Senior Analyst and Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel price decline continues: What does that mean for metal manufacturing?

Decreasing lead times, demand suggest current trends could continue into late summer, early fall

- By David Schollaert

- June 16, 2023

The price you paid for steel that's slated for future processing isn't what you'll pay in late summer. Prices keep falling, and people aren't sure when the price drop will end. Slobodan Miljevic/i Stock/Getty Images Plus

Domestic hot band prices are rolling downhill at an accelerated rate, showing no signs of slowing down yet. But how low will prices fall, and how long will it take to get there? (Whoever last checked out the crystal ball, could you please return it?)

Hot-rolled coil (HRC) prices were at $935/ton ($46.75/cwt), according to Steel Market Update’s (SMU) latest check of the market on June 6, down $135/ton over the past month and down $225/ton from the most recent high of $1,160/ton back on April 11.

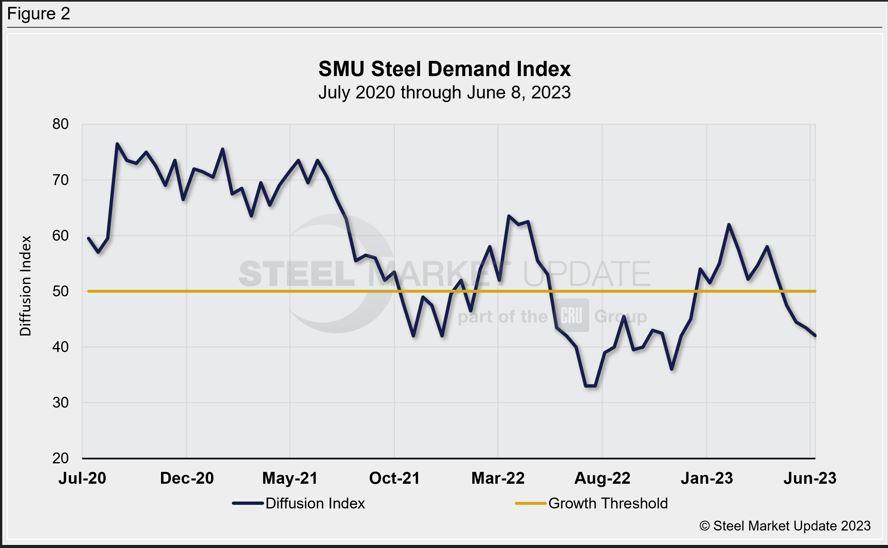

Present dynamics are eerily like what we saw last summer (see Figure 1), and we all know where that led us: a low of $615/ton on average for HRC by Thanksgiving.

But in many ways, it’s not much of a surprise that flat-rolled prices are declining, especially at the current rate. Several other markers SMU tracks are trending down and have been doing so for the better part of the past few months.

HRC lead times have just dipped below the five-week mark on average for the first time since early February, presently ranging between three to seven weeks. The ongoing shift in domestic mills’ readiness to negotiate with buyers on new orders continues, a change from just 26% of buyers of hot band saying mills were willing to negotiate as recently as early April, to about 96% this week, according to SMU’s most recent survey data.

And that’s not all. Steel buyers’ sentiment remains at some of the lowest marks since December, even if it looks like it recovered slightly from a seven-month low of +58 reported in late May.

All these indicators seem to signal the present price downtrend has more room to go. I’m certainly not willing to speculate what will happen next, but all our indicators and several economic gauges seem to be pointing down.

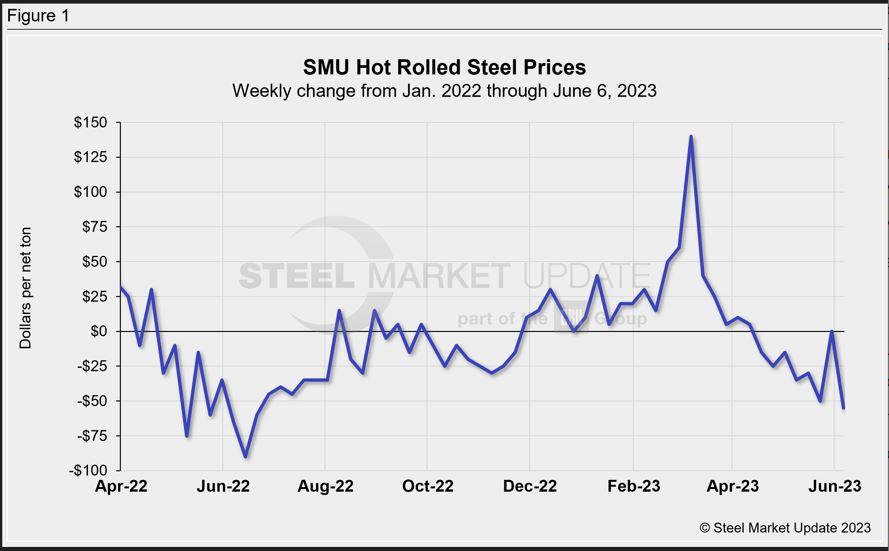

SMU’s Steel Demand Index also indicates apparent demand for flat-rolled steel in the U.S. is in negative territory, a place it’s been since late April, and likely to contract further. The index has continued to shrink and has now been below 50 for four straight readings, which indicates contracting demand. The reading is at 42.1, down 1.4 points from late April’s measure, the lowest total since Dec. 8, when the market last bottomed out (see Figure 2).

This indicator is worth monitoring as it compares lead times and demand and is a diffusion index derived from SMU’s biweekly market surveys. This index has historically preceded lead times, which is remarkable given that lead times are often a chief indicator of steel price moves.

SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times. (Figure 3 shows the past five years.) Historically, SMU’s lead times also have been a top indicator for flat-rolled steel prices, particularly HRC prices. (Figure 4 features the past five years.)

Figure 1. Steel pricing dynamics are very similar to what they were last summer at this time. Could steel prices fall to the $600/ton range again?

We’ve just now started to review survey responses, but they continue to point lower, with more than two-thirds of survey respondents in our latest flat-rolled market analysis saying that prices will either bottom in July or August, with another nearly 26% expecting prices to bottom in September or later. And as for those prices, well, early survey results note that more than 65% of steel buyers expect prices to be at or below $850/ton by August.

Yet, while some sources continue to point to steady backlogs, many argue demand and output are working against each other. And as offshore product tags are dropping aggressively, raw material prices also have dropped considerably, an indication that flat-rolled prices have more room to fall.

Additionally, others would note that present dynamics in the steel market are simply a culmination of the overall slowdown in the economy. While economic pundits debate whether we are in a recession or it has yet to start, many believe that downturn will soon come to pass.

Worrisome in the near term is the fact that these indicators are pointing lower ahead of the historically slower summer period. We’re presently midway through June with a solid two months to go before the steel industry truly engages in contractual talks. Seasonality and a typical summer holiday slowdown could potentially drive demand lower, with prices sure to follow.

SMU Steel Summit

Speaking of contract talks, the premiere U.S. steel conference that unofficially kicks off annual supply contracts is just a few weeks away.

The agenda is packed full of industry experts and key players, and registrations are climbing fast. I know some of you have already registered and booked travel for Steel Summit on Aug. 21-23 in Atlanta. If so, you’re one of nearly 700 people who have already done so.

We had more than 1,300 in attendance last year, and we’re on pace to easily exceed that total. So, you may want to consider booking your hotel soon if you haven’t already. Discounted room blocks are going fast, and non-discounted prices are much higher than in past years.

You can learn more about the agenda, networking opportunities, and how to register here.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI