President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Does the steel price upturn have legs?

Steel service centers aren’t rushing to raise prices

- By John Packard and Tim Triplett

- July 22, 2019

The benchmark price for hot-rolled steel peaked at this time last year at around $910/ton but declined by 40 percent in the second half of 2018 and first half of 2019.

As of mid-July, after a yearlong downtrend, steel prices appeared to have finally turned around. Whether the uptrend has legs or will be short-lived will reveal itself in the coming weeks.

Mills and service centers suffered a serious margin squeeze in the past year as they watched steel prices, and the value of their inventories, decline week after week. Last year’s jubilant announcements of mill expansions and upgrades have given way to idled furnaces, capacity reductions, and questions about true steel demand.

The benchmark price for hot-rolled steel peaked at this time last year at around $910/ton but declined by 40 percent in the second half of 2018 and first half of 2019 despite the Trump administration tariffs that limit the competition domestic steelmakers face from imports.

Steel Market Update (SMU) data indicates hot-rolled prices appeared to bottom out in the first week of July at around $520/ton, but then increased by $30 following two $40 price increase announcements by the major mills. The market may not accept the entire $80 increase right away, but the mills seem to be collecting at least a portion of it, which means higher prices for manufacturers and fabricators.

Steel Market Update Prices

SMU gathers real-time pricing data from steel buyers every week. The price direction, as represented by SMU’s Price Momentum Indicator, had been pointing “lower” for most of the past year. So it was a noteworthy event when SMU moved its momentum indicator to “higher” on July 12.

At that time, according to SMU data, the benchmark price for hot-rolled steel (FOB the mill, east of the Rockies) was averaging $550/ton ($27.50/cwt), with lead times that had stretched a bit to three to five weeks. Cold-rolled averaged $710/ton, with lead times of four to seven weeks. The price for benchmark galvanized 0.060-inch G90 coil averaged $798/ton, with a five- to seven-week lead time for spot orders.

Price momentum for plate steel continued to trend “lower,” with the delivered price for plate averaging $780/ton ($39/cwt), with lead times of three to six weeks.

Service Centers Supporting the Increase?

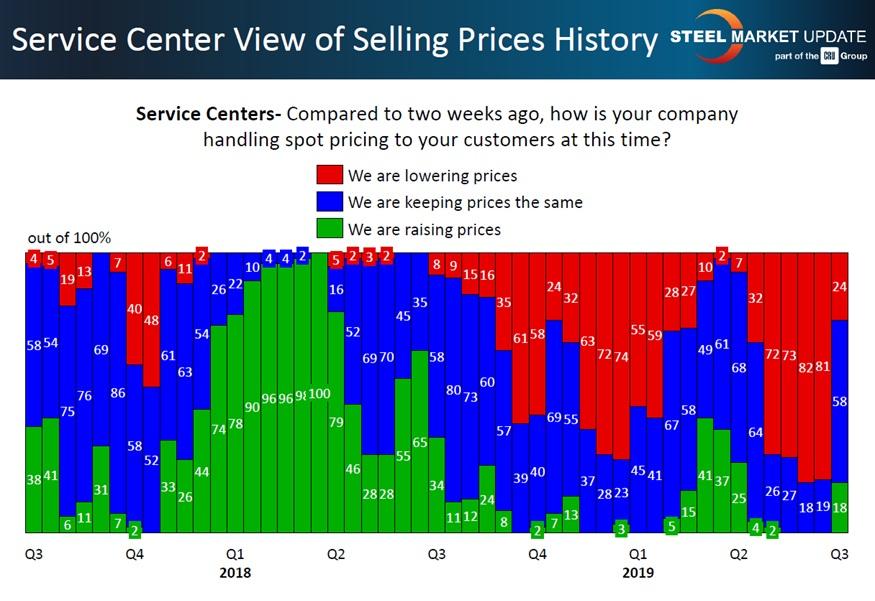

Other SMU market data supports the change in momentum. SMU sends out a market trends questionnaire to steel buyers every two weeks, and the shift in the pricing direction was evident in the last batch of returns. As seen in the bars on the far right in Figure 1, just 24 percent of service centers said they were still reducing spot pricing for their customers, down dramatically from 81 percent in the prior canvass. Perhaps the leading predictor of whether mill price hikes will “stick” is how much support they get from service centers. The fact that the majority of service centers (58 percent) said they were still keeping prices the same, rather than raising them, suggests that many remained unconvinced the turnaround was yet for real.

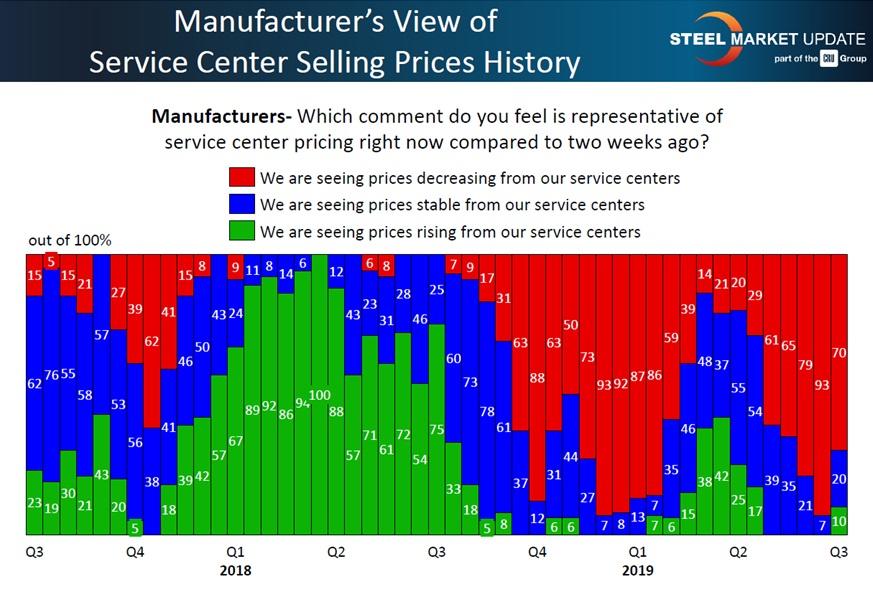

Seventy percent of the manufacturers responding to SMU in the first week of July (see Figure 2) reported that spot pricing from their distributors continued to move lower—still a high percentage, but 23 percentage points fewer than reported in mid-June prior to the mill price increase announcements.

SMU will be watching the green bars in these graphics carefully from this point forward. For the mill price increases to gain traction, the distributors need to begin raising spot prices to their customers. Earlier this year the market experienced a “dead cat bounce.” (Even a dead cat will bounce if dropped from a high enough height.) This can clearly be seen in the green bars during the latter portion of first-quarter 2019. Service center prices rose briefly, then receded. If the latest mill increases receive the same tepid support, the long-awaited rebound for steel may suffer the same fate as that poor cliched kitty.

After months of holding the line on price increases, 18 percent of service centers surveyed reveal that they are raising prices as of mid-July. Many industry observers wonder if this trend will continue or if it is short-lived.

What’s the Market Sentiment?

Opinions are split among steel buyers on whether demand will be sufficient to sustain higher steel prices in the second half. Some fear another bounce in which the turnaround proves only temporary.

Here are some anonymous responses about a temporary price bounce that we received from steel buyers:

- “Yes, I think this will be a dead cat bounce with prices declining again in the fourth quarter due to lack of demand and mills with available capacity.”

- “Yes [dead cat], but I don’t know how much lower prices could go. At $500, mills start to flip out, both integrated mills and minis. Scrap is going up or at least looks that way for August.”

- “I do not feel the momentum will continue. After a bump in pricing, I expect a pause in activity, and then perhaps a slow drift lower. We may not test the lows seen in June, but I do not think this current rally will last.”

- “No dead cat bounce, in my opinion. We cannot be the cheapest market in the world with no import offers for long. Unless demand dips more, I see Q3 picking up a bit of steam.”

- “As we adjust back up to a more normal replacement cycle, then a price bounce back to the mid-$500s seems very reasonable. While mills are targeting to get the price back to $600/ton, I think that will be a tall challenge. As the market resettles, we’ll still have the same dynamics in place as we did prior. There doesn’t appear to be enough reduction in domestic capacity or imports to lower the supply enough to create any tightness. Many are concerned that Canada and Mexico will become more aggressive to grab market share in a rising U.S. price environment. Scrap prices, which typically rise in the fall, may help to keep a floor under prices. But uncertainty in demand may be the biggest wildcard for the second half and could tilt the market in either direction.”

- “We think pricing will relax by October. I think we see $560-$580 in Q4.”

- “Our only concern right now is sustainability of current demand. Things are solid today, but it just seems like a bubble is due to burst.”

Upcoming Events

Nearly 1,000 industry executives are expected to show up for the 2019 SMU Steel Summit Conference, Aug. 26-28, in Atlanta.On Oct. 8-9, Steel Market Update will conduct its next Steel 101: Introduction to Steel Making & Market Fundamentals workshop in Cincinnati. This workshop will include a tour of the Nucor Steel Gallatin Mill.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Fabricating favorite childhood memories

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI