Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabrication investment strategy: Keep buggering on

How shops that invest for the long term win

- By Tim Heston

- October 13, 2016

- Article

- Shop Management

Winston Churchill had a maxim that remains quite apt today: KBO, keep buggering on. Business overall has seemed to enter a new normal, a long phase of slow growth, with some sectors booming and others struggling. All the while the industry’s best fabricators keep investing in equipment, facilities, and their people; work to gain more business; and, well, continue buggering on.

The “2016 Financial Ratios & Operational Benchmarking Survey,” published by the Fabricators & Manufacturers Association International® (FMA), details respondents’ financial performance from 2015. Released annually, this year’s survey shows that respondents had an average operating profit of 5.0 percent, with an average EBITDA (earnings before interest, taxes, depreciation, and amortization) of 8.4 percent. That’s down from 2012, when the Great Recession recovery was in full swing. The average operating profit then was 7.0 percent, and EBITDA margin was 10.4 percent.

Keep buggering on.

A quick disclaimer: These averages come from a sample of 56 companies that reported broad ranges on many ratios and performance metrics. Some companies had EBITDA margins greater than 15 and even 20 percent; others had EBITDA margins of less than 5 percent. Also, again, this data comes from fiscal 2015, and of course business conditions for many have changed since then.

Many metrics and benchmarks depend heavily on a company’s product and customer mix. A project-based fabricator that ships several dozen or so large jobs a year will have different numbers than a piece-part fabricator that ships sheet metal parts out the door multiple times every day.

Although the survey sample is small, the information respondents provide goes extraordinarily deep. Custom metal fabrication is by and large a sector made up of small, private enterprises, and the survey offers one of the few windows available into the finances and benchmarks that drive this industry.

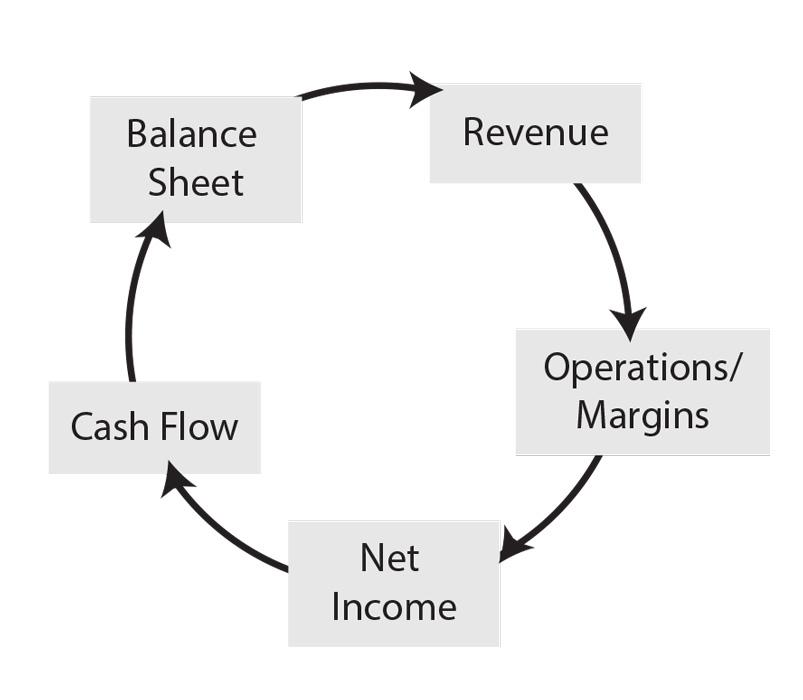

Steve Zerio, an FMA board member who spent three years at a large, multiplant metal fabricator, and who is now CFO at Wixom, Mich.-based Form Tech Concrete Forms, presented a webinar on the survey in September. In it, he described the financial cycle (see figure). Revenue from a shipped order funds operations and margins, which produces net income, which drives cash flow that bolsters the balance sheet, which in turn drives the direction of new orders that, again, provide revenue—and the cycle starts again.

Declining EBITDA can present challenges, of course, and cause the financial cycle to not work as it should. Jobs produce revenue, but that revenue isn’t high enough to sufficiently fund operations. Old machines aren’t maintained or replaced, which makes firefighting maintenance commonplace; people may be overworked and underpaid. All this creates a risky situation that’s tough to sustain.

So how can a shop work to improve its financial standing in this competitive climate?

Quite often, it’s about finding a market sweet spot. A fabricator with high margins may have uncovered a niche or provide a service for which customers pay a premium. Alternatively, a fabricator may focus on extremely high-end processes that aren’t very common, and the lower supply drives a higher price. The shop also could have extraordinarily lean processes with a very short order-to-cash cycle, freeing more capacity. If that capacity is sold, the same resources can now produce more revenue.

Still, this is a competitive industry. Many shop owners have told me that lead time demands continue to become more stringent. According to the survey, average on-time delivery, a long-standing challenge in custom fabrication, is at 86 percent. Some are resorting to holding more finished-goods (or at least “almost finished”) inventory, so they can respond immediately once a major customer triggers an order.

Moreover, the average number of days in accounts receivable (DAR) is climbing, from 43 days for fiscal 2012 to 46 days in fiscal 2015. All this shows that shortening the order-to-cash cycle—or, more precisely, the time between spending money on material and people and receiving money for the order—isn’t easy.

During the past several years the survey has tracked “value added per payroll dollar.” To calculate this metric, subtract material costs from total sales and divide the result by total payroll expenses. During the past four years, this metric has remained remarkably consistent, averaging between 2.13 and 2.49. So for every dollar fabricators spend on people (and after subtracting material costs from the equation), the company gets a little more than $2 in return.

Then there’s the operating return on net assets, or ORONA. This metric divides operating profits by total assets minus accumulated depreciation. A high ORONA means that company assets are producing more operating profit. During the past three years, this metric again has risen slightly. In fiscal 2013 it was 11.6 percent, jumping up to 14.6 and (for 2015) 14.9 percent.

One interesting trend here is that average ORONA in fiscal 2015 was slightly higher even though average operating profit was lower, at just 5 percent. This may show that fabricators are meeting increased competition with efficient use of resources—like, say, a fabricator that invested in a press brake with automatic tool change, so now one operator and one machine can do the work of three machines and three people.

That’s a move in the right direction, and it shows a business model that’s sustainable, even in an environment of intense competition. For custom fabricators that bugger on, invest for the long haul, and provide secure and rewarding employment for their people, this is very good news indeed.

To obtain a complete copy of FMA’s “2016 Financial Ratios & Operational Benchmarking Survey,” visit www.fmanet.org/store, or call 888-394-4362.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI