Contributing Writer

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Potential workplace blood monitoring changes worry metal manufacturers

More stringent lead exposure regulations in California and Washington could influence OSHA action

- By Stephen Barlas

- November 14, 2022

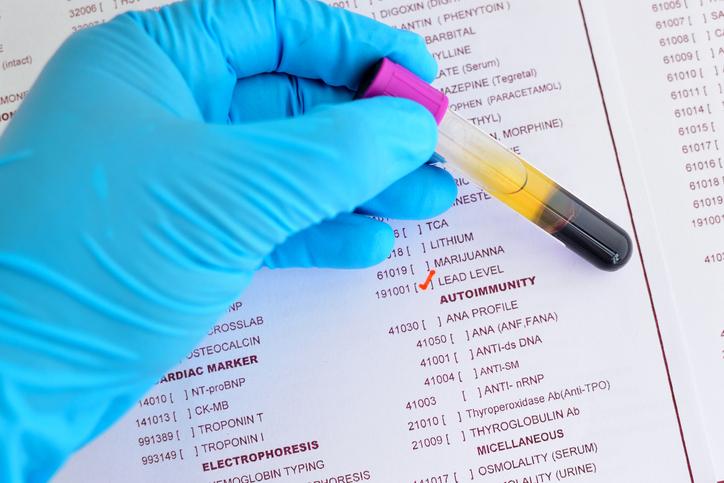

Based on some aggressive regulation action in a couple of West Coast states, the Occupational Safety and Health Administration is considering new blood monitoring levels for lead exposure. jarun011/iStock/Getty Images Plus

Fears are rising from multiple metalworking sectors about the Occupational Safety and Health Administration’s consideration of new blood monitoring levels for lead exposure that would affect a substantial number of U.S. manufacturers who use scrap metal as a production input.

The current OSHA standard is permissible exposure limit (PEL) airborne concentration of 50 µg of lead per cubic meter of air (50 µg/m3) averaged over an eight-hour period. OSHA’s blood lead level (BLL) for medical removal is 60 µg per deciliter (60 µg/dL) or more for general industry. The return-to-work BLL is less than 40 µg/dL.

OSHA appears to be considering a reduction of the PEL to levels now being considered by the states of California and Washington. California’s most recent discussion draft includes a medical removal level when 30 μg/dL is documented after a single test result, when the last two monthly blood lead tests are 20 μg/dL or more, or when the average of the results of all blood lead tests conducted in the last six months is at or above 20 μg/dL. The discussion draft also includes a reduction in the PEL from 50 μg/m3 to 10 μg/m3.

Those kinds of potentially draconian reductions to the OSHA federal standard now being enforced in all states have rung alarm bells from industry groups such as the American Foundry Society (AFS).

“The percent or amount of lead present as a contaminant in incoming materials from scrap metal … is not predictable,” said Greg Kramer, technical director, AFS. “Likewise, the amount of lead in surface dust can be highly variable and would also trigger extensive, costly, and frequent testing. It will likely require changes to the plant’s airflow and ventilation, and enhanced particulate air filtration systems. These operational changes will require engineering work, regulatory reviews and permitting, procurement of equipment and materials, system construction/modification, and performance testing before compliance can be established.”

Anthony Darkangelo, CEO, FCA International, which represents metal finishers, said, “Relying on state rulemaking is allowing the tale to wag the proverbial dog. What is more, given the recent changes by California, Washington, and Michigan, there is a dearth of scientific evidence showing that their methods have resulted in greater employee health. Rather than focusing on worker BLL—which is elevated only after a lead exposure—FCA believes that worker safety would be better advanced through more robust enforcement of existing lead standards.”

Steel Tariffs Stay—for the Most Part

Here’s some bad news for manufacturers using hot-rolled steel: The U.S. International Trade Commission (USITC) decided to maintain the existing countervailing duty order on imports of hot-rolled steel from South Korea and the antidumping duty orders on imports of hot-rolled steel from Australia, Japan, Netherlands, Russia, South Korea, Turkey, and the U.K. Those decisions were based on a five-year review of the tariffs and found that U.S. steel manufacturers would be hurt if the tariffs were removed.

The silver lining for metal consumers is that the USITC did agree to remove the existing antidumping duty and countervailing duty orders on imports of hot-rolled steel from Brazil.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Stephen Barlas

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI