Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2024 metal fabrication forecast: A boring year ahead?

A recession is coming, but metal fabricators might not feel much pain

- By Tim Heston

- December 19, 2023

- Article

- Shop Management

Rob Wolfman, managing partner at Scottsdale, Ariz.-based private equity firm Montage Partners, has noticed a kind of split happening in metal fabrication and related industries, and he sees it continuing into 2024.

“We’ve seen a bifurcation happening during the past two years, and it really depends on who your customers are,” he said. “In industries with great growth prospects—electric vehicles, warehousing, logistics, data centers—the end market demand is there. They’re not being slowed down by the economy, high interest rates, or inflation.”

He added that some shops—especially those with highly concentrated revenue streams focused on specific industries, like certain areas of consumer spending—are seeing a slowdown and may continue to struggle in general.

“On the other hand, many fabricators did very well in 2021 and 2022. They continued to do well this year, and that performance will likely continue into 2024. They’ve maintained a customer mix that hasn’t been impacted by inflation and high interest rates.”

Those fabricators with the right mix of customers, along with the processes and technologies in place to deliver and scale up reliably, could see significant growth going into 2024. Their performance shows the traditional strength of the custom metal fabrication business model, built to serve many sectors of the manufacturing economy at once. When one sector is down, another is up. As long as a fabricator has well-diversified revenue streams (which, admittedly, isn’t always the case), the bottom never really falls out.

The past two economic cycles have been bookended by crises: the financial meltdown and the pandemic. Living through two black swan events, many business leaders are looking out for yet another shockwave to shake the global economy. Chris Kuehl doesn’t see one on the horizon. Quite the contrary, in fact.

Kuehl is economic analyst for the Fabricators and Manufacturers Association and managing director of Lawrence, Kan.-based Armada Corporate Intelligence. He travels almost continuously to various trade groups around North America, and despite alarm bells being rung about 2024 in the general media, Kuehl is hearing a different story. Business for many softened in late 2023, yet others are poised for growth through the first half of 2024. By late 2024, a long-predicted recession might finally take place, but it probably won’t happen in the torrential wake of a black swan. It likely will be sectorial, and not every sector will suffer equally.

In fact, while Kuehl expects some sectors to slow, those in metal fabrication might end the year on a positive note. Especially for well-diversified fabricators, 2024 might be boringly, and refreshingly, normal.

But What About the Turmoil?

Economic concerns abound, of course. Uncertainty remains on the horizon, especially considering global conflicts and less-than-stellar economies abroad.

“People forget that every state in the U.S. has a GDP the size of a country,” Kuehl said. “The GDP of Russia is the same as Indiana, and the GDP of Kansas is the same as Ukraine. The world isn’t thrown into chaos because Indiana invaded Kansas.”

FIGURE 1. Some industries expect to see continued growth despite an expected recession. Armada Corporate Intelligence predicts the fabricated metal products sector will grow at a little more than 1% next year.

Kuehl referred a report in The Economist magazine that cited falling housing prices, increased bankruptcy, and the fact that many households have exhausted the savings they gained during the pandemic. Then comes the concern about higher interest rate’s effect on government debt.

“Some solid arguments suggest this assessment may be too gloomy,” wrote Kuehl in his early November Fabrinomics e-newsletter. “The issue of evaporated savings is true enough, but that upper third [of the income distribution] still has close to $3 trillion to do something with, and there have been solid income gains at all levels as the worker has more leverage than in past years.”

As for bankruptcies, Kuehl cited Standard & Poor’s data that show more than 500 bankruptcies filed in 2023—a number that doesn’t deviate too much from the bankruptcies filed between 2016 and 2019. Sure, 2021 and 2022 had fewer filings, thanks to lower interest rates and government assistance. Here again, 2023 looked to be a return to normalcy, a trend that’s likely to continue next year.

Even oil and gas markets haven’t been pummeled by the Israeli-Hamas conflict. “Some of the interesting comments from commerce representatives [in Saudi Arabia] boils down to, ‘Look, we know the oil will run out. We have to be other kinds of economies, and that means working together with the U.S., Europe, and even Israel.’ All this has meant that oil prices have stayed somewhat stable."

One potential black swan, of course, is government dysfunction. Recent government decisions haven’t been bad for fabricators, especially when it comes to infrastructure spending, but going forward, the industry shouldn’t expect anything else quite that impactful. 2024 is an election year, after all.

“All the infrastructure money has already been passed, and it’s already been allocated,” Kuehl said. “But anything new will just get hammered.”

Next Year Still Might Be Better

“Many sectors now that are doing well are connected to fabricated metals,” Kuehl said. “Some wonder how long this lasts in 2024. A lot of the demand is driven by nonresidential construction, but the concern is that there isn’t a whole lot in the pipeline. Construction companies are doing well with the current round of projects, but we don’t know what the next round is going to be. Manufacturing construction is still 70% higher than it was a year ago, but we’re seeing a slowdown on this next year.”

Fabricators are also benefiting from booming oil and gas and, thanks to government incentives, alternative energy sectors (though consumer demand has waned of late). “Regardless, all those numbers have gone up steadily,” Kuehl said. That, of course, is all good news for the metal fabricator.

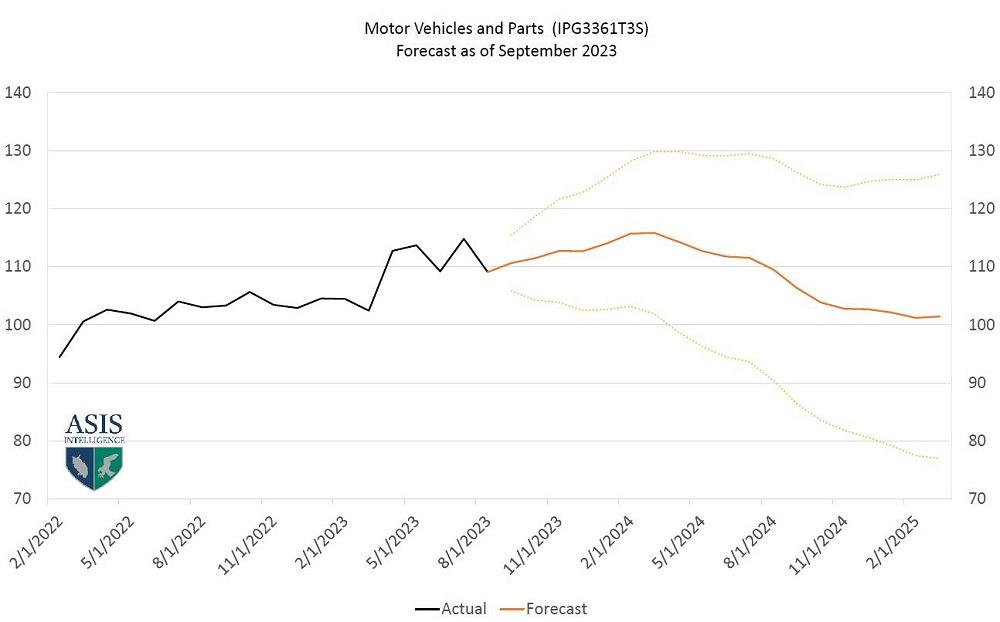

According to the October edition of The Watch, a monthly publication from Armada Corporate Intelligence, the fabricated metal products sector is expected to grow just 0.6% between the end of 2022 and the end of 2023. This number could reflect the industry’s bifurcation. How fabricators fared depended on the customers they served.

Sectors that depend on consumer spending and housing slowed, while spending associated with infrastructure, electric vehicles, military, and other sectors continued rising. Demand also could have softened due to inventory factors (more on this later). Average that all out, and the industry’s activity dipped over the last half of 2023.

According to The Watch’s forecast, trends might be reversing through the end of 2023 and the first half of 2024 before softening again later next year. More evidence of the industry’s bifurcation, some might see a slowdown while others might see continued, strong growth. The industry might still end positive, at an overall growth rate of 1.33% (see Figure 1). “The long-range outlook has improved slightly overall,” the report stated, “and is now expected to remain just above the 20-year average.”

Inventory and the Fabricator

“So much activity in manufacturing overall has been driven by a push toward more inventory,” Kuehl said. “It was a natural response to the supply chain mess. No one wanted to get caught without inventory. Now, 65% of companies are reporting that they’re overstocked. Until they blow through that inventory, they’re not ordering anything new.”

For fabricators, the inventory effect has particularly been seen in farm equipment, commercial vehicles, and construction machinery. As The Watch reported, “Many that were struggling to get inventories rebuilt in the years following the pandemic have not only fully recovered, but have now seen overproduction across many categories.” Some pockets in the farming and construction equipment sector have short supply and extended lead times, but for the most part, the sector’s inventory-to-sales ratio has surged. All that might affect growth heading into 2024.

That said, the inventory situation might be less pronounced moving forward. According to Wolfman, “Some might have purchased too much inventory earlier this year in certain pockets, and those customers pulled back during the second half of this year as they bleed through the inventory. That issue might clear out through next year.”

Automotive Softens

At this writing, the UAW was still voting on tentative deals struck between the Detroit Three and union leaders. Not long before this, as reported by The Watch, almost 40% of parts suppliers had begun to announce layoffs. A lot of that was driven by unknowns in demand. “They really didn’t know what production line was going to be shut down,” Kuehl said.

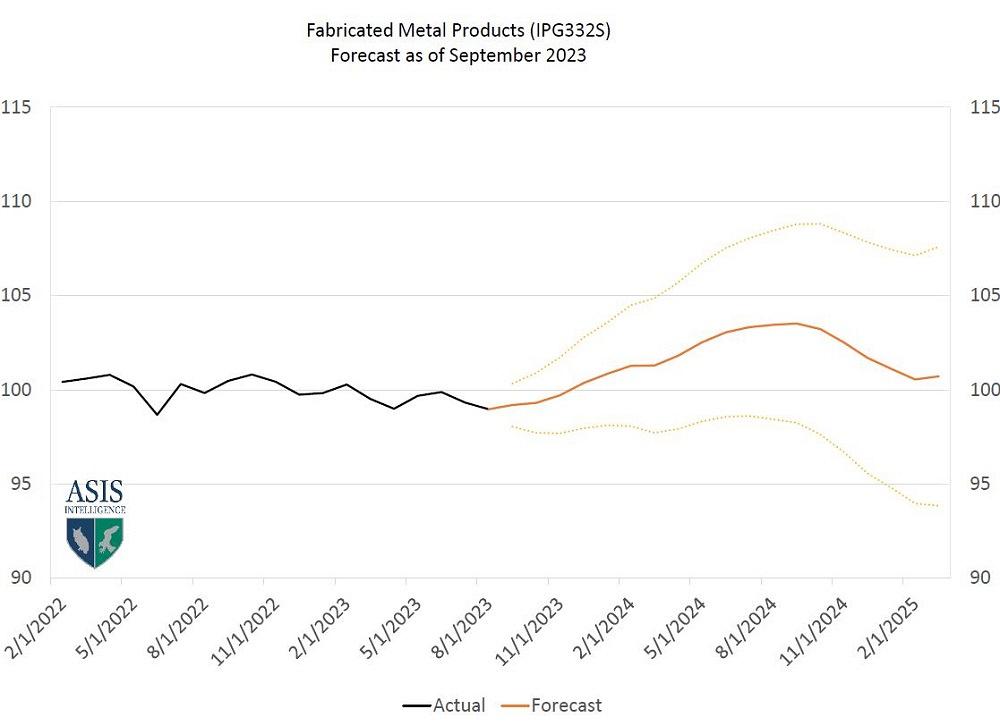

Despite the tumult, the end of 2023 will likely be positive in the automotive sector. Next year, though, not so much. The Watch predicts the automotive sector to end 2023 at a growth rate of 9%. Next year, however, the model shows a decline of 8.8%, with production softening by the end of the year into 2025 (see Figure 2). The U.S. sold more than 15 million vehicles through September, up 14% from 2022, yet down from the 18 million units sold in 2021.The units sold reveals a new automotive market reality: Consumers have plenty of choices beyond the Detroit Three. Yes, public sentiment for unionization is up, but people still want a new car.

As Kuehl put it, “[The strikes] might do wonders for the Japanese and Korean car market.”

Perhaps more telling than units sold is inventory. As The Watch reported, ‘Inventory-to-sales ratios for automotive are still 57.7% lower than they were prior to the pandemic … Auto sales are also still surprisingly strong, given the price of vehicles and the credit pressure most consumer households are under.”

All this together creates a softening, though not plummeting, automotive forecast, despite labor troubles and all the negative headlines. It’s yet more evidence that next year just might be refreshingly boring.

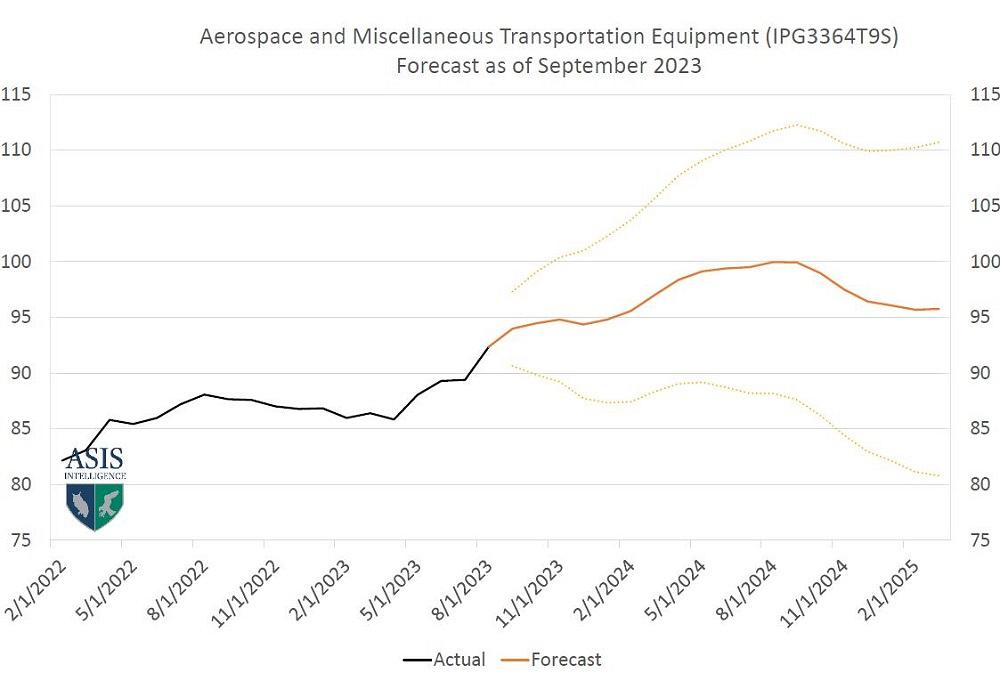

Aerospace Levels Off—Maybe

At this writing, The Watch reported aerospace ending 2023 nearly 9% higher than 2022. Go out into 2024, though, and the forecast gets a bit murky. The outlook has growth for 2024 at a little more than 2%, but the range of the sector’s potential trajectory remains wide (see Figure 3).

FIGURE 3. Aerospace is expected to grow a little more than 2% in 2024, but the range for potential growth (and contraction) remains wide.

The Watch reported that supply chain challenges were still depressing output, and global competition for certain materials and products was ramping up. All this is happening in an environment where both commercial and military aviation customers compete for suppliers’ attention.

“The airlines are still expanding and making up for the fact that they didn’t think travel would be coming back as strongly,” Kuehl said. “But the supply chain is constrained. And you can’t ship a plane that’s 98% complete.”

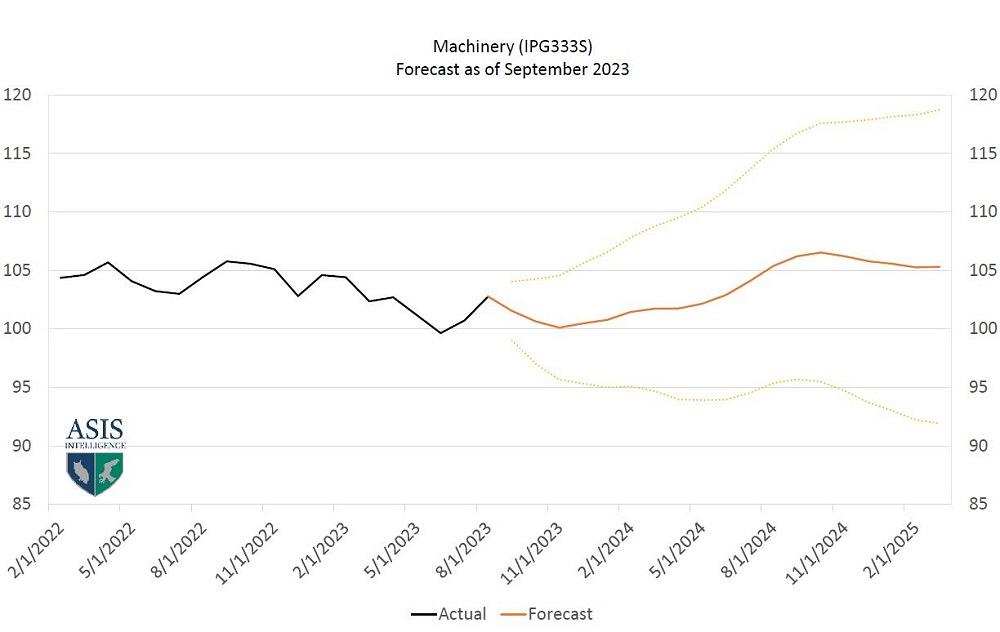

Machinery: Transportation, Construction, and Ag

The Watch sees the machinery sector—which includes agriculture, construction, and transportation equipment—contracting a bit in late 2023, ending 2% lower than in 2022, but the 2024 outlook remains strong, ending the year at a growth rate greater than 5% (see Figure 4).

The sector has plenty of challenges, especially considering trends in residential construction and commercial trucking. The report shows transportation equipment orders as somewhat weak, likely driven by ripple effects of the Yellow bankruptcy. “This will continue to be a headwind as quality used equipment is put on the open market. That could easily slow Class 8 truck orders.”

All that said, construction equipment manufacturing is still up, thanks to still-strong nonresidential construction demand. How long this lasts is, again, the big question.

“Health care construction rebounded after the pandemic,” Kuehl said. “In fact, we’re seeing a kind of decentralization of health care. We hear from electrical distributors, for instance, that a hot market now is imaging centers and urgent care centers spreading out into the suburbs.” This, he added, is driving demand for a lot of products that use fabricated metal parts.

The drive toward more capital spending overall, including all sorts of industrial machinery, hasn’t abated. “Capital spending has never really dropped,” Kuehl said. “It’s leveled off, and it’s not growing as fast as it was, but it’s still growing. About 75% of that is machinery and about 25% of that is physical space [manufacturing space] to accommodate that new machinery.” This includes manufacturing plants, warehousing, and server farms. “If you turn your back on your garage,” Kuehl quipped, “Google will buy it.”

An Industry Shaped by Retirements

“We’re still dealing with the fact that we see 10,000 people hit retirement age every day,” Kuehl said. “And by 2030, all of the boomers will have hit retirement age. Yes, boomers tend to work longer, but you can’t stop aging.”

Wolfman added that the sequence of events occurring as workers and business owners retire is shaping the industry in many ways, both positively and negatively. On the negative side, retirees leave without passing on their knowledge, training successors, or documenting what they do. This is happening everywhere (even at some of the largest companies), but it’s especially prevalent in the smallest shops. When owners retire, they have no one to pass their business on to, so quite often, they’re just closing up shop and selling off equipment.

The transition has a positive side, though. If good companies aren’t being passed on to a family member or others within the company, buyers are still out there, despite the higher interest rates. As Wolfman explained, good metal fabrication companies—those with well-diversified customer portfolios, well-documented processes, good database management, and a deep bench of engaged and knowledgeable employees—are still in demand in the mergers and acquisitions arena.

FIGURE 4. Machinery production—which here includes agriculture, construction, and commercial trucking equipment—is expected to grow by 5% in 2024.

“There’s still a lot of acquisition activity,” Wolfman said. “Multiples have fallen compared to what they were 18 months ago. But for really high-quality businesses, multiples haven’t come down. Valuations remain strong.”

It goes back to that bifurcation—the split between progressive, well-diversified companies and the shops that have been dependent on a handful of clients in volatile industries.

Companies with good revenue diversification and well-maintained investment strategies, both in people and manufacturing technology, could see continued growth. That prediction applies to 2024 and, for that matter, any other non-pandemic, nonfinancial-crisis, refreshingly boring year.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI