Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Historically high steel prices appearing more regularly

Hot-rolled coil at $1,000/ton could be here for a while

- By Michael Cowden

- November 16, 2023

Steel prices continue to climb, meaning $1,000/ton for hot-rolled coil could be here for a couple of months. industryview/iStock Editorial/Getty Images Plus

Cleveland-Cliffs announced in early November that it would seek a minimum base price of $1,000/ton ($50/cwt) for hot-rolled coil (HRC).

The move back into four-digit sheet prices happened fast and started even before the United Auto Workers (UAW) union strike against the Detroit-area Big Three automakers had been resolved.

Below is a timeline of Cliffs’ target HRC prices since the spot market for steel sheet bottomed out in late September:

- Sept. 27: $750/ton

- Oct. 19: $800/ton

- Oct. 31: $900/ton

- Nov. 7: $1,000/ton

Is $2,000/ton the New $1,000/ton?

That November announcement is important because $1,000/ton is a big, round number. We neared or crossed that level only once in a blue moon before the pandemic. The most recent examples have occurred after the Section 232 tariffs shocked the market in 2018 and shortly before the financial crisis in 2008.

Since 2021, we’ve seen HRC at or above $1,000/ton with some regularity, most recently last spring. Does hot band at a grand mean what it used to, or is HRC at $2,000/ton the new threshold for shockingly high prices?

How is it that we’re again talking about sheet prices at or above a grand? For starters, sheet lead times continue to extend and are now the longest they’ve been since late 2021.

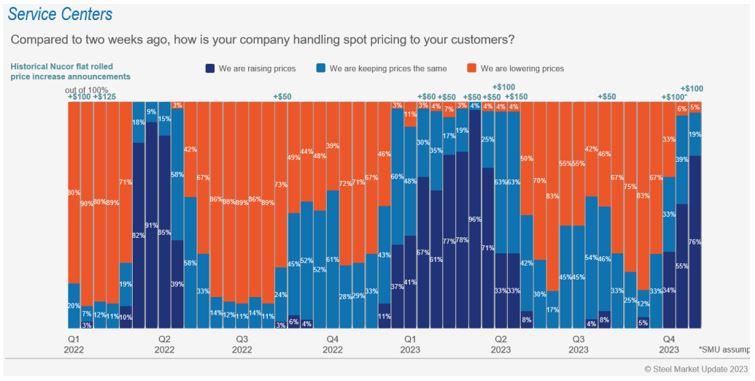

We also continue to see service centers raise prices in tandem with mills, according to our steel market survey results. That indicates there is buying downstream as well (see Figure 1). Seventy-six percent of service center respondents tell us that they are raising prices, the highest reading we’ve had since the first quarter—when we also saw a spike in U.S. sheet prices.

Here is what some of those who think prices will go higher have to say:

- “The UAW strike is over, and demand has been steady for the last four months. The mills see an opportunity to raise prices as demand should historically increase in the first quarter.”

- “Offshore supply is limited until February.”

- “Too many sat on the sidelines awaiting a collapse due to the auto strike, and the mills collectively did a great job of limiting availability during the short-term impact of the strike. It will take a few more months for inventories to get back in balance and allow prices to settle.”

Peak in Late Q4 2023 or Late Q1 2024?

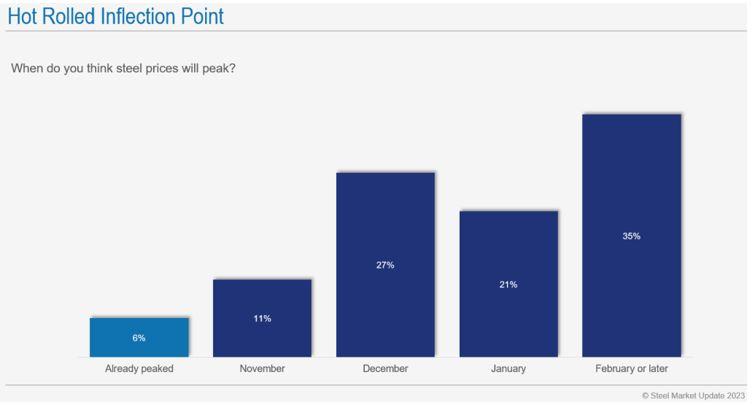

Sheet prices have been so volatile over the last three years that I’m not going to guess what price HRC might reach. I’ll instead focus on when prices might peak (see Figure 2).

Opinions diverge slightly on that question, per our survey data. Thirty-five percent of survey respondents think that U.S. HRC prices won’t peak until February or later, but 27% think price will peak in December. What gives?

Figure 1. As of early November, a majority of service centers revealed that they were raising prices for spot purchases.

Here is what some who think prices won’t peak until mid-to-late Q1 2024 have to say:

- “Depending on how auto comes back, I can see more upside into the first quarter.”

- “Not sure the fundamentals line up for the aggressive increases. I feel the mills are being opportunistic. It will need to come back down in late February or early March. They will make a lot of money between now and then.”

Here is what some of those who think prices will peak sooner have to say:

- “We’re in somewhat of a price spike. I feel it will top out.”

- “We are expecting a few more weeks of hikes and then to see things fizzle out as the holidays start.”

- “Once people realize that demand is weaker than expected, they will revert back to keeping lean inventories.”

Durable Demand

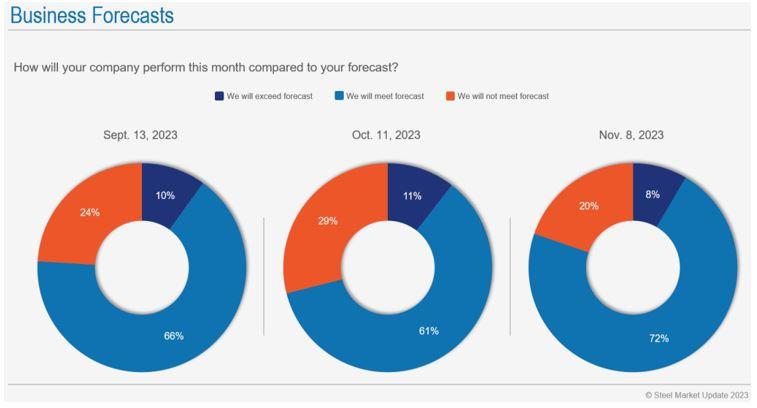

Despite some of the comments above, most steel buyers continue to report that demand for their products is solid. Despite the huge swings in sheet prices this year, we’ve consistently seen 70% to 80% of survey respondents say that they expect to meet or exceed forecasts for the month. It was no different for November (see Figure 3). (December data wasn’t available at the time this column was written.)

It probably doesn’t hurt that 23% of respondents tell us that demand is improving, the highest reading we’ve seen since the first quarter.

Here is what respondents have to say about demand:

- “Our customers sense pricing has bottomed out and are now trying to replenish stock. They want to get ahead of future price increases.”

- “Auto’s rebounding and good early 2024 order book coming in.”

- “With auto coming back, buyers are willing to build inventory again.”

Imports Gain Appeal

It’s not just domestic steel buyers who tell us they’re seeing more activity when it comes to importing steel. So, too, are steel traders.

Nearly 90% of steel traders we surveyed say that their products are competitive in the U.S. market (see Figure 4). That’s a big change from late September when domestic prices bottomed and when only half of trader respondents said their offers were appealing to U.S. buyers. Breaking it down by product, traders report that imports are most competitive when it comes to coated sheet and discrete plate.

We probably shouldn’t expect a flood of imports. U.S. buyers were ordering imports to hedge against higher domestic prices, a steel trader said. But he also noted that it was specialty items, certain thicknesses and grades, that were competitive. And, even then, it was mostly material from countries not subject to Section 232 tariffs, such as South Korea, Australia, Mexico, and Canada. (Recall that South Korea and Brazil are subject to an absolute quota rather than the 25% tariff. Australia, Mexico, and Canada are not subject to Section 232 tariffs. Also, we’d love to see more traders participate in our survey. Email us at info@steelmarketupdate.com to do so.)

Sheet-Plate Spread

Here’s one to think about: Prices for discrete plate have carried a hefty premium over HRC since early 2022. That gap, while still wide, is narrowing.

And while HRC lead times have been stretching out, those for plate have slipped. It’s therefore probably no coincidence that sheet mills announced price increases tallying into the hundreds of dollars per ton in the fourth quarter—even as Nucor cut plate prices by triple digits.

Figure 2. Just over a third of steel buyers believe that HRC won’t hit peak price levels until possibly February or later.

We had seen a trend of customers shifting plate orders, where possible, to sheet because discrete plate was so expensive. Could we see that trend reverse, with sheet losing ground to plate, should plate prices continue to fall while HRC prices rise?

Attend the Tampa Steel Conference!

We often see registrations for the Tampa Steel Conference, sponsored by Steel Market Update and Port Tampa Bay, surge at year end. This year is no exception.

Tampa Steel runs Sunday through Tuesday, Jan. 28-30, at the JW Marriott Tampa Water Street. You can learn more and register here.

Here’s a pro tip: Consider arriving on Saturday so you can take in Tampa’s Gasparilla Pirate Fest. Learn more here about Ye Mystic Krewe’s plans to invade and take the key to the city.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Fabricating favorite childhood memories

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI