President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices continue to climb

Most buyers surveyed by Steel Market Update believe the current trend will be short-lived

- By John Packard and Tim Triplett

- August 15, 2019

The longevity of the uptrend in steel pricing depends in large part on the support the mills get from distributors. Getty Images

Since late June the nation’s steelmakers have raised prices three times on flat-rolled and twice on plate products, managing to reverse the 40 percent decline in steel prices that began last summer. Steel prices have increased more than 12 percent since bottoming in early July.

The mills have seized the momentum heading into the second half of the year. But for how long?

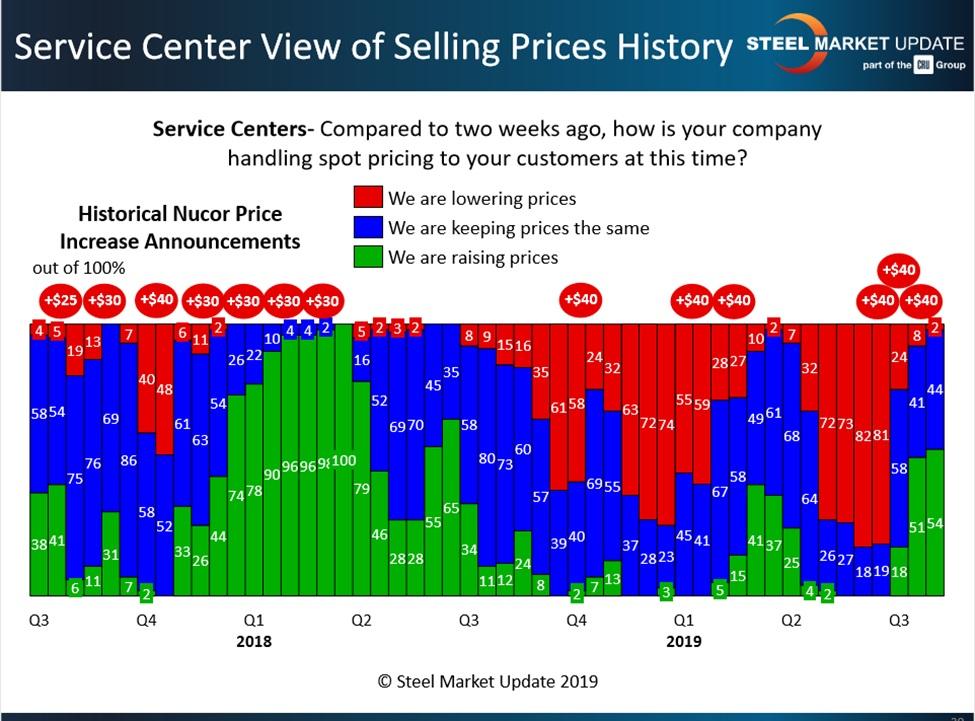

Three out of four buyers—manufacturer and service center executives—who responded to Steel Market Update’s market trends questionnaire in the week of Aug. 12 said they expect the mills’ ability to collect higher prices will be short-lived. About 11 percent said they were not paying higher spot prices at all, even after the string of mill price hikes. Another 73 percent said they expect steel prices to drop in the fourth quarter. It’s only the remaining 16 percent that expect the mills to maintain their pricing momentum at least through the end of the year. The longevity of the uptrend in pricing depends in large part on the support the mills get from distributors. Nine out of 10 service centers told SMU they were having trouble passing along the higher prices to their customers.Nevertheless, as seen in Figure 1, 54 percent reported they were raising prices to their customers in mid-August. Very few (2 percent) admitted to continuing to offer discounts to win sales. Still, a substantial percentage (44 percent) were holding the line but not attempting to raise their prices in support of the mill increases.

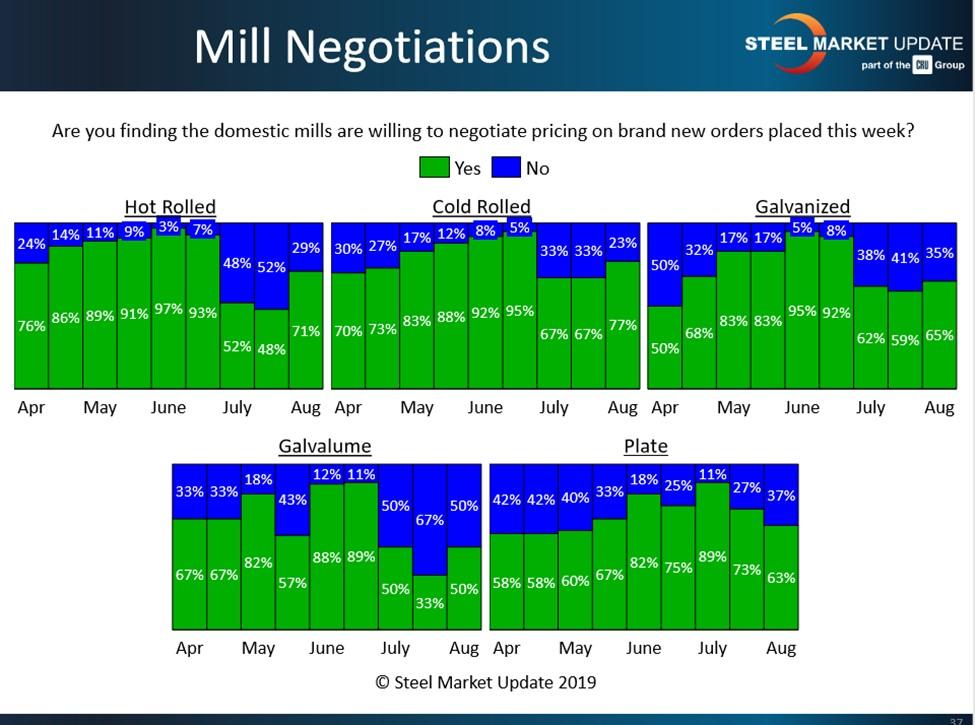

For a steel industry that is hoping to collect higher prices on flat-rolled and plate products, the mills seemed surprisingly willing to negotiate, according to SMU’s mid-August data. As the green bars in Figure 2 show, the vast majority (from 50 to 77 percent of buyers, depending on the product) reported the mills were still open to price negotiations. Of course, with a total of $120/ton in flat-rolled increases and $80/ton in plate increases in play, the mills had room to negotiate and still collect a portion of the upcharge.

Mill lead time is one key indicator of price momentum tracked by SMU. If the lead times for spot orders of steel grow longer, the mills obviously are busier than they were, and they are less likely to negotiate price. As Figure 3 shows, lead times have extended a bit so far in the third quarter.

Steel Market Update Prices

SMU gathers real-time pricing data from steel buyers every week. SMU’s Price Momentum Indicator has been pointing “higher” for flat-rolled products since mid-July.

According to SMU data, the benchmark price for hot-rolled steel (FOB the mill, east of the Rockies) averaged $585/ton ($29.25/cwt) as of Aug. 12 with lead times that had stretched a bit to three to six weeks. That compares to $550/ton and three- to five-week lead times in mid-July. Cold-rolled averaged $760/ton ($38.00/cwt) with lead times of four to seven weeks, up from $710/ton a month prior. The benchmark price for galvanized 0.060-inch G90 coil averaged $848/ton with lead times of four to 11 weeks, up from $798/ton with five- to seven-week lead times in mid-July.

Steel plate prices have been on the decline all year, and the jury is still out on whether the market has found a bottom as a result of the latest price hikes. The delivered price for plate in mid-August averaged $790/ton ($39.50/cwt) with lead times of four to six weeks, just a small increase from the $780/ton price and three- to six-week lead times the prior month.

What’s the market sentiment on the price increases? Here is a sampling of comments SMU received from its steel-buying survey respondents:

- “I think they have pulled orders ahead, and we will see some price reduction in late October or November. But I don't think it will get back to the bottom numbers we saw in July.”

- “We feel orders were pulled ahead, and beyond September mills may be challenged to keep order books full.”

- “It's all posturing before contract season. Without supply-side discipline, demand fundamentals will kick in. Also, foreign pricing has already peaked, so any domestic tailwind will quickly become muted.”

- “One theory going around is that the domestic mills are smarter today and will manage capacity to ensure that the prices don't drop. That would be a first.”

Adding to the uncertainty over steel pricing, U.S. Steel made a splash on Aug. 13 when it announced it will no longer use index-based pricing, effective with its 2020 contracts. Widely used by most mills, contracts that adjust up and down with a published index price are designed to protect both buyers and sellers from unexpected fluctuations in the market. U.S. Steel contends that such adjustable price contracts are excessively influenced by spot market transactions, which represent only a small fraction of the total market. As a result, they claim that the volatility of spot market prices distorts the economics of volume-based agreements.

Should other mills decide to follow U.S. Steel’s lead, the change has wide-ranging implications for steel prices and the way mills negotiate contracts with buyers in the future.

Upcoming Events

On Oct. 8-9 Steel Market Update will conduct a Steel 101: Introduction to Steel Making & Market Fundamentals workshop in Cincinnati. This workshop will include a tour of the Nucor Steel Gallatin mill.

On Jan. 7-8 Steel Market Update will conduct a Steel 101: Introduction to Steel Making & Market Fundamentals workshop in Fontana, Calif. The workshop will include a tour of the California Steel Industries mill.

John Packard, president/CEO of Steel Market Update, can be reached at john@steelmarketupdate.com. Tim Triplett, executive editor for Steel Market Update and the former editor-in-chief for Metal Center News, can be reached at tim@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI