Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

The 2017 FAB 40: Tooling up for growth

Top shops predict a better 2017

- By Tim Heston

- June 20, 2017

- Article

- Shop Management

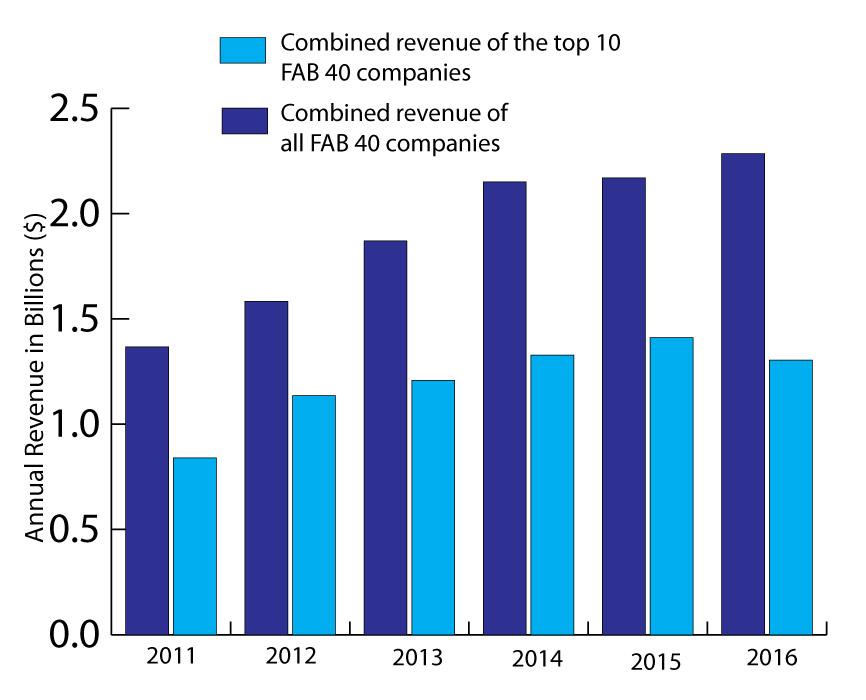

Figure 1

The combined revenue of the FAB 40 continues to grow, though revenue of the top shops fell in 2016 due to softness in some key markets. Most predict higher growth going into 2017 and beyond.

After a less-than-stellar 2016, the custom metal fabrication industry this year seems to be breathing a collective sigh, doubling down, and preparing for significant growth. That in a nutshell is what this year’s FAB 40 tells us.

Some big markets last year—including oil and gas, transportation, and various heavy equipment sectors—had seen better days. But according to many in the FAB 40, some of these markets have likely bottomed out and are on the rebound. (This doesn’t include the automotive sector, which has been softening for some fabricators.)

Since 2010 The FABRICATOR has published its annual FAB 40, a cross section of successful metal fabricators, and at this point the list has become a valuable tool that helps uncover some trends in what remains largely a private industry. Market researchers can’t turn to SEC filings to truly find out what’s going on.

Categorizing custom fabrication becomes even more difficult as you start to analyze the industry’s largest players, including those who participate in the FAB 40. Many offer machining. A few are vertically integrated (to varying degrees) with metal service centers. And at least one company offers plastics as well as metal manufacturing.

Fabricators continue to offer more and more services, sometimes through organic growth, but more often because of strategic acquisitions. Investors know that having a unique process mix can really set a shop apart. It’s not about establishing a “one-stop shop in metal fabrication” anymore. After all, if a customer needs both plastic and metal parts, even the broadest metal fabricator isn’t a one-stop shop. Today it’s about growing a one-stop shop for a target group of customers. In this sense, customers are shaping the way their suppliers grow more than ever before.

This approach also helps with differentiation. Good management can improve delivery and quality performance, but what about bringing in an entirely different type of manufacturing? Duplicating that isn’t a straightforward affair.

Scale helps here too. A $10 million sheet metal and plate fabricator might buy a small machine shop, perhaps invest in a drill line to get into a little structural work, but it’s probably not going to invest in plastic injection molding or bring in a coil processing line. As the profiles on the following pages show, the same thinking might not apply to a $50 million fabricator (or an investment group that owns that fabricator).

All this is happening as more custom stampers are entering metal fabrication, and more custom fabricators are adding stamping presses to tackle the medium-volume market. Fabricators now can follow a product life cycle, from prototyping through lower-volume fabrication to higher-volume stamping. And they can offer machining and other ancillary processes.

Customers have driven this evolution for years as they send more work to fewer top-performing suppliers. The dot-com bust and Great Recession played a role, too, as fabricators acquired the assets from machine shops at competitive prices. And the acquisition activity continues as shop owners of the boomer generation near retirement.

So how does one describe a custom metal fabricator these days? The FAB 40 is a good place to start. In total, these companies serve disparate customers, from heavy structural and construction projects to intricate assemblies for medical equipment and devices. But anchoring it all is sheet, plate, and tube fabrication.

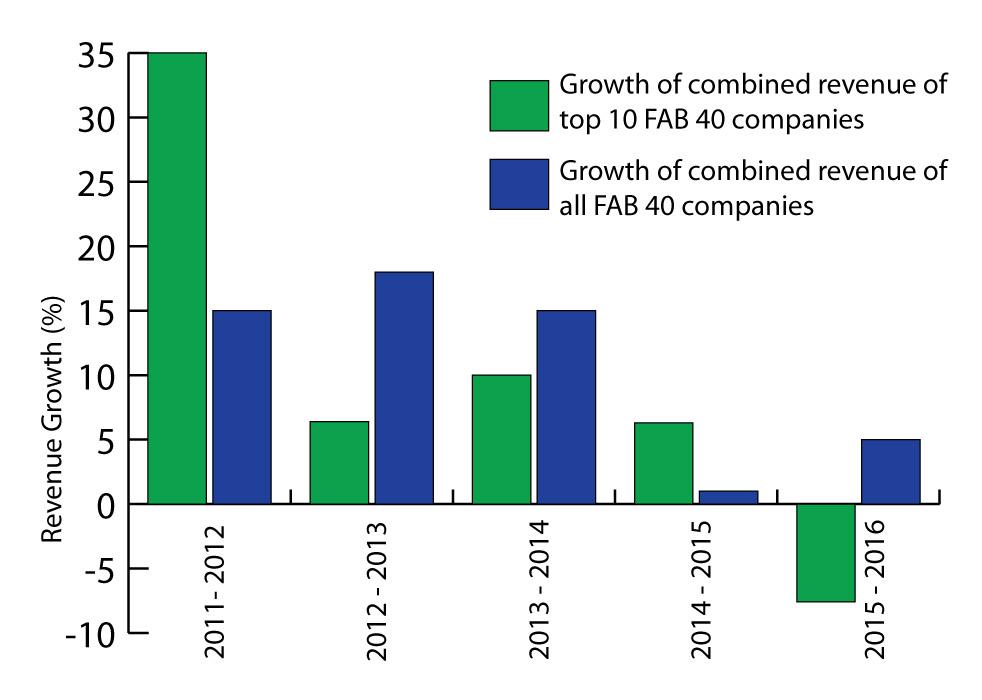

Figure 2

Growth rates for the FAB 40 in 2011 and 2012 skyrocketed as the industry continued to rebound from historic lows during the Great Recession and acquisition activity increased among the largest shops. Growth has slowed since and has remained somewhat flat for the past two years. Many predict robust growth to return in 2017.

Even within this list, the characteristics of each business are very different. For instance, sales per employee varies tremendously, mainly because of the different costs of material and outside services. A fabricator of large construction projects may have a sky-high sales-per-employee metric, but its purchasing costs (raw stock, manufactured components, services, etc.) might be very high too, so it ends up with typical margins.

FAB 40 Trends

Know that the FAB 40 is just a statistical slice of the industry, and participation varies from year to year. All the same, the information may help give at least some insight into broader industry trends.

For instance, the FAB 40 presents a statistical snapshot of revenue concentration—that is, how much revenue is flowing to the country’s largest fabricators.

After the Great Recession, more revenue than ever flowed to the top shops, thanks largely to some major acquisitions. As Figure 1 shows, the top 10 FAB 40 shops in 2012 generated more than $1.1 billion in combined revenue, while the remaining 30 shops combined generated less than $500 million. The combined revenue for all shops that year was $1.6 billion.

In 2016, the top 10 generated more than $1.3 billion (a little less than 2015), while the remaining shops increased their combined revenue to nearly $1 billion. Combined revenue for all FAB 40 companies climbed to a new high, to almost $2.3 billion.

Still, 2016 was tough for many, including some of the industry’s largest players—not surprising, considering the weakness in oil and gas, agriculture, mining, and other heavy equipment markets.

It’s no surprise that the revenue total of the FAB 40’s 10 largest participants declined by more than 7 percent. Overall, the FAB 40 growth (that is, combined revenue of all shops) has remained relatively flat for the past two years, growing by 1 percent in 2015 and 5 percent in 2016 (see Figure 2).

One would think that with negative or flat growth, shops would be hitting the pause button on capital expenditures. Not so. FMA’s “2017 Capital Spending Forecast” (which is far more positive than capital spending in the broader economy) pegged total projected equipment spending at more than $2.2 billion, which isn’t the highest ever, but an historically high level all the same. As described in the following pages, some FAB 40 shops hope those investments will start to pay off in a serious way this year.

The FAB 40 gives us one view of a dynamic industry that relies on keeping technology up-to-date to stay in the game. Even in the face of uncertainty and sluggish business through 2015 and 2016, fabricators have been tooling up for the growth they expect this year and beyond.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI