Contributing Writer

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

The big squeeze

As Detroit loses market share, automotive stampers' fortunes hinge on customer mix

- By Kathleen McLaughlin

- February 7, 2006

- Article

- Shop Management

|

If you're a parts supplier to the New Domestics, 2006 could be the best of times. However, if you supply parts to the Big Three, 2006 could be the worst of times.

Ford Motor Co.'s and General Motors' financial problems are painful reminders that the domestic automotive industry is changing.

A market dominated by three companies is a distant memory as Japanese and European automakers' market shares steadily increase. The Big Three have evolved into the New Six—Toyota, Honda, Nissan, GM, Ford, and DaimlerChrysler.

"The Big Three used to control 90 percent of the North American market," said Dennis DesRosiers, president, DesRosiers Automotive Consultants Inc. "Globalization has created eight near-equal competitors fighting for market share three companies used to control. Suppliers tied to the Big Three will have to make a negative adjustment to remain profitable."

Too Many Cars, Intense Competition

Honda and Toyota Motor Corp. reported record November automotive sales, while GM, Ford, Chrysler, and Nissan stalled compared with the same month in 2004. The Big Three's sales slump is attributed to this past summer's over-the-top employee-discount pricing blitz to reduce bloated inventories. Overproduction and deep discounts contributed to a 1.6 billion third-quarter loss for GM.

"Overcapacity not only leads to financial losses, but it also contributes to a slide in market share," DesRosiers said.

GM's share of the U.S. automotive market in the first 11 months of 2005 declined to 26 percent from 27.3 percent during the same period in 2004. Analysts are forecasting the Big Three will each lose another point of market share in 2006, which is less than in past years. One percentage point of U.S. market share represents more than 168,000 car and truck sales, which keeps an assembly plant and several parts factories in operation.

2006 will be a challenging year for the Big Three, but volumes will remain intact, commented Mike Jackson, director of North American vehicle forecasts, CSM Worldwide. "We are predicting that 2006 will be slightly below 2005's 15.8 million units at 15.7 million units," Jackson said.

"We're coming off a fairly strong year in terms of total volume. Volumes may be flatter in 2006, and total North American sales and production volumes will be down slightly," said Craig Fitzgerald, partner in the strategy and global services group Plante & Moran.

|

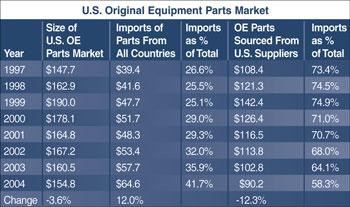

| Figure 1 OEM output is expected to increase by nearly 8 percent, or 1.2 million units, from 2004 to 17.0 units by 2009 before tapering to 16.8 million units by 2011. GM, Ford, and Chrysler combined will account for about 55 percent of the cars and trucks sold in the U.S. by 2011. Source: CSM Worldwide. |

Analysts are predicting that within five years, GM, Ford, and Chrysler combined will make only about half the cars and trucks sold in the U.S (seeFigure 1).

"The Big Three won't be able to restore the market share they've lost," said Fitzgerald. "Because they have a fair amount of new product going online in 2007, their share losses will be less than in past years."

Detroit's Faulty Logic

The Big Three are infamous for beating up their supply base. As a result, suppliers' trust in GM fell to the lowest levels in 15 years, with 85 percent reporting a poor working relationship, according to Michigan-based Planning Perspectives. To ease strained supplier relations, GM has adopted a three-year supplier initiative. Instead of demanding across-the-board cost cuts, the automaker is setting price targets for individual auto parts.

Under the new plan, GM will work with its top 300 suppliers in North America to establish lower prices on individual parts. However, some analysts warn the plan offers suppliers less flexibility and pressures them to open factories in low-cost countries such as China or India. Price targets will be lower for parts that are more vulnerable to material cost spikes, such as vehicle frames.

|

| Figure 2a Source: DesRosiers Automotive Consultants Inc. |

Automotive stampers will continue to experience pricing pressures to varying degrees, depending on whom they supply, and lower volumes from the Big Three (see Figure 2aand 2b).

|

| Figure 2b Source: DesRosiers Automotive Consultants Inc. |

"Chrysler is adopting a more collaborative relationship with suppliers that is more value-driven and less price-driven," said Fitzgerald. "Ford is starting down a similar path. I am cautiously optimistic they will become more value-oriented and less short-term price-focused.

"GM will continue to be strongly short-term price-focused by demanding suppliers become global," Fitzgerald said. "The automaker is adopting the least amount of change and collaborative approach. However, collaboration is one transformation element that is essential to becoming competitive again."

Relying on Incentives. Incentives have been a part of the automotive industry for the past 20 years. Last summer incentives peaked at about $8,000 to move inventory. As capacity is cut and new models are introduced in 2006, Big Three incentives should hover at $1,000, said DesRosiers.

Because incentives are destroying automakers' profit margins, manufacturers are trying to get away from offering cash. "Chrysler is trying to put a value on a service or another aspect of the ownership experience, such as free service and maintenance or extended warranties," Jackson said.

In contrast to Detroit-based automakers, Japanese automakers haven't needed to rely on deep discounts to sell cars. For example, Toyota tends to build fewer vehicles than the market demands. Plant capacity is tightly controlled, growing slower than demand. The carmaker has been able to maintain strong pricing, which has led to greater profits.

Incentives wouldn't be necessary if GM and Ford offered vehicles consumers wanted. With increased demand, inventories wouldn't build up as much, and discounts could be smaller or perhaps unnecessary.

"The Japanese make money the old way: They design, build, and sell cars," Fitzgerald said. "Detroit makes money the new way: They force profits out of their suppliers and serve as a bank."

Holding on to Old Models. It's expensive to introduce new models, and because of financial problems, Detroit is manufacturing models for too long. Most vehicles are in the marketplace seven or eight years; however, the Big Three keep vehicles on the market 10 years or more.

"GM has finally stopped producing the Chevy Blazer®, which was first engineered 22 years ago and has remained mostly unchanged," DesRosiers said. "While it's economical to keep older models, the technology is old, and the quality isn't at the same level as the newer vehicles."

Detroit also is struggling to develop vehicles that appeal to a worldwide market. In the North American market, a paltry 0.5 million vehicles are exported.

Historically, the vehicles that are developed here, such as trucks, have not taken export requirements into account, resulting in vehicles which tend to be unsuitable for other markets, commented Jackson.

Running on Empty

The troubles facing Detroit are too big to solve through incentive programs, as demonstrated by the summer's sales boom that turned into fall's sales bust. Untenable cost structures forced GM to announce in the fourth quarter of 2005 that it will shutter 12 plants and eliminate 30,000 jobs by 2008. Soon after Ford made a similar announcement that it planned to close 10 plants and cut 30,000 jobs in North America.

"As difficult as these restructurings are for GM and Ford, it's necessary to cut excess capacity," said DesRosiers. "The North American automotive sector is much better off with a strong GM and Ford than a weak GM and Ford. Instead of relying on incentives and squeezing their supply base, they are taking the steps needed to be competitive again."

Ford planned to announce a comprehensive restructuring plan in January that aims to restore North American operations for profitability. The automaker's goal is to boost capacity utilization to at least 95 percent. Currently Ford's North American factories are running at 72 percent capacity. Anything less than 90 percent is considered operating at a loss.

Chrysler is the only Detroit automaker that enjoyed a profitable 2005. However, because of lower production volumes and productivity improvements, the carmaker plans to cut more than 100 jobs at its Detroit V-8 engine plant.

"The Big Three are making progress on reducing health care and legacy costs, but in other areas such as reducing warranty costs and making assembly capacity more flexible, they are seriously behind and do not appear to be working on it very aggressively," said Fitzgerald. "After the cuts, GM and Ford still have too many brands to support. Production development dollars need to be spent crisply over fewer divisions."

Many Parts-Makers Struggling

Rising raw material costs, global pricing pressures, and declining Detroit sales are pushing many of the Big Three's suppliers, including Delphi and Tower Automotive, into bankruptcy.

In 2004 Standard & Poor's Credit Ratings Services downgraded about half of the 50 automotive suppliers it rates. The number of suppliers predicting losses has risen by more than 50 percent since December 2004.

Delphi's Downward Spiral. The nation's largest automotive parts supplier, Delphi sent shock waves through the automotive industry when it declared bankruptcy in October 2005. The parts supplier lost $4.8 billion in 2004 and $741 million in the first six months of 2005. Delphi expects to emerge from bankruptcy in 2007.

"In the first and second quarter, we will begin to see some bankruptcies and sales of businesses that were formerly suppliers to Delphi," Fitzgerald said. "Excess capacity is one of the reasons that suppliers are earning low financial returns.

Delphi's bankruptcy announcement was well-planned, according to Fitzgerald. "They created an essential-supplier list, which allowed them [the suppliers] to collect pre-petition receivables. Delphi wanted to give its suppliers a better chance of staying viable," he said.

The parts-maker is asking for 60 percent pay cuts and plans to close a substantial portion of its U.S. factories as part of its reorganization. The United Auto Workers has expressed doubt that the union will be able to reach a deal with Delphi. According to Autodata, GM has approximately three months' worth of inventory to last through a possible strike.

"A strike that lasts several months or more would be very deleterious to GM and will probably shut down most OEMs around the U.S, because Delphi has product in most cars in the market," Fitzgerald said. "GM is increasing its internal product-validating capabilities to approve new suppliers in the event of a strike."

To avoid a strike, GM may have to craft a bailout deal, which it can ill afford. But it also can't afford the risk of its supply chain imploding at a time when its banking on new models to recover from a sales slump.

"Delphi will emerge at half the size, clearly market-focused on a few core product areas," Fitzgerald said. "I expect them to be successful."

Visteon's Restructuring. The No. 2 auto parts supplier has been plagued with accounting irregularities and severe cash flow problems. Visteon hasn't turned a profit since it was spun off from Ford in 2000. After losing billions of dollars in the last four years, Visteon spun off 23 facilities into a holding company managed by Ford to stave off bankruptcy and ensure a continuous flow of parts.

"Visteon has restructured its business model by changing its customer base, wage structure, and structural costs," said Fitzgerald. "Whether it will be sufficient to help it avoid bankruptcy remains to be seen, but without the agreement, it would have been down the same path as Delphi."

The auto parts-maker received a $300 million short-term loan, which ended Dec. 15, and is in negotiations for an 18-month secured loan.

"The restructuring will be ongoing," Fitzgerald said. "Visteon needs to continue to cut costs, focus on core product areas, create competitive technologies in those core product areas, and close major contracts with customers outside the Ford base."

To become more competitive, Visteon opened a technical center in Shanghai to support its expansion into Asia and is opening plants in Mexico and Slovakia.

Some Suppliers Finding Success

To be a successful supplier in this economy, a stamper needs to become outstanding at being a low-cost producer, technology innovator, or assembler of electrical and mechanical components, Fitzgerald commented.

Michigan-based American Specialty Cars (ASC) has created a niche to make it competitive. The supplier produces low-volume (5,000 to 10,000 units per year) specialty cars like the Chevy SSR®, Toyota Camry Solara®, and the Dodge Viper® coupe. The supplier does not provide overflow capacity to automakers. Its business model focuses on producing cost-effective, low-volume niche vehicles—something not economically feasible in most North American assembly plants.

Since the launch of the SSR in fall 2004, the company has produced 22,433 units (12 percent more than the supplier's 10,000-unit-per-year goal). ASC doesn't perform final assembly of the SSR, but it does manage more than 90 percent of total vehicle content.

ASC's business model is based on a flexible, low-investment production system. For example, to produce SSR subassemblies, the supplier uses six robots and employs laser-guided cars that operate on 12-volt batteries to move work-in-process instead of expensive, high-tech conveyor systems.

Because of the SSR's success, OEMs want a piece of the niche market. Currently the supplier is in negotiations with several automakers to create specialty vehicles.

"Successful suppliers have a diversified customer base that values a specific competency they've developed," Fitzgerald said. "Approximately 15 percent of best-in-class stamping and tool and die suppliers are earning double-digit operating incomes because they are focused on cost delivery, quality, and metrics."

The Age of Profitless Prosperity

An automotive supplier that has the right product mix and cost structure can be very profitable. The New Domestics are practically minting money, while Detroit and its suppliers are coming to terms with unprofitable business models.

|

| Figure 3 |

"The traditional Big Three have strong volumes but not a high degree of profitability, as Detroit has to rely on high incentives to sell cars," said Jackson. "It's crucial for GM and Ford to trim overcapacity, bolster economies of scale, and deliver striking products that resonate with consumers to become profitable again."

When Detroit hurts, its supply chain really hurts. "Supplier profitability has been declining for the past 10 years, and profit margins declined sharply when steel and other ferrous metals spiked in 2003," Fitzgerald said.

To restore profit margins to a reasonable level, more capacity will have to be taken out of the supply base. "In the end there will be blood all over the floor, but the winners are going to be bigger than we've ever seen before," DesRosiers said.

Many industries, such as textiles, furniture, and steel, have gone through similar restructurings. "When you have a fundamental uncompetitive cost structure and globally set price, there is no way to protect long-term, less productive industries," Fitzgerald said.

"Business conditions will become meaningfully better in the beginning of the new decade, but they will come at a huge pain to hundreds of thousands of automotive industry workers," Fitzgerald said. "The next few years are going to be tough for Detroitcentric suppliers. However, after the transition, we will have a competitive industry that can again enjoy profitability."

| Machine tool industry outlook Double-digit growth to continue |

| Years of machine tool underinvestment, a strong U.S. industrial economy, and a rise in operating rates and capacity utilization all indicate double-digit demand for machine tools over the next few years. "Growth won't be perfectly linear; there will be another period of flattening (weaker demand) over the next five years," said Eli Lustgarten, senior vice president and senior analyst at Longbow Research. "Currently we have a flat yield curve, which suggests a potential slowing of industrial activity six to nine months later." October U.S. machine tool consumption totaled $277.53 million, according to AMT - The Association For Manufacturing Technology and the American Machine Tool Distributors' Association (see Figure 3). This total was down 5.2 percent from September but up 25.4 percent from the total of $221.31 million reported for October 2004. With a year-to-date total of $2,549.50 million, 2005 was up 11.3 percent compared with 2004. Lustgarten said several macroeconomic factors drive machine tool spending. Some are: Rising operating rates. Operating rates are coming back from low levels. A 78 percent to 82 percent range indicates strong business spending. The overall capacity utilization rate for November was at 82.2 percent, with manufacturing at 79.4 percent. This strength should continue into 2006. Growing industrial production. Industrial production increased 0.7 percent in November after an upward-revised gain of 1.3 percent in October. At 109.0 percent of its 2002 average, November output was 2.8 percent above its level a year ago and should accelerate further in 2006. Improving balance sheets. Cash on balance sheets is at record levels because of tremendous profitability improvements. Automotive Impact Foreign Competition |

STAMPING Journal® acknowledges the following sources used in preparing this article:

American Specialty Cars Inc., www.ascglobal.com

American Machine Tool Distributors' Association, www.amtda.org

AMT—The Association For Manufacturing Technology, www.amtonline.org

CSM Worldwide, www.csmauto.com

DesRosiers Automotive Consultants Inc., www.desrosiers.ca

Longbow Research, www.longbowresearch.com

Planning Perspectives Inc. www.ppi1.com

Plante & Moran PLLC, www.plantemoran.com

About the Author

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI