President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

To buy foreign steel now or to stay with domestic sources?

A risky procurement decision gets riskier with unpredictable nature of current U.S. trade practices

- By John Packard and Tim Triplett

- July 20, 2018

Purchasing imported steel is always a gamble, but current political unpredictability makes it even riskier nowadays.

Is now the right time to consider buying foreign steel?

The attractiveness of today’s buying opportunity is definitely in the eye of the beholder. Some Steel Market Update (SMU) sources say it’s a “no-brainer” to consider foreign offers today. Others consider the tenuous trade situation in Washington to be too unpredictable.

The first half of the year saw a steady stream of price increases by the domestic mills in response to healthy demand and limited competition from foreign mills as the Trump administration maneuvered to restrict imports. The benchmark price of hot-rolled steel has increased by more than 50 percent since this time last year. But in late June and early July, prices appeared to stabilize, suggesting that the market may have peaked.

SMU has changed its Price Momentum Indicator from “higher” to “neutral,” meaning the market is potentially in transition and we cannot predict which way prices will move over the next 30 to 60 days.

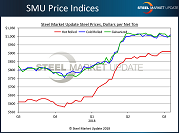

As of July 16, Steel Market Update data showed the U.S. price of hot-rolled coil selling from $890/ton to $930/ton, with an average of $910/ton FOB the mill east of the Rockies. Cold-rolled pricing fell $980 to $1,040, with an average of $1,010. The benchmark price for galvanized 0.060-inch G90 sold from $1,036/net ton to $1,136/net ton with an average of $1,086 (see Figure 1).

U.S. steel prices now are the highest in the world. The spread between foreign and domestic exceeds $100/ton in some cases (after tariffs are added). For some steel buyers, the opportunity appears too good to pass up, especially if you believe the Section 232 25 percent tariff will be removed before the end of the year. (Using the Section 232 national security provision of the Trade Act of 1962, Trump placed tariffs of 25 percent on imports of steel and 10 percent on imports of aluminum, effective June 1. The tariffs apply to metals shipped from most nations of the world, including the U.S.’s closest trading partners in Canada, Mexico, and the European Union.)

But others urge caution, warning that current domestic prices are unsustainable, and the spread may well narrow in the coming weeks and months. Buyers might find that the foreign orders they place this summer are not the deal they hoped by the time the material arrives this fall.

Steel and aluminum tariffs imposed on imports by the Trump administration have propped up steel prices in the U.S., but for how long? Many believe the administration placed the tariffs on U.S. allies as a bargaining chip to use in trade negotiations, and thus the tariffs are only temporary. What will happen to domestic steel prices if the tariffs are rescinded?

“The elevator ride down will be a rapid one,” said one steel executive.

“U.S. pricing will profoundly correct, as imports will be significantly cheaper than domestic,” said another.

Figure 1. Steel prices have climbed tremendously in the past 12 months, but in recent weeks that trend appears to have leveled off.

“What if the tariffs disappear, and we are stuck with $50/cwt steel in a $35/cwt market? This is the time to begin reducing inventories,” commented a third.

With domestic hot-rolled steel prices more than $900/ton, traders tell SMU they can ship to the U.S., pay the tariff, and still be competitive with domestic steelmakers. Import volumes have slowed marginally this year but could pick up in Q4. A sharp increase in supply would prompt a reaction from U.S. mills and bring domestic prices down.

Commerce Secretary Wilbur Ross stated recently that a new NAFTA pact is possible by Labor Day. What happens to the steel and aluminum tariffs if there’s a new NAFTA? It’s hard to imagine a “free trade” agreement that includes such tariffs.

There are other wildcards on the political front to consider. Will there be a shift in power in Washington after the midterm elections in November? What other new antidumping and countervailing duty cases, or circumvention rulings, may factor into the foreign/domestic steel equation?

“Given the track record of the Trump administration’s unpredictable decision-making, even attractive foreign buys could still get quota’d, tariffed, quarantined, or prohibited by presidential fiat,” commented another steel executive. “Domestic mills are assiduously watching import license data. They will take steps if foreign tons begin to undercut pricing or market share.”

Buying foreign steel always carries inherent risks, from long lead times to shipping problems to quality issues. Add to that the shifting price spread and political intrigue on the trade front, and foreign deals call for extra caution these days.

The eighth SMU Steel Summit Conference will take place Aug. 27-29 at the Georgia International Convention Center in Atlanta. More than 750 executives from manufacturing, steel distribution, fabrication, steel mills, trading companies, toll processors, and suppliers to those industries have registered to attend as of mid-July. For more information about the conference, visit here or call 800-432-3475.

Editor’s Note: SMU was purchased by the London-based CRU Group at the end of May 2018. The CRU Group is well-known for its steel indices, analysis, and consulting services. Its hot-rolled coil (HRC) index is used by more than 80 percent of the contracts for steel in the U.S., as well as the Chicago Mercantile Exchange for financial transactions. John Packard, founder of SMU, continues to be its president/CEO.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI