Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices rebound against a backdrop of uncertainty

The automotive strike and international conflicts don’t dim the demand for domestic steel

- By Michael Cowden

- October 18, 2023

Steel prices appear to have bottomed, prompting some steel buyers to wonder if that's a short- or long-term trend. IpekMorel/iStock/Getty Images Plus

Steel Market Update’s latest survey data reflects a consensus among steel buyers that sheet prices have bottomed out and might rebound.

Lead times continue to extend. Fewer sheet and plate mills are willing to negotiate lower spot prices. Seventy percent of survey respondents think prices bottomed out in October.

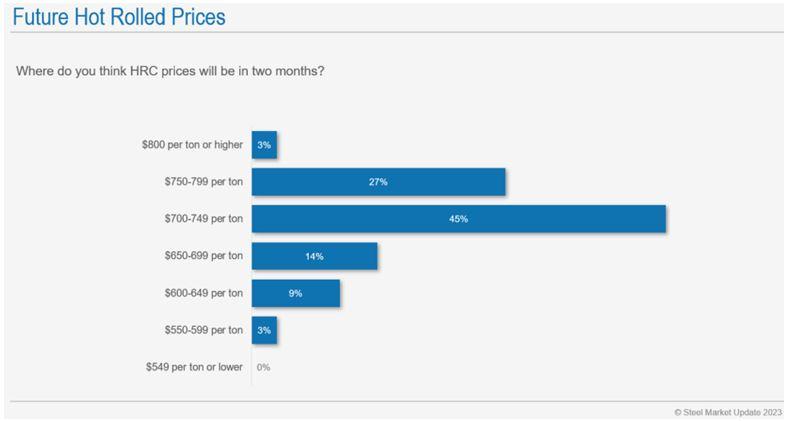

Also, 75% of respondents think that we’ll end the year with hot-rolled coil (HRC) prices above $700/ton (see Figure 1).

That’s somewhat remarkable considering that concerns lingered—especially ahead of the United Autoworkers (UAW) strike—that HRC could fall into the $500/ton range.

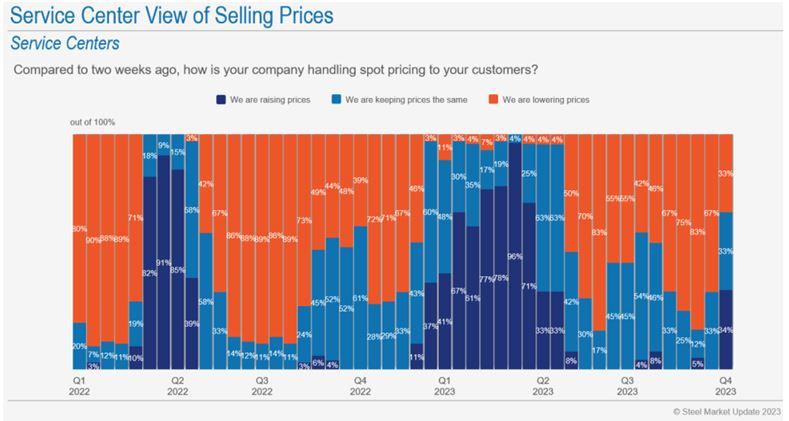

Notable, too, is that the sheet price increase led by Cleveland-Cliffs in late September appears to have gained more traction among service centers than a prior round of hikes announced in June/July (see Figure 2).

Approximately one-third of service center respondents reported increasing prices in our mid-October survey. Compare that to only 8% following the increase led by U.S. Steel in mid-June.

We haven’t seen service centers following the mills’ increased prices at this level since late Q4 of 2022, just ahead of a sheet price spike in Q1 of this year.

Meanwhile, more than 70% of respondents predicted that they would meet or exceed forecasts in October (see Figure 3). That trend has proven durable despite volatility in prices and current events.

What’s also interesting is that price expectations have firmed even as the consensus about the length of the UAW strike has shifted. Approximately 50% of survey respondents in early October predicted that the UAW strike would reach at least seven to eight weeks. In September, shortly after the strike was announced, about 50% thought it would last only three to four weeks. A month ago, only 10% predicted that the strike would last more than seven weeks.

How are prices rising even though most people underestimated the length of the UAW strike? It appears that mill idlings, maintenance outages, and strength in other markets have to date offset lower demand from union-represented automotive companies.

A majority of steel buyers surveyed by Steel Market Update indicate that they expect hot-rolled coil prices to surpass the $600/ton range by the end of 2023.

Perhaps the Bottom Has Not Been Reached

But not all the data we collected in our survey supported the narrative that prices have bottomed out and rebounded. A significant number of service centers, for example, continue to reduce inventories. Why is that (see Figure 4)?

Is it a reflection of typical seasonal factors? Not wanting excess inventory in certain jurisdictions, such as Harris County, Texas, for example, where year-end inventory taxes are levied? Recall that lead times for many flat-rolled steel products are into late November or December, and customers in such locations typically don’t want excess steel at year-end.

Is it because inventory carrying costs are higher because of higher interest rates? Or are some service centers concerned that the rebound in sheet prices that we’ve seen over the last few weeks isn’t sustainable?

Also, we’ve seen a modest increase in the number of respondents who report that they’re on the sidelines (see Figure 5).

That may be just noise. We’re not reading too much into it unless we see the same trend continuing in future surveys.

But I can see why it has the potential to become a trend. Some big buyers bought large volumes at a significant discount to prevailing spot prices in September. Those deals mean some probably don’t need to return to the spot market (except to fill in holes) for the balance of the year.

Additionally, these are uncertain times. At home, the UAW has said it will change tactics, no longer waiting to announce strikes on Fridays but instead announcing them at any time and with little notice. Also, will there be a deal for U.S. Steel this year, and what might a deal look like? Would it result in more consolidation or less consolidation at the mill level? In the Middle East, the Israeli-Hamas conflict holds the potential to expand into neighboring countries. What might the ramifications of that be, if any, for steel markets in the U.S.?

SMU Subscriptions

Do you like what you’ve read here? Then consider taking a free trial and subscribing to SMU. Reach out to Lindsey Fox for more information.

SMU Events

Our next in-person Steel 101 will be in the spring of 2024. Stay tuned for the location and dates.

In the meantime, more companies continue to register for the Tampa Steel Conference, which we do together with Port Tampa Bay. Some of you told us last year that high hotel costs were an impediment, so register at here before the hotel rates go up!

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI