- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Economy edges out other concerns

- By Vicki Bell

- February 26, 2008

- Article

- Shop Management

for the past four years, the fabricating update e-newsletter has surveyed its subscribers—metalworking professionals—about their main business concerns. for three years, steel prices ranked no. 1. in the 2008 survey, we added a concern that is on the front burner in this presidential election year, one that affects every citizen, regardless of occupation—the u.s. economy.

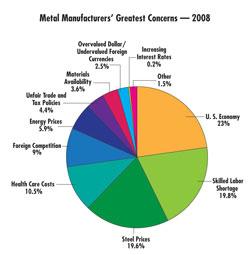

given all the economic coverage of late, it probably comes as no surprise that in this survey, the u.s. economy ranked as the no. 1 concern at 23 percent. running neck-and-neck for the no. 2 concern were the skilled-labor shortage (19.8 percent) and steel prices (19.6 percent).

the other concerns listed in previous surveys and repeated in the 2008 survey ranked as follows: health care costs (no. 3, 10.5 percent); foreign competition (no. 4, 9 percent); energy prices (no. 5, 5.9 percent); unfair trade and tax policies (no. 6, 4.4 percent); materials availability (no.7 8, 3.6 percent); overvalued dollar/undervalued foreign currencies (no. 8, 2.5 percent); and increasing interest rates (no. 9, 0.2 percent).

the remaining 1.5 percent of respondents chose the category "other."

economy in the news

on the day this article was begun, msnbc.com featured the following headlines in its business stories: "why fed rate cuts may be spurring inflation"; "consumer confidence weakens significantly"; "foreclosures up 57 percent in the past year"; "key home price index shows record decline"; "home depot's profit drops 27.5 percent."

among the articles on the home page of the new york timesweb site were "new data show rising inflation and slumping home values" and "ford is pushing buyouts to workers."

also on this day, cnn.com ran the story "bernanke vs. the economy," in which staff writer david ellis reported that federal reserve chairman ben bernanke and treasury secretary henry paulson warned in mid-february that the u.s. would see slower economic growth in the coming year, but the two believed that the economy would avoid tipping into a recession, helped in part by the $170 billion economic stimulus package signed by president bush feb. 13 and recent interest rate cuts by the federal reserve.

embedded in the cnn article was a Quick Votethat asked this question: Do you believe the U.S. economy is in a recession? Among the 23,174 responses tallied at the time this article was written, 80 percent said yes and 20 percent said no.

A day later, Feb. 27, msnbc.com's lead story bore the headline http://www.msnbc.msn.com/id/23367821/Bernanke: "Fed ready to act to boost economy—Fed chief tells Congress economic situation is distinctly less favorable."

The article reported, "'The economic situation has become distinctly less favorable' since the summer, the Fed chief told the House Financial Services Committee. Since Bernanke's last such assessment last summer, the housing slump has worsened, credit problems have intensified, and the job market has deteriorated.

"Bernanke said that the confluence of these factors has turned people and businesses alike toward a more cautious attitude toward spending and investment. This, he said, has further weakened the economy."

Clearly, the economy is a justifiable concern. However, one can't help but wonder if the media is simply reporting the problems or in fact is making the situation worse by focusing predominantly on bad economic news and under-reporting any positive news that could help raise consumer confidence and create more spending and investment.

Fabricators on the Economy

Several subscribers who responded to the Fabricating Update survey expressed their fears that the media is part of the problem. One wrote, "The U.S. [population] has heard that we are in a recession and are taking the media serious. I'm worried that fear will override reason when it comes to doing business."

Another wrote, "Consumer confidence is important for our business, and it is affected by the state of the economy and the media."

One respondent expressed his belief that "Prices and costs can be mitigated, but when the economy goes south, it will eventually shut down commercial construction."

Business in 2008

How is business faring early in 2008 for metal fabricators? It's a mixed bag. Some fabricators are experiencing declining business, while others are booming.

Among those whose businesses are doing well is a subscriber from a company that manufactures pumps. He wrote, "We have not seen a slowdown in our business. [The shortage of] skilled help is our No. 1 concern; material issues are No. 2. Everywhere I go, I have to stand in line at numerous suppliers. I do not see a downturned economy, or recession. I only see steady growth—double-digit percentages."

Another subscriber wrote, "We could easily take on 25 to 30 percent more work, if we only had the skilled labor to do it."

According to one respondent, his industry currently is faring well: "The economy is looking very healthy in the aerospace/defense sector; we are in our third record-breaking year in a row."

Others said that at this time, they are not seeing an economic slowdown in their businesses. Perhaps their businesses are farther down the chain of those that suffer as the economy tightens?

Some subscribers reported that they already are feeling the effects of a weaker economy: "Sales are at a lower level at this point."

"We have had to lay off 19 percent of our work force due to poor sales in this troubled economy."

One subscriber spoke for those companies that work on large, cooperative projects: "Many of the items on this list are of great concern to me. The price of materials and skilled-labor shortage I would say would be my next two biggest concerns. However, if the economy is doing poorly, that will have the greatest effect on my business. A lot of our industry depends on very large projects. Many companies will only get a small portion, but it's like a dead whale in the water in the fact that many companies are fed by that one huge project. When the economy is down, many of those projects get put on hold and the sales dry up. At that point, you have to ride it out and hope you can undercut your competition. Our product is mainly American-made, so trying to undercut Chinese pricing is getting difficult."

Skilled Labor

Second to economic concerns and surpassing steel prices for the first time is the skilled-labor shortage.

Commenting on the labor shortage, subscribers said:

"Skilled tube welders are not being trained fast enough to replace the retirees."

"I see the demand for welders in the industry. I teach welding, and get two or more phone calls a week, as well as walk-ins and e-mails, asking for my welding students to apply for jobs."

"The lack of skilled labor is a major concern; pride of workmanship is a big concern as well."

"If we don't have skilled labor, none of the other things will be an issue."

"Our educational system and parents have failed to prepare this generation for the work force."

"We would like to increase our sales and the business is currently there, but we cannot find enough skilled labor to do it."

Several subscribers noted the need for a more educated work force. "My company and many other ones in the state of Wisconsin are experiencing an acute shortage of skilled welders that have the ability to work from drawings and written weld procedures to successfully complete complicated weldments."

Another echoed this thought: "Not only is skilled labor scarce, but there is a major shortage of welding engineers. Most fabricators do without but are falling behind European and Asian companies who have them and are taking advantage of their abilities to get complex work done correctly and efficiently. Solution—invest in university programs (i.e., LeTourneau, Ohio State, Ferris State, Penn College of Technology, Montana Tech, and Utah State) and direct promising young people their way."

One addressed how higher education has contributed to the lack of skilled labor: "College-college-college ... it was stuffed down our throats as the ticket out of the mills and into a life of 8-to-4 and cushy jobs. I have a bachelor's degree in business, and some of our skilled employees make more than I make. Now, our company is at a loss when it looks for more of these skilled welders, fitters, or inspectors as they simply don't exist! Everyone now is book smart with no experience! All of the labor jobs are gone overseas, to a large degree, and everybody jumped on the bandwagon with college being the lifesaving career choice."

Steel Prices

Steel prices, a longstanding concern of metal manufacturers, continue to rise. Dan Davis, editor-in-chief of The FABRICATOR®magazine, provided a snapshot of pricing trends in his blog post, "Steel price boom a bust for fabricators" on thefabricator.com. Davis said, "[Fabricators] remember back in 2003 when prices were much more reasonable. For example, hot-rolled sheet was selling for less than $300 per ton back then, and now it's selling close to $600 per ton. Granted, those 2003 prices were below historic averages, but since then the prices have risen to historic highs. This is a history lesson no fabricator wants to sit through."

Davis concluded that the upward trend in pricing isn't going to disappear any time soon.

Few Fabricating Update subscribers who chose steel prices as their No. 1 concern commented on their choice. They likely have come to the acceptance stage of the grieving process when they acknowledge "it is what it is, and we have little control over it."

However, among the comments made was this impassioned plea to suppliers: "The small gains in margin [we] made last year will be entirely negated by the recent increases in cold-rolled steel. My plea to the mills: Stop playing games with the market!"

Another subscribe simply wrote, "Steel increases could kill many small auto suppliers."

Steel prices are affecting entities besides manufacturing. An educator said, "I'm a high school welding instructor, and the cost of steel and hard goods to run a welding program is increasing every year. If the prices continue to increase, I'm not sure if our program will last. I am sure there are other welding programs out there that are feeling the same with the increases."

Other Concerns

Other concerns listed on the survey registered votes and comments.

Health Care Costs—"A hard choice to make. Health care cost and the skilled-labor shortage are both at the top of my list." Another subscriber believes that health care costs are affecting the skilled-labor availability, and another wrote about the impact on his company: "Our 32-year-old manufacturing company is being crushed by the cost of health care coverage."

Foreign Competition—One subscriber wrote, "I feel that I have been sold out to the multinationals and free traders." Another conveyed a graphic picture of what he sees as the ultimate result of foreign competition: "The bloated costs of manufacturing in America are going to be punctured by the rising needle-sharp pin of the Chinese manufacturing environment, leaving an exploded, rotting American carcass to dry under the burning sun of the new world order."

Others, feeling that they can't beat the competition, are joining them. "We now manufacture 70 percent of our product in China."

Energy Prices—Ranked No. 8 in the 2007 survey, energy prices have overtaken unfair trade and tax policies. With oil price at an all-time high, this comes as no surprise. Commenting on this concern, a subscriber said, "One thing that seems to be strangely missing from the presidential candidates' positions/concerns is the cost of gasoline and fuel. I believe that is the main cause of our current difficulteconomy, and no politician has even mentioned it? This increased cost in fuel affects EVERYTHING—employees, both potential and current, have experienced triple the cost of fuel, requiring shorter commutes for potential employees, effectively shrinking the available labor pool limited by travel distance from work, not to mention freight cost for shipping everything from raw material to finished product."

Unfair Trade and Tax Policies—The percentage of subscribers who chose this category as their No. 1 concern stayed almost the same as the percentage in 2007 (4.4 in 2008 versus 4.5 in 2007). Among the comments received on this topic was:

"If taxes in this country were made equal across the table, it would bring jobs back to this country and put more people back to work in good paying jobs. If you look, all of the good jobs are going out of country because of labor cost and taxes that are placed on the manufacturers. [We need] fair and equal taxes across the board."

Tax concerns aren't confined to the national level. A subscriber from New York said, "Every time we increase business, New York State increases some fee. We just received a use-tax on our trucks, as well as the increased tolls."

A former New Yorker weighed in on trade policies: "My company in New York closed and moved operations to Mexico, where I have now been residing for nearly two years. Other co-workers were not as fortunate and are now struggling to start over again in new careers and new fields of work. I feel that NAFTA has much to do with Americans losing their jobs to countries offering lower wages, fueling the degradation of the U.S. economy in the efforts to reduce production costs and serve evolving nations."

Another subscriber believes, "We can all compete if we have support from our leaders. Enforce the trade policies in place."

Materials Availability—Difficulty obtaining materials is a serious concern for some companies. One fabricator said, "We [experienced] a titanium material shortage last year, causing parts shortage for a long time."

Another said, "A lot of material that we use is becoming hard to get—for example, A514 plate. The demand as far as I know has increased tremendously. So for what is available, you have to pay a pretty penny to get it. Then there is the fact that you have to buy domestic on certain items, and this is getting bad. There are times that we quote an order with imported steel and when we get the order, only domestic is available."

Overvalued Dollar/Undervalued Foreign Currencies—The percentage of subscribers choosing this category also has stayed virtually the same (2.5 percent in 2008 versus 2.4 percent in 2007). One subscriber summed up the effect of undervalued foreign currencies by saying, "Ultimately, if China's currency wasn't undervalued, they couldn't produce and ship [products] into the U.S. for 40 percent less than we can sell our product domestically."

Rising Interest Rates—With the Federal Reserve continually cutting interest rates, this category garnered only 0.2 percent of votes as the No. 1 concern and no comments. At this point, it appears that fabricators are not concerned about interest rates or are more concerned with other pressing challenges.

Many respondents wrote about how interrelated the concerns are and how difficult it was to select just one. "All of the above are critical issues, and many of them tie closely together. The reason that I put the economy first is that all of the other issues affect the economy. I would really put our unfair trade policies at or near the same level. We have lost enough manufacturing plants. Our politicians do not see the big picture with respect to manufacturing; they appear to see only the direct worker level and not the number of highly skilled jobs that support a typical plant. Not to mention the business-to-business component that supports lots of other jobs."

Another subscriber said, "They all weigh heavily on our business," and one expressed the importance of all factors more vividly when he said, "A survey of this type is like asking if you would rather be shot or hanged. The real problems in the U.S. are structural, and until they are addressed, we will continue to quibble about details."

Related Survey

Around the time that the Fabricating Update survey was being conducted, the Fabrinomics™ newsletter ran a similar survey. This newsletter asked its readership, members of the Fabricators & Manufacturers Association International® (FMA), this question: "What concerns you most about U.S. manufacturing?" Respondents could select up to three answers.

The choices and the percentages of responses in descending order of frequency are:

- Cost of raw materials (66 percent)

- Availability of skilled workers (64 percent)

- High energy costs (42 percent)

- Foreign competition (40 percent)

- Availability of raw materials (35 percent)

- Uncertainty in the stock market (1 percent)

- Staying current with new laws and regulations (less than 1 percent)

Fabrinomics comprises summaries of recent relevant business and economic stories delivered to FMA/TPA members by Dr. Chris Kuehl, FMA's economic analyst and founder of Armada Corporate Intelligence.

For more information about membership, visit www.fmanet.org.

About the Author

Vicki Bell

2135 Point Blvd

Elgin, IL 60123

815-227-8209

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI