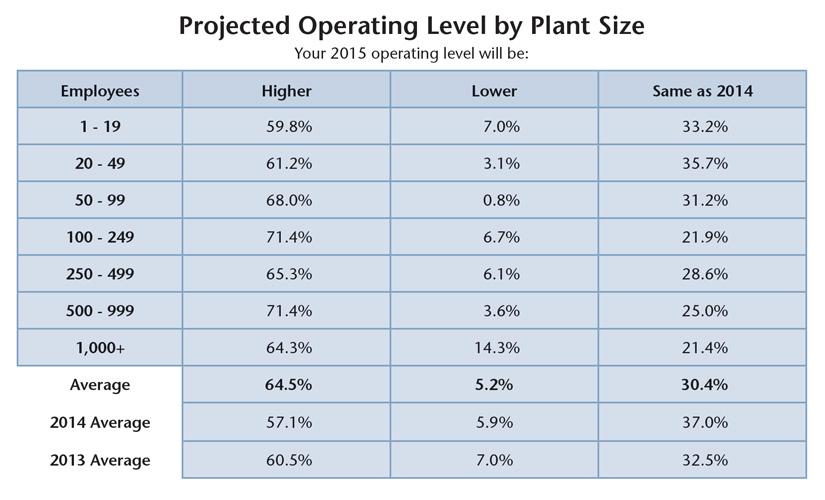

Figure 1

Most in the industry expect operating levels to stay the same or rise in 2015, continuing a trend that has edged positively for the past three years. Source: “2015 Capital Spending Forecast,” FMA.

He added that all this talk of problems with exports and a strong dollar should be balanced with some perspective that considers the sheer enormity of the U.S. economy. “We’re still living in a country where Texas has the same GDP as Canada, where Dallas alone has the same GDP as Argentina.” The U.S. is a piece of a global economic puzzle, but it’s an extraordinarily large puzzle piece.

There seems to be enough pent-up consumer demand stateside to keep the economy rolling in the short term. According to an October study from Thomson Reuters/University of Michigan, consumer sentiment is as high as it’s been since July 2007. The Conference Board came out with similar results; consumer confidence, after dipping a bit in September, rose again in October.

Combine this with falling unemployment and gas prices, and you get a consumer that may be willing to ramp up spending—new cars included. In October, J.D. Power and Associates said it expects new-car and -truck sales will climb to 13.83 million in 2015. “The average age of the fleet is still 13 years,” said Kuehl, “and Americans still want cars.”

Consumer confidence also is helping the outlook for recreational industries, including RVs and boats. According to a forecast from the American Recreation Coalition, most components of the recreation industry reported significant gains in 2014, and the general outlook for the outdoor recreation industry in 2015 is optimistic.

(After one late-October road trip, Kuehl quipped, “Just on the highway today I’ve seen more gigantic RVs than I thought existed. They’re like rock star tour buses.”)

The U.S. has become a major oil and gas producer, which has benefited fabricators that serve not only drilling and extraction, but also heavy transportation. Railcar deliveries continue to trend upward. According to a report from Railway Age, “Due to the rapid expansion in oil production and the lack of any significant pipeline additions, rail will continue to benefit, and we anticipate strong annual deliveries of oil service tank cars throughout the forecast horizon.”

Falling gas and oil prices may be good for consumer confidence, but they do present problems for the oil and gas sector. Gasoline is mostly an inelastic good, Kuehl said. “People don’t see low gas prices and say, ‘Hey, I’m going to drive to Montana for the heck of it.’ We’re starting to learn what the other oil states have learned. After a while, you produce more than people can consume.”

Kuehl added, however, that—depending on how the political climate evolves—2015 may well be the year that the 1970s-era law preventing export of U.S. crude may finally go away, which will open up more opportunities for the sector.

Nevertheless, making U.S. crude available to the world probably won’t have an immediate effect on prices. “We already export a lot of refined products,” Kuehl said. “But frankly, the worldwide demand just isn’t there. We could sell a lot to Europeans, but they don’t need any more until their economies recover.”

The fossil fuel glut includes coal. Australian mining giant BHP Billiton Ltd. announced record output from July through September, a whopping 12.8 million metric tons, just at a time when the world doesn’t need all of it, especially China and Japan. As The Wall Street Journal reported, “Miners are shoveling more metallurgical coal into a global market already awash with the steelmaking commodity, delaying any recovery in prices that are at multiyear lows.”

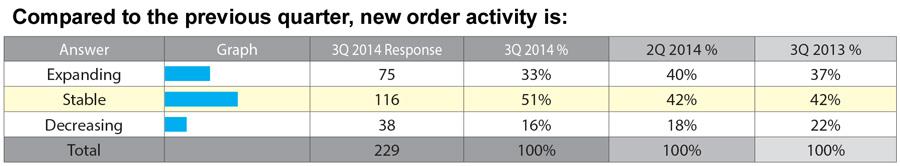

Figure 2

New-order activity largely remained stable or increased during the past year, but decreasing order activity isn’t insignificant. Source: “3rd Quarter 2014 Forming & Fabricating Job Shop Consumption Report,” FMA.

This in turn is making an already slowing mining equipment industry even slower. According to Bloomberg Intelligence, equipment demand from Caterpillar’s top mining customers is forecast to shrink by 18 percent during the next two years.

On the other hand, Caterpillar reported that commercial construction in North America is holding steady. According to Bloomberg data, construction spending in August rose 5 percent from a year earlier. Overall, Cat is forecasting 2015 growth to be modest or flat.

Some of those construction dollars will be going to storage facilities tailored for another business that’s experiencing a glut of products: farming.

As Kuehl put it, “Bumper crops are great for agriculture when it comes to productive capacity, but it’s miserable as far as making money. The price of almost everything is nearly half of what it was a year ago, and a lot of farmers are putting as much as they can into storage, hoping they can get a little better price by selling it later.” This, he said, has put a strain on Deere & Co. and others in the agricultural equipment space.

OEMs seem to be balancing a U.S. economy that’s strong enough for the Fed to phase out quantitative easing, with lackluster performance overseas. On the one hand, you have lowering unemployment, rising consumer confidence, and a busy automotive sector. On the other hand, those plummeting commodity and food prices, which are boosting consumer confidence, are creating uncertainties of their own. All the same, the energy sector itself—thanks in large part to the hydraulic fracturing boom—is bigger than anyone thought possible just a decade ago.

All this makes for complicated forecasting. Still, according to the “2015 Capital Spending Forecast” from FMA, released at the FABTECH® show in November, most in the industry expect operating levels to stay the same or rise, and the trend has edged positively for the past three years. Only 7 percent expected a decrease in 2013; only 5.9 percent expected a decline in 2014; and this year only 5.2 percent expect lower operating levels for 2015 (see Figure 1).

A look at quarter-to-quarter activity brings up a little more complexity, though. FMA’s quarterly “Forming & Fabricating Job Shop Consumption Report” shows that new-order activity largely remained stable or increased during the past year, but the number of shops reporting decreased order activity isn’t insignificant: 16 percent reported declines in the third quarter and 18 percent in the second quarter (see Figure 2).

This shows a competitive industry, especially when it comes to winning large accounts—the lifeblood of many contract fab shops. In FMA’s “2014 Financial Ratios & Operational Benchmarking Survey,” more than half of respondents said that 80 percent of revenue came from fewer than eight customers. Lose one large customer, and activity on the shop floor declines rapidly.

Building Capacity

Custom fabricators need to juggle highly variable demand cycles from myriad customers, and to do that they need capacity. Judging by the “2015 Capital Spending Forecast,” they’re building that capacity with more equipment. Projected capital spending growth has slowed from the dramatic rebound seen postrecession—2015 projections are up only 3.5 percent over 2014—but the spending has shifted.

Specifically, fabricators are expecting to spend much less on consumables and supplies (down almost 30 percent) and more on capacity-building machinery, especially in cutting and forming, where spending has jumped past prerecession levels.

Preparing for the Unexpected

The fabricating industry is looking to add capacity to gear up for the unexpected. Custom fabricators are all too familiar with demand variability, and demand has become even more variable in recent years.

As Olds from Washington Metal Fabricators put it, “Our forecasting is getting better, but sometimes we don’t see it coming. It’s the nature of the business.”

Garry Griggs, CEO of Magic Metals, a custom fabricator based in Union Gap, Wash., launched his shop in the mid-1980s, and he’s seen customer demands and inventory requirements ramp up over the years. “We have one customer that we ship about 15,000 parts a day to on a just-in-time basis, and we don’t know what we’re to ship them until the night before.”

With 160 employees, Magic Metals made $25 million in 2013, and Griggs said he has been touring vendor showrooms on the lookout for new, capacity-building equipment. He added that those shops that don’t have the capability to respond quickly may have a difficult road ahead. “It’s going to be tough if you’re not fast enough.”

But for those that are fast enough, he has a positive outlook. “I am very positive that manufacturing will have its renaissance,” he said. “We lost some competitors after the recession, but those of us who are left are that much better.”

For more information on FMA’s 2015 Capital Spending Forecast, the “Forming & Fabricating Job Shop Consumption Report,” and the “2014 Financial Ratios & Operational Benchmarking Survey,” visit www.fmanet.org, or call 888-394-4362.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI