Executive Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

As trade war begins, supply chains get complicated

U.S. companies looking for relief left in limbo

- By Tim Triplett

- June 14, 2018

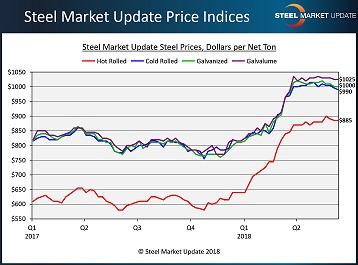

Figure 1. Steel prices seem to have plateaued for the moment after rising aggressively in the first quarter of 2018.

Many thought President Donald Trump’s threat to impose tariffs on steel and aluminum imports from Canada and Mexico on national security grounds was merely a negotiating tactic to leverage concessions in the North American Free Trade Agreement (NAFTA) negotiations. That no longer appears to be the case.

As of June 1, steel from the nation’s closest trading partners, along with the European Union and most of the rest of the world, is subject to a 25 percent tariff. Aluminum imports face a 10 percent tariff.

The hardline stance of the Trump administration is likely to have two immediate effects: to reduce the volume of imports and to increase prices on both foreign and domestic steel and aluminum products. In the months to come, absent any conciliatory action, retaliatory tariffs could put downward pressure on profits and job growth and take a significant toll on the U.S. economy, according to economic experts.

Various nations have followed through on their vows to retaliate against what they consider “illegal” U.S. tariffs. Canadian officials have placed 25 percent tariffs on U.S. exports of steel, plus 10 percent tariffs on other items, such as food and agricultural products; those tariffs are valued at $13 billion and were effective July 1. Mexico’s tariffs, announced June 5, range from 15 to 25 percent and target $3 billion in U.S. goods, including steel, bourbon, pork, produce, and cheese. The long list of U.S. items subject to 25 percent tariffs in the EU nations, effective June 20, includes steel, aluminum, and other consumer goods. It’s worth noting that U.S. steel exports to Canada and Mexico were greater than U.S. steel imports from those countries, at least prior to the escalating trade war.

How this acrimony over tariffs plays out in the rest of the NAFTA negotiations remains to be seen. The dearth of goodwill between the three nations at the moment could worsen given the contentious exchange between Canada’s Prime Minister Justin Trudeau and Trump following the G7 Summit in Quebec.

Not all nations must pay the U.S. tariffs. Argentina, Brazil, and South Korea have agreed to quotas that will restrict their exports to the U.S. Tariffs are actually preferable to quotas, according to trade experts, because countries can continue to ship goods subject to a tariff, albeit at a higher price, whereas the flow of goods from countries subject to a hard quota must cease completely once the quota limit is reached.

The U.S. Department of Commerce (DOC) initiated a process by which companies can appeal to have individual product imports exempted from the tariffs if they can make the case that the item is essential to national security or is not produced in the U.S. in a sufficient and reasonably available amount or of a satisfactory quality. Companies have filed more than 12,000 requests for product exclusions, which supposedly are to be reviewed within 90 days of their posting. As of June 6, the DOC had not approved or denied any of them. The process has been widely criticized as confusing and cumbersome. Even members of Congress have called the paperwork burdensome and expressed doubts that the DOC has the resources to process so many requests in such a short time.

Price Momentum’s Pointing Up

Steel prices have bounced around in recent weeks as the market waited to see what the Trump administration would do. Now that the tariffs are a reality, and imports will be less competitive, the domestic steelmakers can be expected to hold the line on prices for the moment with an eye toward probably raising them further down the line. Steel Market Update’s Price Momentum Indicator is pointing higher for all flat-rolled steel products for at least the next 30-60 days.

According to SMU data, as of the first week in June, hot-rolled coil was averaging $885/ton ($44.25/cwt) FOB the mill east of the Rockies with lead times of four to eight weeks. Cold-rolled coil averaged $995/ton ($49.75/cwt) with lead times of five to eight weeks. For galvanized coil, demand stretched lead times up to 12 weeks, bumping the average base price to an eyebrow-raising $1,000/ton ($50.00/cwt). Figure 1 provides a perspective of just how prices have risen over the past 16 months. Steel plate had an average delivered price of $962.50/ton ($48.125/cwt), with buyers on allocation/controlled order entry.

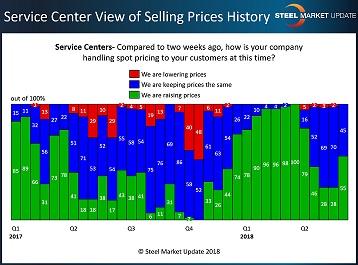

Other SMU survey data supports the likelihood that flat-rolled steel will rise even further as distributors are already supporting higher spot prices. SMU polled service centers in the first week of June, and a majority (55 percent) of those surveyed reported rising spot prices (see Figure 2), a jump of 27 percentage points from mid-May. Seventy-two percent of the manufacturing companies responding to SMU’s questionnaire reported that their service center suppliers were increasing spot prices. None from either group said they saw spot prices on the decline.

Figure 2. Service centers surveyed by Steel Market Update are certain about one thing: They aren’t reducing steel prices anytime soon.

Is there is any good news to report for fabricators and manufacturers who buy steel? Only 25 percent of the industry executives polled by SMU foresee a shortage later this year. The majority (62 percent) expect a tightening of supply but no shortage. The other 13 percent remain confident flat-roll will be readily available. Just expect it to cost more.

SMU Steel Summit Comes to Atlanta

SMU’s popular Steel Summit Conference is on pace to attract 800 executives to the Georgia International Convention Center in Atlanta Aug. 27-29. For more details on the conference program, visit www.steelmarketupdate.com or call 800-432-3475.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Tim Triplett

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI