President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

What does the election mean for steel trade?

The Democrat-controlled House could commence investigations into the current metal tariffs

- By John Packard and Tim Triplett

- November 15, 2018

Even with the Democrats taking control of the House of Representatives, fabricators don't have to worry about increasing steel prices--at least for now.

The hotly contested November election is finally behind us. The Democrats took control of the House of Representatives for the 116th Congress, while the Republicans retained control of the Senate. What does that mean for steel trade?

Congress must approve the new North American free trade deal negotiated by the Trump administration before it can take effect. The so-called United States-Mexico-Canada Agreement (USMCA) is likely to face added scrutiny now that the Democrats control the House. Dems reportedly want stronger labor and environmental protections in the new agreement. President Trump has threatened to terminate the existing NAFTA agreement if he does not get his USMCA deal. Whether he has the authority to terminate such a trade pact without congressional approval may have to be decided by the courts.

The USMCA “free trade” agreement with Canada and Mexico does not address the Section 232 tariffs on steel and aluminum imports into the U.S. Naturally, officials from Canada and Mexico strongly oppose them. The administration continues to insist that the tariffs are necessary to ensure U.S. national security. Some Democrats in Congress are among the skeptics who believe the national security claim is just an excuse to protect the domestic steel and aluminum industries and artificially raise prices. Now that they are in control, expect the Democrats to call for hearings on Section 232 and its effects on downstream steel-consuming industries, as well as foreign policy hearings on the tariffs and relations with U.S. allies.

Wrangling over the USMCA may result in a relaxation of the tariffs for Canada and Mexico, which would complicate the tariffs and quotas for other U.S. allies. Add to that the prospect of U.S. litigation over the tariffs and increased activity at the World Trade Organization as disputes continue, and 2019 will provide many opportunities for change in steel and aluminum policy, according to Washington trade attorney Lewis Leibowitz.

The Impact on Steel Prices

With the 25 percent Section 232 tariff in place on imports from China and other unfriendly rivals, as well as allies like Canada and Mexico, U.S. steel imports are down significantly. Through the first 10 months of the year, total st

eel imports declined by more than 11 percent compared with the same period in 2017.With less competition from foreign mills, domestic steelmakers were quick to raise prices and ramp-up production. The mills now are operating above 80 percent of their capacity, maintaining production at the highest rates seen in a decade. Publicly traded mills have reported record revenues and profits. In a sign of their prosperity, they have agreed to share the wealth in new contracts with the United Steelworkers. Union workers are set to receive a 14 percent raise over the four-year term of the newly negotiated labor pact, plus improvements to health care and retirement benefits.

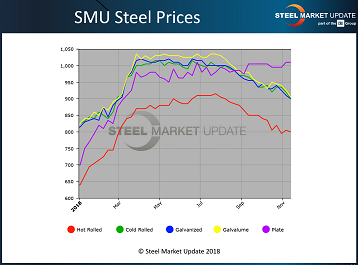

Steel prices have not reacted entirely as expected in the second half of this year, however. The benchmark price of hot rolled steel peaked in July at around $915/ton. Since then, the market has seen a correction. Despite continued strong demand from service centers, manufacturers, and fabricators, steel prices have declined by more than 12 percent in the past few months. Lead times on spot orders from the mills have shortened considerably, indicating that they are less busy and more willing to negotiate on price to fill their order books.

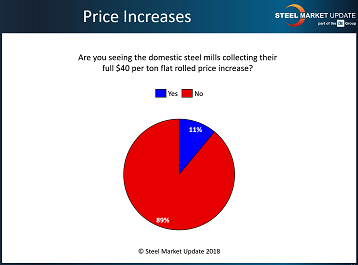

In an effort to slow the price erosion, leading mills announced their intention to raise flat-rolled prices by $40/ton on Oct. 10. But the increase failed to stick, and prices have continued to inch downward (see Figure 1).

Steel Market Update’s canvass of the market on Nov. 11 found the following prices on hot-rolled, cold-rolled, and galvanized steels (FOB the mill, east of the Rockies): Hot-rolled averaged $800/ton ($40.00/cwt), with lead times of three to five weeks. Cold rolled averaged $900/ton ($45.00/cwt), with lead times of five to eight weeks. The base price of galvanized coil averaged $900/ton ($45.00/cwt), with lead times of four to nine weeks. Including extras, benchmark 0.060-inch G90 galvanized averaged around $978/ton. The average base price for Galvalume was $905/ton, with lead times of six to eight weeks.

Steel plate is the exception to the price correction, with demand still outstripping supplies and mills keeping customers on allocation. Plate averaged $1,010/ton FOB delivered to the customer’s facility, with lead times of five to nine weeks.

Figure 1. The price increase that many steel mills announced in early October hasn’t really resulted in the boost they were looking for.

While the price trend is difficult to assess as mills begin taking orders for what is expected to be a strong Q1 2019 for the U.S. economy, SMU has shifted its Price Momentum Indicator from “neutral” to “lower” (see Figure 2), meaning we believe prices are likely to continue declining over the next 30 to 60 days.

Prospects for the economy and steel demand in 2019 rest in large part on what happens on the political front. House Democrats, who have been unable to get anything going on Capitol Hill for two years, will be eager to challenge the administration on issues as diverse as Russia, infrastructure, health care, immigration, and trade.

“Elections always matter,” Leibowitz said, “but this one perhaps more than most.”

Upcoming SMU Events

SMU is still accepting registrations for the next Steel 101: Introduction to Steel Making & Market Fundamentals workshop. The two-day event is scheduled for Jan. 29-30 in Starkville, Miss., and includes a tour of the Steel Dynamics Columbus steel mill.

For more information, visit www.steelmarketupdate.com/events/steel101 or call 800-432-3475. SMU will be adding more steel training workshops during calendar year 2019 in conjunction with a number of steel mills around the U.S. and Canada.

SMU’s 2019 Steel Summit will return to the Georgia International Convention Center in Atlanta on Aug. 26-28. The 2018 conference attracted 912 executives from manufacturing, steel distribution, steel mills, trading companies, toll processors, and other companies associated with those industries. SMU anticipates 1,000 executives will attend the 2019 event, which is located next to the Hartsfield-Jackson Atlanta International Airport.

Registration opens in early January 2019. For complete information on the event, visit www.steelmarketupdate.com/events/steelsummit.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Fabricating favorite childhood memories

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI