President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Anxiety grips the U.S. steel markets

Hurry up and wait. Hurry up and wait. The steel industry is a mess

- By John Packard

- July 26, 2017

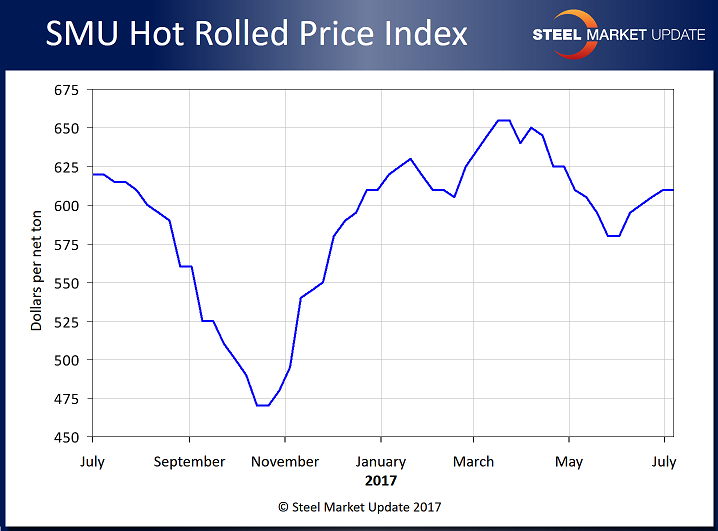

Figure 1. In early July steel market prices were very close to what they were at the beginning of June.

In my July 2017 article in The FABRICATOR®, I mentioned the market was poised for a strong upside price move because of the expectation that President Trump was about to become the savior of the domestic steel industry (steel mills, not manufacturing companies).

The U.S. steel mills announced a $30 per ton price increase on flat-rolled early in June. The expectation at the time was for more price announcements as we approached the deadline imposed by President Trump on the U.S. Department of Commerce (DOC) regarding the Section 232 (national security) review for steel and aluminum. That deadline was the end of June 2017.

In early July steel market prices were very close to what they were at the beginning of June (see Figure 1). Steel Market Update has the benchmark hot-rolled price average at $610 per ton ($30.50/cwt). Our SMU Price Momentum Indicator is pointing toward higher steel prices over the next 30 to 60 days.

However, uncertainty surrounding the Section 232 recommendation and announcements by the DOC and President Trump has caused the market to pause, and prices have been mixed over the past few weeks.

We have left the SMU Price Momentum Indicator at “higher” because the president has been making statements that he is going to “fix” the domestic steel industry by controlling “dumped” foreign steel into the U.S. market. He continues to promise tariffs, quotas, or a combination of both. We have no choice but to take him at his word and to expect that any action will push steel prices higher.

The June 30 deadline for the DOC to make its recommendations has come and gone. Commerce Secretary Wilbur Ross told senators on the Ways and Means Committee last week (July 14) that he expects the recommendation to be ready as early as this week (week of July 17). I expect once the recommendation is made, President Trump will not use the full 90 days he has available to make a final determination on actions to deter foreign steel imports.

Again, the steel community is counting on the trade actions to be quite restrictive, which would affect the supply of steel as we move into the fourth quarter. Right now, about 24 to 27 percent of apparent steel supply is coming from foreign-produced steel. The steel mills are running at an average capacity utilization rate of 75 percent (probably closer to 80 percent on flat-rolled steel).

If imports were cut in half, this would put about 1.5 million tons of monthly demand back on the domestic steel mills. To put this into perspective, at a 75 percent utilization rate, the domestic steel mills produce about 1.75 million tons of steel per week. Adding 1.5 million tons would be like adding an extra week’s production to each month.

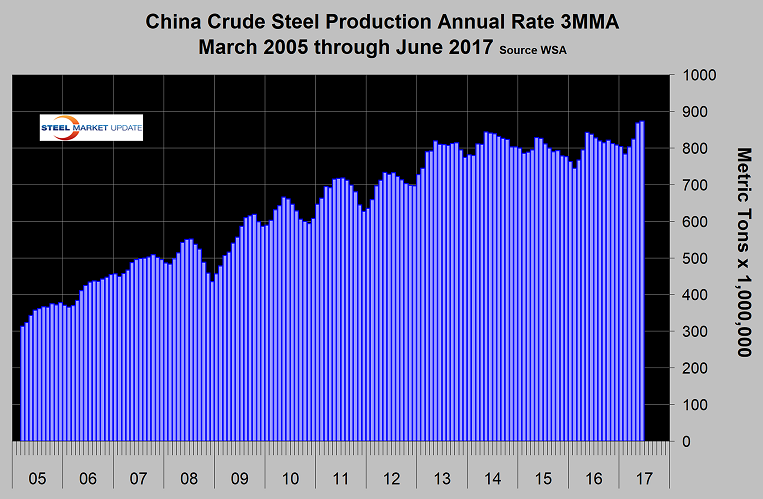

What is the U.S. government trying to accomplish with the Section 232 steel and aluminum investigations? It wants the world to recognize and then deal with overcapacity. This is mostly directed at China, which has been flooding the world with cheap steel to keep its mills running. The Chinese have been promising to reduce capacity and have shut down some old and polluting steel mills. Even so, the Chinese steel mills produced the most steel in the country’s history in May 2017 (most recent statistics available). Our analysis is showing the country’s steel production to be in a growth mode (albeit modest) at a time when they are promising to reduce capacity (see Figure 2). Last year, the Chinese steel mills exported more steel than the U.S. produced.

U.S. steel mills have been using the antidumping (AD) and countervailing duties (CVD) system to try to block or reduce foreign steel from coming into the U.S. market. China has been blocked, but other countries such as South Korea and Taiwan, even though they have AD/CVD covering many of their products, have continued to ship into the U.S. market. In my opinion, the government will go after those countries that failed to scale back exports of products cited as being dumped into the U.S. market.

Figure 2. China’s steel production seems to be in a modest growth mode. In May, the country produced the most steel in the country’s history.

At the same time, I expect our NAFTA partners, Australia and Europe, will be spared from an across-the-board quota or tariffs that might be imposed on other countries.It is known that President Trump is trying to lower the U.S. trade deficit. I believe he is using steel as a tool to force concessions from those countries with which the U.S. has the biggest trade deficits.

As I write this, we still do not have answers to so many questions, and the steel market remains confused and anxious. The Section 232 discussion is drowning out all other discussions and negotiations within the industry, and steel buyers need to understand its effect on supply and pricing so they can make informed buying decisions.

Maybe by the time this article is published, there will be some clarity.

From August 28-30, Steel Market Update will conduct its 7th SMU Steel Summit Conference in Atlanta. Many highly qualified speakers will discuss what is “free and fair” trade from both sides of the issue. For more information, visit www.steelmarketupdate.com/events/steel-summit or call 800-432-3475.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI