Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Manufacturing survey shows productivity growth in Northeast Ohio

Heart of the Rust Belt continues to shake off corrosion with advanced manufacturing, strong metal fabrication industry

- By Gareth Sleger

- February 20, 2019

The heart of the Rust Belt is beating with manufacturing productivity these days.

That’s according to the recently released 2019 State of Northeast Ohio Manufacturing Report, which collected data from 381 respondents in 18 Northeast Ohio counties between November 2018 and January 2019. The report was co-spearheaded by Ohio manufacturing advocacy organization MAGNET and Northeast Ohio business development organization Team NEO.

The biggest takeaway from the third-annual report is that the region’s manufacturing continues to be productive despite skills/talent/technology gaps, plateauing economic expansion, evolving tariffs/trade war, and rising raw material costs. Essentially, Northeast Ohio is a microcosm of the current state of U.S. manufacturing.

“We make pieces and parts for almost any industry,” MAGNET President and CEO Dr. Ethan Karp said of the region. “We have a few household name companies, but the industries that our manufacturers serve and those that responded to the survey are completely representative.”

The manufacturing industry accounts for 14 percent of employment (almost 300,000 jobs) and 40 percent GDP in Northeast Ohio. Most of the respondents were from those in leadership positions representing mostly small (less than $10 million in 2018 revenue) and medium ($11M-$99M in 2018 revenue) companies.

The metal fabrication sector alone in Northeast Ohio, which employs more than 50,000 workers in the region, produced one of the most massive Gross Regional Product outputs in the survey’s timeframe at more than $6 billion. Metal fabricators also pushed out $11 billion in exports, the third most of any of the region’s industries in 2018.

And just like most manufacturing sectors across the U.S., companies in Northeast Ohio experienced a boom last year. Nearly 70 percent of the region’s manufacturers reported financial and workforce growth in 2018. And a whopping 92 percent of businesses said their workforce remained the same or grew from 2017. Only 1 percent of the same companies expect a workforce shrinkage this year.

“The biggest positive is that manufacturers remain optimistic next year for their company performance despite being slightly more worried about the economy,” Karp said of the mixed outlook for the rest of 2019. While survey respondents were more optimistic about macro expansion the past two years (56 percent in 2017 and 58 percent in 2018), only 35 percent said they are expecting economic expansion throughout the rest of the year. Naturally, manufacturers are also keeping an eye on the escalating trade war with China – 66 percent of Northeast Ohio companies say President Donald Trump's imposed tariffs have negatively impacted business.

But even though overall manufacturing optimism may have hit a peak in 2018, survey respondents are still predicting revenue to remain the same or to grow for their own companies: 78 percent in gross revenues (down 8 percent from 2018), 76 percent in new orders, and 72 percent in profits.

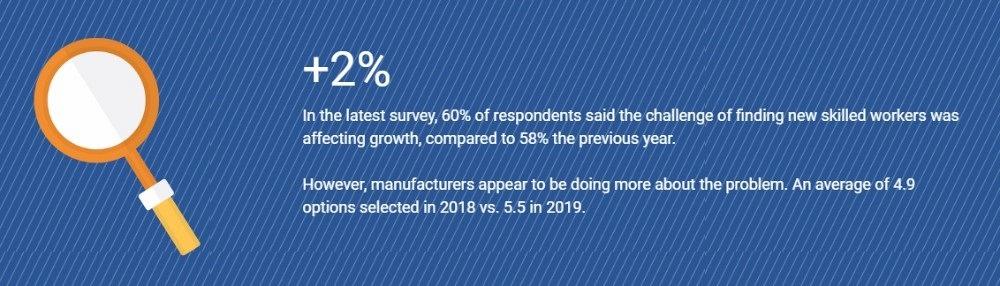

That also means the Northeast Ohio region is minding the ever-growing manufacturing gaps: skills gap, talent gap, and technology gap. The survey reveals that there are 2,316 vacant manufacturing positions in Northeast Ohio, with an average of six openings per company. So, it’s no surprise that 86 percent of respondents say attracting qualified workers has been challenging and 60 percent say the inability to bring in that talent is hindering growth. The gap problems are compounded by the fact 63 percent of the region expects to lose close to 5 percent of staff to retirement over the next three years.

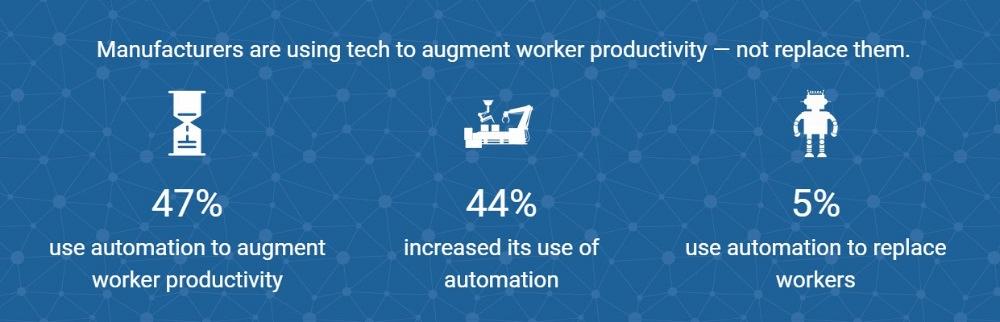

As a result, like the rest of the country, companies in the Rust Belt are shaking off the corrosion by deploying more and more smart manufacturing tactics to improve productivity. An overwhelming 84 percent of responding companies say that they are augmenting current personnel with advanced automation instead of filling open positions – or replacing workers (only 5 percent say they use technology to replace employees). Combining present-day workforce with technology like IIoT (Industrial Internet of Things)-connected machines, collaborative robotics, big data strategies, and additive manufacturing (AM) is making the region more industrious than it has been in decades, says Karp.

“The biggest misrepresentation is that manufacturing was lost at the same time as the major jobs decreases in manufacturing since the 1970s,” said Karp. “In our region, the reality is that because of productivity increase, we are producing more product than we ever have before. The impact on the economy is that manufacturing is even more important than it was 40 years ago. Also, of course, even by the name “rust belt,” people don't understand the technological revolution that is happening that enables this productivity boom.”

But Karp says the region’s embracement of smart manufacturing still had room for improvement, especially with smaller companies. The survey shows that only 16 percent of Northeast Ohio companies are “dabbling” with IoT. And while 3D printing is on the rise in the region with 38 percent of companies using it, only 10 percent are using it for things like tooling.

“Biggest negative is that most small manufacturers aren't investing and adopting the major available technologies at high rates, even well-known ones like 3D printing,” said Karp. “Industry 4.0 technologies like augmented reality, collaborative robots, or even connecting machines all have very little uptake so far. We hope that that changes in the future.”

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Fabricating favorite childhood memories

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI