Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Differentiation in manufacturing: Cadence hits its unique stride

For one company, it’s the entire business system, not just its proprietary technology

- By Tim Heston

- January 4, 2016

- Article

- Laser Welding

Custom fabricators continually strive to be different in customers’ eyes, but it’s not easy. Just having a laser used to set shops apart from the crowd. That’s not the case now. Shops sometimes bring in more machine technology—a new laser, press brake, or robotic welder—but if nearby competitors can drum up the funds to make the investment in the same equipment, nothing is legally stopping them from doing so.

Cadence Inc. has a different story, but in many ways still faces the same challenges all other contract manufacturers do. The company launched with a proprietary blade-grinding technology that founder Martin Lightsey invented. Yet if Lightsey pinned success solely on proprietary technology, his company wouldn’t be the $100 million, 500-employee, six-location industrial and medical device contract manufacturer it is today.

Breaking Into Medical

In 1985 the company, at the time named Specialty Blades Inc., was a small blade grinding shop in Staunton, Va. Lightsey had big plans to serve both the industrial and medical device sectors, and helping the company grow would be a proprietary grinding technology he invented for sharpening precision blades, from tiny razor blades to industrial knives several feet long (see Figure 1).

Unlike conventional systems that required lengthy setup times and hundreds and sometimes thousands of setup pieces, Lightsey’s initial 9-axis CNC machine had unique fixturing that snapped the workpiece into a certain position, depending on the blade geometry. This proprietary machine shortened setup time to just several minutes, which in turn opened the door to prototyping and low-volume production.

Lightsey realized the machine’s potential, not only for industrial applications, but also for the medical device sector. It was just a matter of time for that unique technology to help the company really take off—right? Of course, the story isn’t that simple.

Walk into any grocery store and you’ll see packaging that has some serious materials engineering behind it. New heat-resistant plastics have allowed people to come home from work, grab a meal from the freezer, stick it in the microwave, and have dinner.

Cutting those plastics requires sharp knives. The longer those knives stay sharp, the fewer times they need to be changed out, and so the more efficient a food processor can be. Here, Lightsey’s company filled a need.

The grinding machines can handle blades of various metal thicknesses, but their sweet spot is 0.062 in. and thinner. The technology seemed to be a perfect fit for the medical industry, particularly the endoscopic sector.

“Martin had developed this machine really to make headway into the minimally invasive surgery space. But it didn’t happen that way. Our product mix for the first 19 years of this business was about 80 percent industrial applications—blades for cutting films and plastics—and 20 percent in the endoscopic medical space.”

So said T.M. Dickinson, vice president of sales, who added that during the past 11 years, the company has changed dramatically. In 2005 it was a $14 million shop that, as its name at the time suggested, specialized in blades. Just 11 years later, the organization has grown into a six-location contract manufacturer with laser cutting, extensive laser welding, stamping, plastic injection molding, tube and needle fabrication, and more (see Figure 2).

Figure 1

Technicians at Cadence’s Staunton, Va., plant work with the company’s proprietary blade grinding systems.

The growth started with a concerted sales effort. Although Specialty Blades’ unique grinding technology was perfectly suited for the medical field, many prospects still perceived the firm as a supplier of industrial knives.

So in 2005 Specialty Blades created a new division called IncisionTech to focus specifically on the endoscopic market and improved its oversight and regulatory compliance departments. In 2008 the company expanded further into the medical industry, making its first big move beyond blades.

“We realized there was more to the medical device space than just cutting,” Dickinson said. “Piercing and fluid delivery was a piece we were missing.”

To that end, the company purchased Popper and Sons, a Rhode Island firm that had been making needles, metal tubing, and related fluid-delivery products since 1922.

“After we bought Popper, though, we knew we had a branding issue,” Dickinson said. “We had Specialty Blades, IncisionTech, and Popper, and all used the same manufacturing resources. And our engineers would support all three facets.”

Many carried around three business cards, each with a different company name, which of course caused confusion. So after the Popper acquisition, the company changed its name to Cadence. “So now we could all go to market with the Cadence brand,” Dickinson said.

In 2012 Cadence expanded again in the medical arena, moving beyond what Dickinson called “the business end of the medical device, the cutting and the piercing. We wanted to move up the value chain and do more subassembly work. And in some cases, we really wanted to do finished-device assembly. So we created a division in Pittsburgh that does just that, with a 21,000-square-foot Class 8 cleanroom.”

At this point Cadence had flipped its customer mix ratio. Ten years ago the ratio was 20 percent medical, 80 percent industrial. In 2012 it was 80 percent medical and the life sciences market (research facilities and the like) and just 20 percent industrial.

Finally, in 2014 Cadence expanded further into the medical space and diversified into the automotive market as well, acquiring Plainfield Precision’s plants in Sturgeon Bay, Wis.; Plymouth, Mass.; and in the Dominican Republic. The Sturgeon Bay location gave Cadence stamping and tool- and diemaking expertise; the Plymouth plant came with plastic injection molding capability, valuable in the medical industry where most parts are a combination of metal and plastic; and the Dominican Republic facility gave the company cleanroom assembly services that are close to many medical device OEM assembly plants in the Caribbean, including quite a few in the Dominican Republic.

Advanced Technology

Such growth didn’t happen just from a single proprietary grinding technology, though it certainly was an important piece of the puzzle. Other advanced technologies make up other puzzle pieces, and this includes advanced laser processing.

Figure 2

During the past 11 years, Cadence has grown into a major contract manufacturer with extensive laser processing, including both laser cutting and laser welding.

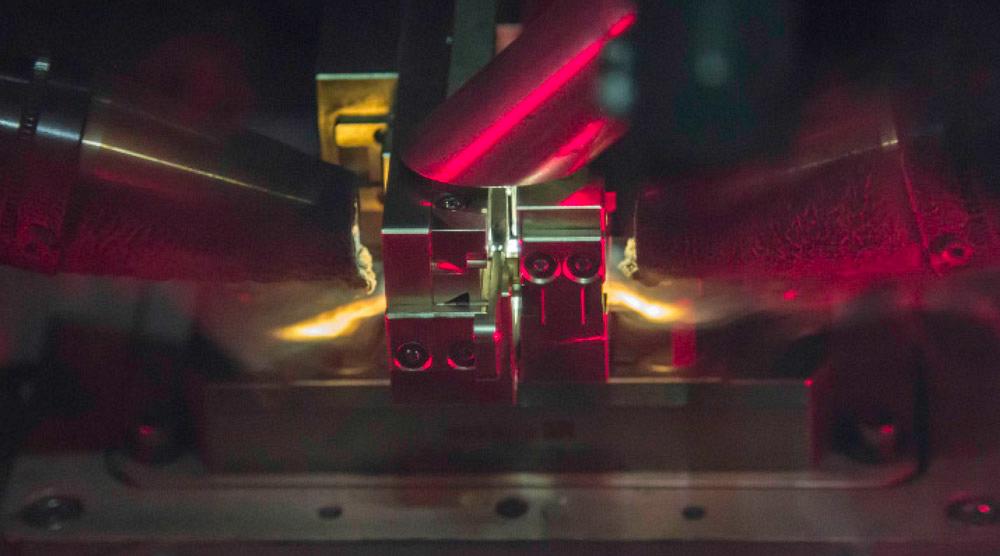

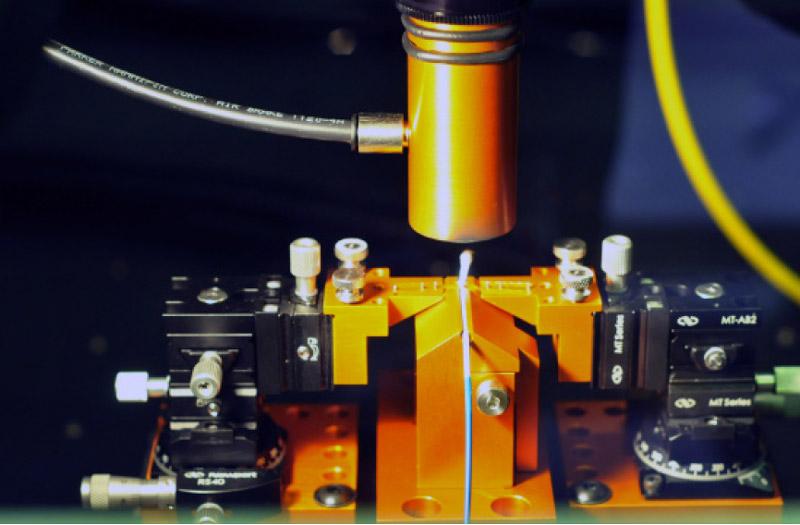

For one customer Cadence welds 3 million parts annually, joining a machined part to a stamping in a highly automated cell. In all, the company has six automated laser welding centers across all its plants, as well as six manual laser welding cells, including the company’s Advanced Welding Lab™ in Virginia (see Figures 3 and 4).

“We’re probably one of the largest laser welding houses that nobody has ever heard of,” said Jack Abato, vice president of operations.

The company builds its own laser systems using off-the-shelf components. In several cutting systems, a 14-in.-wide coil is fed under a low-powered fiber laser cutting head, which cuts small workpieces nearly continuously, stitch-cutting the part profiles to leave microtabs (so parts stay in the nest) and cutting strip to a sheet of manageable length for the operator to unload. It looks like a conventional laser cutting nest, just miniaturized.

The 2014 Plainfield acquisition, with its stamping capabilities, gave Cadence more processing options. If a part reaches a certain volume, engineers now consider building a die for it. This isn’t just because of the greater throughput, but also because of the automation possibilities when it comes to joining. Recently for one customer, the company developed a transfer stamping line in which the part is blanked, formed, and then laser welded in the very next transfer station.

For lower-volume laser welding work, the company uses flexible fixturing, such as a metal breadboard, commonly used in electronics assembly, to mount fixture components. It’s not unlike the flexible fixturing grid tables many custom fabricators use—only, again, shrunken down in size. If technicians need to change over a job, they just rotate breadboards.

Abato said that engineers are considering flexible robotic fixturing with special end effectors for a few components. The goal is to create a flexible fabrication cell with laser-cut parts being picked up by robots that would present them under the laser welding head.

As Abato explained, “We would get better repeatability, and there would be no custom tooling requirements except for the end effector that holds the parts.”

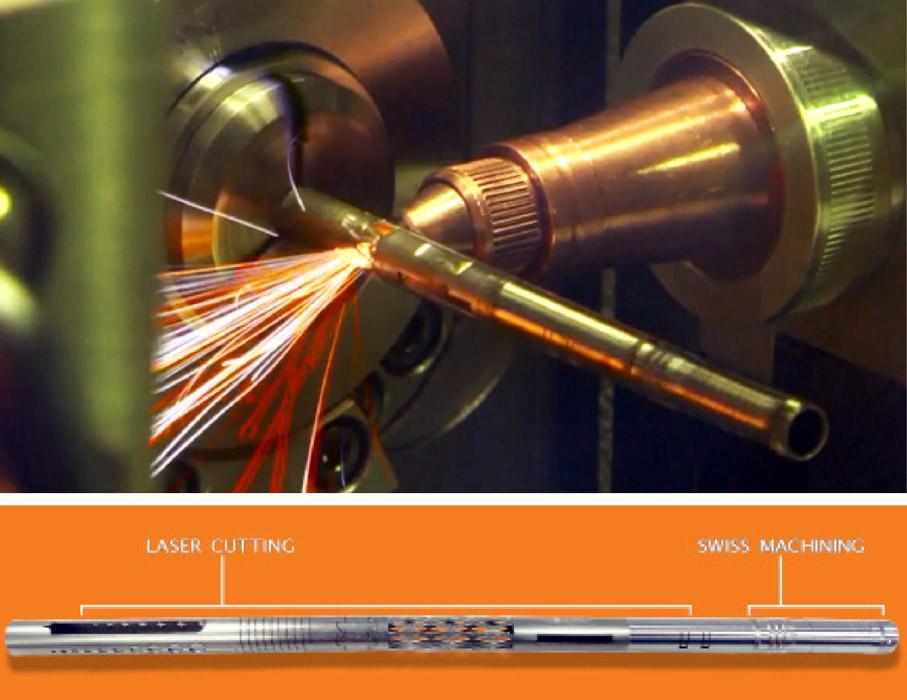

The medical field has plenty of applications for small-diameter (many less than 0.5 in.) stainless tubes, and some products actually require a portion of that tube to be flexible. One end of the tube is solid and rigid, with a few turned features, while the other end has a thin web of material remaining, allowing the structure to flex. Unlike the rigid section, it’s far too flimsy to withstand the pressure from a hard tool. And it’s all made out of one piece of tubing.

That part showcases a relatively new laser processing technology known as laser Swiss machining, which combines 6-axis Swiss machining and laser cutting. The machine looks like a standard Swiss turning center, with stationary and live tools, except that one of those live tools happens to be a low-powered fiber laser for cutting precise profiles on the tube OD (see Figure 5).

A Business System

Abato is no stranger to lean manufacturing. He graduated from Osaka University in Japan and spent years implementing continuous improvement projects. He arrived at Cadence three years ago, and when he and other managers with lean experience saw the current state of operations, they saw opportunity.

Cadence wouldn’t seem like a place where lean manufacturing could really apply, at least in the traditional sense. After all, the company produces thousands of different parts, and many of those parts pass through some truly advanced machinery, all tested to meet the stringent demands of ISO 13485 (the standard for medical device manufacturing) and customer requirements. When making a process or technology change, the medical device customer needs to certify that process.

Still, just because a process produces a quality product doesn’t mean it’s particularly efficient. For instance, until recently the company’s Rhode Island plant produced needle products using batch-and-queue techniques.

Admittedly, the waste from this process wasn’t obvious. A fab shop processing large batches may have a mountain of work-in-process between the laser cutting and press brake department. But when thousands of little parts fit into a box, as they do with Cadence’s needle fabrication, all that WIP doesn’t take up much space. A few boxes sitting on the floor doesn’t look too wasteful.

Of course, those boxes of WIP sat for days between processes, waiting for certain machines to become available. This was something Abato and others picked up on immediately.

Managers would schedule an order to be cut. Then the entire batch would be moved to deburring, then grit blasting, then point grinding, then dimpling, and final assembly (each product consisted of a kit of two needles). In all, it took 25 days for the product to make its way through the shop.

The company did it this way because the operation produces a variety of different needle geometries. After all, the shop couldn’t possibly set up dedicated, product-specific lines.

Nevertheless, the improvement team uncovered what a lot of fab shops uncover as well. Although an operation may produce a lot of different part numbers, many of them undergo the same or similar process routing.

This happened to be the case at Cadence’s Rhode Island plant. The improvement team rearranged machines into a multiprocess cell, and now needles flow through the operation, from cutting to deburring to dimpling and so on, in a matter of minutes. “We used to have somewhere in the neighborhood of 170,000 pieces of WIP in that [needle] operation,” Abato said. “Now the cell produces 1,700 complete pieces a day with no more than 3,400 pieces of WIP.”

The company also has implemented rhythm scheduling for some applications, grouping parts that require similar setups together. For instance, one grinding operation produces parts for a group of customers, each of which has a once-a-month delivery. Instead of sequencing these jobs strictly by the due date, the scheduler releases similar jobs together, so operators can avoid having to change out grinding wheels.

“So say we run 25 jobs for the month,” Abato said. “By the time you get to the 25th part, you may have changed your grinding wheel only once.”

Figure 4

An R&D setup in the Advanced Welding Lab™ fixtures two small parts under a low-powered laser welding head.

The Whole Package Differentiator

All this is part of what the company is now calling the “Cadence Business System.”

“It’s not a cookie-cutter approach,” Abato said. “The Cadence Business System covers the entire business at all six of our facilities, from corporate headquarters to supply chain logistics to shipping and receiving.”

If you visit Cadence’s home page, you’ll read about a larger Wisconsin facility opening soon and details about its advanced welding lab and finished-device assembly (what it calls the Product Realization Center™). It’s obvious that the contract manufacturer is positioning itself as a supplier that can shepherd projects from the early design stage through the ramp-up to full production and final assembly.

But you have to do a little digging online to find out that the company has a proprietary grinding machine (along with a proprietary electropolishing process). These processes make the company competitive, for sure, but in the customers’ eyes, that technology by itself may not set the company apart from the competition. It’s instead the whole package: the sales and engineering collaboration in product development, the continuous improvement, and the technology mix (laser cutting, laser welding, stamping, machining, plastics manufacturing, assembly, and proprietary technology)—in other words, the entire Cadence Business System.

The same could be said of numerous top-tier custom fabricators and, for that matter, any company that doesn’t compete on price alone.

Images courtesy of Cadence Inc., 9 Technology Drive, Staunton, VA 24401, 800-252-3371, www.cadence inc.com.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI