President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

The steel price slide might be ending

Announced price hikes have jolted the market

- By John Packard and Tim Triplett

- February 14, 2019

As of mid-February, the direction of steel prices in the near term was almost as big a mystery as prices in the future. (For companies looking for a way to get a better handle on possible steel price increases or minimizing risk in their steel supply chain, see the sidebar What Does the Future Say About Steel Prices?).

Multiple mills announced a $40/ton hike in the price of flat-rolled steel products in January, but weeks later it remained unclear if the increase would have much effect on the spot market. Just because mills announce an increase does not mean they will collect it. Much depends on the support the increase gets from steel distributors and ultimately what the market is willing to bear given the current demand.

Current Steel Prices

As of Feb. 12, the Price Momentum Indicator from Steel Market Update (SMU) was set at “neutral” on flat-rolled steel, as the price direction was unclear. (All prices below are FOB the mill, east of the Rockies.) The price of hot-rolled steel averaged $680/ton ($34/cwt), with lead times of two to five weeks. Cold-rolled steel was selling at an average price of $810/ton ($40.50/cwt), with lead times of four to eight weeks. The benchmark price for galvanized 0.060-inch G90 coil averaged $888/ton, with a lead time of four to nine weeks. For Galvalume 0.0142-in. AZ50, Grade 80, the average price was $1,101/ton, with a lead time of four to seven weeks.

For steel plate, the SMU average was $1,005/ton ($50.25/cwt) FOB delivered to the customer’s facility. SMU’s Price Momentum Indicator on plate was “lower,” meaning prices were expected to have mild erosion over the following 30 to 60 days. Plate lead times were four to seven weeks.

What Buyers Are Saying

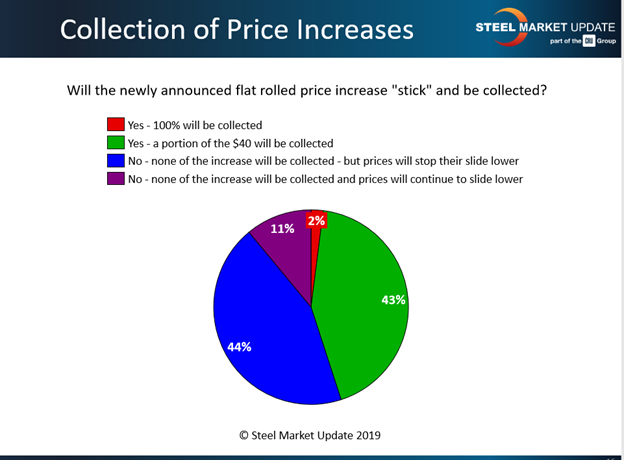

SMU canvassed the market during the week ending Feb. 8, asking buyers: Will the newly announced flat-rolled price increase stick? At that time, very few of the respondents expected the mills to collect the full $40/ton. More than 11 percent predicted the announcement would have no effect and that steel prices would continue to decline. The average price of hot-rolled steel has plummeted by 25 percent since last summer.

A large percentage of those surveyed, however, definitely expected the announcement to have an impact (see Figure 1). About 44 percent believed the mills’ action would finally put an end to the seven-month downtrend in steel prices. Another 43 percent predicted that not only would the announcement stem the bleeding, but the mills also would manage to collect at least a portion of the increase.

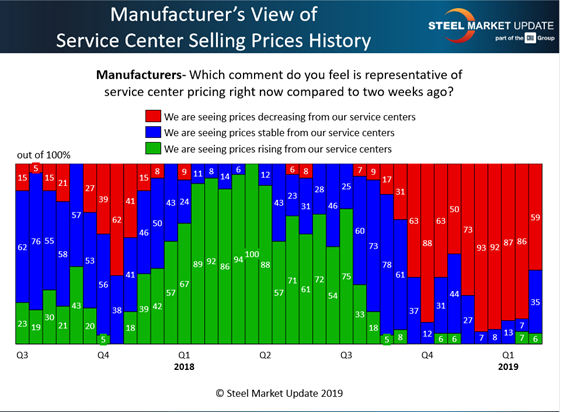

Looking at price momentum a different way, SMU asked manufacturers if they were seeing price offers from their service center suppliers increasing, decreasing, or remaining the same. In mid-January, 86 percent of the manufacturing companies responded that spot pricing from distributors was lower than earlier in the month. Two weeks later, only 59 percent reported spot prices as still in decline—a significant change (see Figure 2).

Next, SMU looked to see if the service centers were supporting higher prices (see Figure 3). The latest data showed that 28 percent of the steel distributors said they were still lowering spot prices that week. However, more than twice as many, 59 percent, reported lowering prices in mid-January. Again, another possible sign that prices were firming.

We need to be careful not to infer from this data that the flat-rolled price increases are definitely sticking. The jury is still out on that question. It could be a temporary phenomenon.

The last time Nucor announced a price increase back in October, it ultimately failed. There was an uptick in quoting for a couple of weeks, and then distributors went right back to discounting spot prices and dumping inventories on the market.

Figure 1. Most of those surveyed by Steel Market Update believe that announced price increases for flat-rolled steel means that the recent price slide for the material has come to an end.

What Does the Future Say About Steel Prices?

By Gaurav Chhibbar

What will the price of steel be in three, six, or nine months? The futures market allows for this question to be addressed, if not answered.

Futures trading is not a new concept; it has been around for a long time. Many commodities have futures that trade on several exchanges around the world.

Manufacturers and fabricators often are presented with a simple question: What will my raw material cost tomorrow? This question takes a different form depending on the timeline. It may be: What will my raw material cost next month or next year? Market players, including producers, processors, consumers, and traders, use futures as a means to lay off risk or express their view. That view forms the basis of a price at which buyers and sellers are willing to transact in the future. Their willingness is informed by the information they have at the time of making the decision.

For a manufacturer who is concerned with servicing customer needs in the future, understanding futures is a vital tool. After all, no one is going to be changing catalog prices daily to match steel or aluminum price fluctuations. Neither is it a sensible decision to lay down heavy inventory positions to protect against risk of price appreciation while servicing a customer contract. The genesis of the futures market was precisely to address these issues.

Gaurav Chhibbar is a partner in Metal Edge Partners, 1107 Hazeltine Blvd., Suite 493, Chaska, MN 55318, 612-310-7164, info@metaledgepartners.com, www.metaledgepartners.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI