Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

DFM and the metal fabricator

How DFM drives down costs at Dynisco

- By Tim Heston

- October 11, 2018

- Article

- Manufacturing Software

Machine operators notice one of their bosses walking around the fab shop with a customer, someone who obviously has an inquisitive mind. He’s asking questions, engaging. He’s a purchasing manager who works for Dynisco, a testing and measurement equipment maker based in Franklin, Mass. And he’s working directly with engineers at the supplier and his employer. He’s learning about fabrication, asking for input, and working to estimate Dynisco’s total cost of ownership for the parts the fabricator sends the company’s way.

Matt Miles, product development manager at Dynisco, relayed this story to introduce the company’s approach to continuous improvement, an initiative that began in earnest in 2009 and grew during the economic recovery. And from the start, the company engaged its supply chain, including its sheet metal parts suppliers. This made sense, considering the company has no in-house fabrication capability. How can you fully streamline an assembly process if you don’t address the parts that go into that assembly?

The company’s journey since then involves breaking down communication barriers, spreading best practices, and discovering a simple truth that could be viewed as the keystone of an efficient supply chain: The total cost of ownership needs to be known, and it shouldn’t be a secret.

Analyzing Total Costs

Earlier this year at The FABRICATOR®’s Leadership Summit in Scottsdale, Ariz., a group of custom fabrication executives were asked about some of their greatest challenges. Finding skilled people was at the top of the list, but also on that list was dealing with what one executive called “unsophisticated pricing strategies.”

It’s a common story heard in custom fabrication circles. A competitor lures work away with a low-ball price. A few months later, maybe a few years, after dealing with various delivery and quality issues, the customer comes back to the fabricator with a new appreciation for realistic pricing and high quality.

Miles has more than 18 years of engineering and supply chain experience, with an emphasis on product development, and for much of that time he’s focused on design for manufacture (DFM). He recalled a time at a previous employer when he worked with a supplier on parts costing. “He had been making parts for a long time with us, and we discovered that, for some parts, he really wasn’t making anything. In fact, he was taking a loss. But then he had other breadwinner parts. So we sat and worked with him, and we told him, ‘We want you to make money on every part you make for us.’”

Miles added that this wasn’t charity. After all, underpaying for some parts makes it more likely that the supplier will charge more for other parts. “DFM is really about having an honest conversation with suppliers,” he said.

Dynisco uses a DFM module from the DFMA® software suite produced by Wakefield, R.I.-based Boothroyd Dewhurst Inc. DFMA stands for design for manufacture and assembly. The software helps engineers estimate the cost of piece-parts as well as the cost of putting those parts together into an assembly.

Dynisco then marries this DFM data with its in-house total-cost-of-ownership (TCO) analysis, a tool that comes from company President John Biagioni, who came aboard in 2009 in the wake of the Great Recession. Biagioni is an executive with engineering knowledge who held previous positions in supply chain management and operations.

“He developed our TCO analysis spreadsheet,” Miles said, “and what’s great is that this TCO model is a natural fit for DFM. With [the software] we get what we call the ‘should cost’ for materials and processes that go into a product. And that’s where the TCO model starts.”

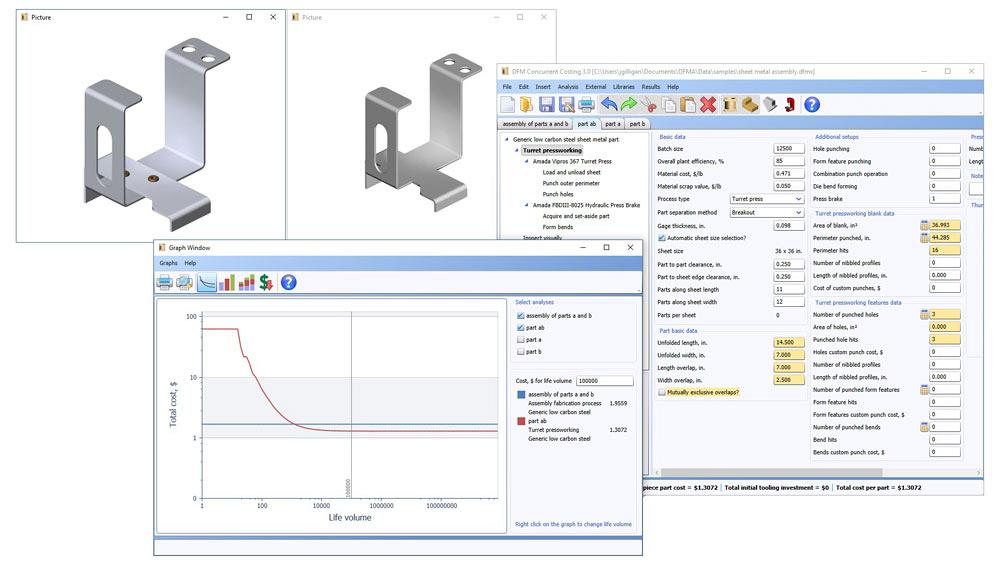

A CAD plug-in allows for concurrent costing during the design process. Image courtesy of Boothroyd Dewhurst Inc.

The company’s TCO model has three tiers, the first being the individual piece part and assembly costs, which come from DFM. The second tier of TCO incorporates factors such as inventory holding costs (for instance, to account for longer lead times from certain supplier locations) and total landed costs that include elements like insurance and duties. “This is especially useful when we examine suppliers from different locations,” Miles said. He added that the third tier incorporates hidden costs, factoring in different overhead costs, the cost of poor quality, and engineering costs.

The TCO model incorporates risk factors like natural disasters, infrastructure issues, and intellectual property issues, especially if sourcing from low-cost locations. “We factor in these costs that aren’t usually considered,” Miles said, “and this makes up an entire third of our total cost of ownership calculation. We can, say, get three different quotes from three suppliers in different regions, and we run this analysis side by side. Our TCO tool gives us a good estimate of the costs we may miss instead of looking solely at the cost of a specific part.”

Developing a “Should Cost”

Establishing TCO is a bit like building a pyramid, and at its base is DFMA. Again, the software analyzes the cost of a part made at a certain volume, while TCO analyzes the total cost of the entire job, including costs that often lie hidden, particularly in global supply chains. Still, if the software stands on shaky ground, so does the TCO.

This, Miles said, is why Dynisco uses DFM not in a dictatorial way (meet this price or we’ll go elsewhere) but as a starting point in the conversation with suppliers. The company has sometimes edited its “should cost” calculations based on supplier feedback. But more often than not, the conversation leads to better, easier-to-fabricate designs.

For instance, Dynisco representatives met with one of the company’s sheet metal suppliers to talk about a machine cover made of 0.060-inch-thick 6061-T6 aluminum that had a 12-in. radius. This created a U shape that had to be bump-formed on a press brake. This can be tricky for any material and a true bear when working with tempered material like crack-sensitive 6061-T6.

So engineers sat down and collaborated to redesign the part and choose a new material. Carbon steel wasn’t a possibility because of weight considerations, but other aluminum grades were considered. In the end, engineers at Dynisco and the fabricator chose 5052, a material that’s much easier to form. They also found that the 12-in. bump-formed radius was purely cosmetic; changing the geometry and adding standard 0.25-in. bend radii wouldn’t affect how the final product functioned. The forming ended up being much easier and, hence, less costly.

Miles added that the DFM on many parts boils down to proper tolerancing. He brought up another sheet metal part that involved six bends over a final part width of 13 in.—with a tolerance on that overall dimension at only ±0.005 in. After talking with the sheet metal supplier, Dynisco engineers changed the drawing so it had a reasonable tolerance for typical bending on a press brake, and fabrication went onward.

The collaboration led to the spread of best practices and, not least, training design engineers on the basics of sheet metal forming—such as which materials are easy to form, which aren’t, and what off-the-shelf press brake tools can and can’t accomplish.

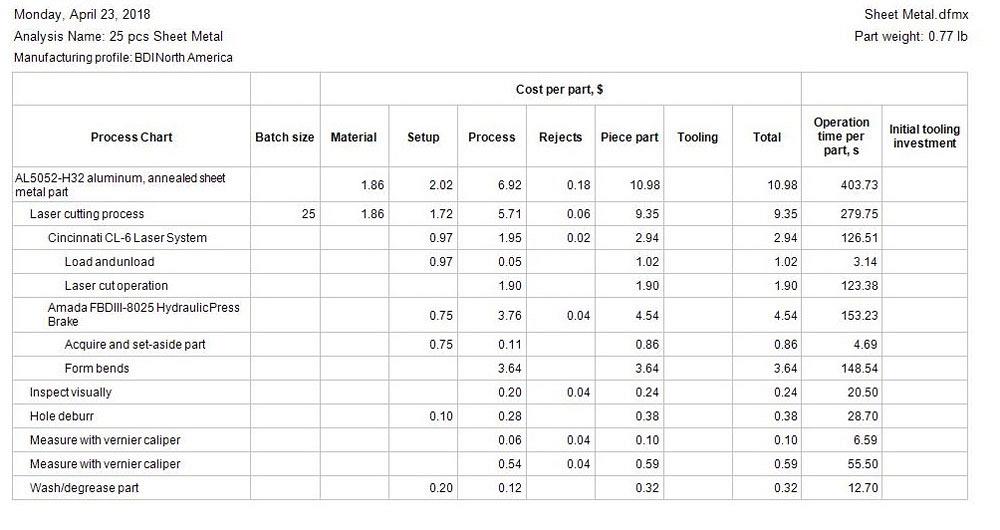

For a particular part geometry and volume, Dynisco’s DFM incorporates material costs; setup costs, be it for a machining center, laser cutting machine, press brake, or anything else; processing time; cost of rejects; and tooling costs.

“Let’s say I’m producing a sheet metal part out of 5052 aluminum,” Miles said. “I’ll enter a cost per pound, the size of the part, and the volume, all of which I can base on inputs from the CAD model. Then I’ll need to set it up on the laser, form a few bends, then insert some hardware and perform some cleaning and deburring. I also include the cost of measurement, such as for first articles. I can accommodate for all of those processes and cost it in the software.”

DFMA software provides cost and time breakdowns for the materials, setups, processes, rejects, and tooling required to manufacture parts. Image courtesy of Boothroyd Dewhurst Inc.

He added that the analysis includes estimates for hourly rates at work centers and estimates for setup times—and the defaults for these variables can be tweaked based on what the company learns from its suppliers. After all this, the software produces a “should cost,” which gives Dynisco a starting point.

Diving deep like this helps the OEM consider alternative fabrication methods. Say setup costs and processing times are high for a certain formed part. Is there a way to reduce that setup time? What about tool change automation on a press brake? Or alternative forming methods, like folding machines or panel benders? Such alternatives may or may not have an impact. Regardless, Miles said, a good DFM analysis at least spurs engineers to ask questions and consider the possibilities.

“We’re not beating up suppliers on costs,” Miles said. “We’re having a discussion about costs, and we expect our suppliers to make money.” He added that if a supplier doesn’t make money, the relationship can’t be sustainable—which, in the long run, isn’t good for anyone.

Open Communication

With material costs heading upward, now is a very good time to take cost out of a product. The situation is challenging, of course, but as Miles explained, it has a silver lining: Rising material costs are opening the lines of communication between OEMs and suppliers, spurring creative thinking.

Material prices have, of course, risen before. Miles recalled one conversation at a previous employer in which he worked through a DFM initiative with a supplier who disagreed on his assumption about the material price.

“He disagreed, so I said, ‘Fine, what do you think it should be?’ He said the price should be 50 cents more per pound. I said, ‘You got it.’ We calculated it out, and the increased material price added only a nickel to the overall cost of the part. That’s because most of the cost was based on processing time due to the geometry of the part, not the amount of material we were using.”

He added that the best outcome in this situation is to redesign the part to decrease the processing times, lower the manufacturing costs, and, ultimately, make the situation better for everybody. The key is to know what exactly is driving the cost in a product and, if possible, reduce or eliminate it.

Miles emphasized that DFM and TCO are about listening and, most critically, visiting and learning. An engineer or purchasing manager can visit the fabricator and learn what it takes to set up a press brake, about material thickness inconsistencies, and about particular manufacturing steps that may be troublesome. These kinds of conversations—about loosening tolerances and choosing formable material—are far more productive and, in the long run, save more money than simply haggling over the price.

Dynisco, www.dynisco.com

Boothroyd Dewhurst Inc., www.dfma.com

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI