Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Cadrex Manufacturing Solutions harnesses the power of scale

How to build a 2,000-employee metal manufacturer in 15 months

- By Tim Heston

- November 3, 2022

- Article

- Shop Management

Two years ago, Cadrex Manufacturing Solutions didn’t exist. Now, after a 15-month (and counting) acquisition spree, it’s a 2,000-employee, 20-plant behemoth.

Over the past year, Cadrex Manufacturing Solutions, an organization owned by CORE Industrial Partners, a private equity firm out of Chicago, has been on a quiet, lightning-fast buying spree. At this writing, it has purchased 10 manufacturing companies across the country—all within the past 15 months.

They’re now all part of a $500 million-plus operation with 20 plants and more than 2,000 employees. Cadrex’s swift moves could be a harbinger of a changing industry landscape. Metal fabrication’s long-anticipated wave of consolidation might finally be starting in earnest.

Acquiring at Warp Speed

“Cadrex’s thesis is to invest in essential industries, meaning recession or booming economy, the companies they invest in survive and thrive because the end markets they invest in are critical in nature.”

That was Brian Steel, who in September was named Cadrex’s CEO. Previously, Steel led Tenere Inc., a contract fabricator that built its businesses on information and communication technologies, or ICT (think server racks and related products), as well as products related to renewable energy. Cadrex acquired Tenere in July.

Out of context, Tenere’s acquisition looks like a typical private equity play in metal manufacturing. After all, Cadrex acquired Tenere from The Watermill Group, another PE firm with a broad portfolio of industrial companies. Many fabricators operate under PE ownership, but they still run as independent enterprises with their own branding and P&L statements.

Cadrex, however, is taking a different approach. In August 2021, the organization acquired CGI Automated Manufacturing, a highly automated fabricator out of Romeoville, Ill. Just a month later, Cadrex purchased Advanced Laser, a Chippewa Falls, Wis., custom fabricator with a focus in aerospace and ICT. Two months after that came Precision Metal Fab in Ponca City, Okla. In February 2022, Richlind Metal Fabricators, an aerospace and defense manufacturer in Chaska, Minn., came into the fold. That same month, Cadrex purchased DFF, a large machining operation in Agawam, Mass., with more than 100 machine tools on its 300,000-sq.-ft. floor.

In May came Elite Manufacturing, a Bloomingdale, Ill., fabricator in the gaming and kiosk business. “The end markets they serve fit our investment strategy very well,” Steel said, “with states looking at the deregulation of gambling to raise tax revenues.”

In July came Tenere’s acquisition, and September saw yet another purchase, IDL Precision Machining, a Seattle-area machining operation. And finally, in early October came the acquisition of E.P.M.P., a precision fabricator near San Antonio, Texas.

“The quick pace [of acquisition] has to do with opportunity,” he said, “and Cadrex’s ability to capture that opportunity. I’ve been in venture-backed and private-equity-backed companies most of my career, and I’ve never seen an organization be able to move efficiently through the deal process. And they’re using it to their competitive advantage. They see a very decentralized market dominated by small organizations.

“The dominant three players in North America have yet to be established. Cadrex saw this as an opportunity not just to be among the dominant three, but No. 1 in precision fabrication and mechanical solutions market in North America.”

Brian Steel was named CEO of Cadrex Manufacturing Solutions in September. The executive previously led Tenere Inc., which Cadrex acquired in July.

He added that location is key. Cadrex facilities are all in North America, including one in Mexico and 19 in the U.S. “All the major OEMs and customers I talk with have a strategy to build in a region for a region,” Steel said. “Not everything that’s manufactured is coming to North America. But if an end product is going to be consumed here, our OEM customers want to build it here.”

A rapid ramp-up of OEM demand is in part what’s driving Cadrex’s swift acquisition strategy. Since the early days of the pandemic recovery, customer demand has outpaced supply—and this includes the supply of capital equipment. “If I were to place an order for certain pieces of automated equipment, we might not see that equipment for more than a year,” Steel said, adding that finding available industrial real estate has also been a challenge. “That’s the real power behind the platform. We can acquire and add capacity and footprint in a matter of months.”

All Under One Umbrella

The acquisitions combine many company brands into one—another element that sets Cadrex apart. “A lot of mergers and acquisitions never bring operations together,” Steel said. “They may even operate under one name, but in reality they’re many companies with separate P&Ls. They don’t share work among facilities. That can and has worked in this industry, but that’s not the approach we’re taking. We’ve already broken down barriers to ensure we’re not over capacity in one area of the business and under capacity in another. We’ll move work to satisfy customer needs.”

The company has been aggressively rolling out ERP system integration so that operations can share data. It’s also growing a dedicated data analytics team that hopes to tap into the company’s wide-ranging automation and even its manual machinery to gather utilization data.

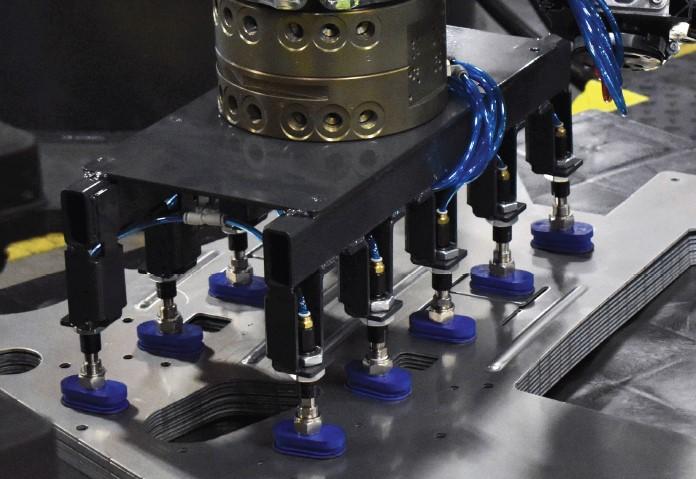

“We have more than 600 pieces of equipment across our business units in a wide variety of manufacturing environments,” Steel said, describing plants with automatic tool change press brakes, flexible manufacturing systems with panel bending and blanking capabilities, robotic bending and welding—the list goes on. Most recently, the company invested in a 300-ton gap press stamping line with automated transfers. The presses can run as standalone machines or integrated as part of a larger multistation line—evidence that at even the largest operations in this business, plants need automation to be flexible.

“Not all of our equipment is new and automated, so we have our own automation and robotics team put simple controllers on our older machines,” Steel said. “We want to measure uptime and downtime, and see why we’re down—all of it giving a real view of our capacity.”

Benefits and Challenges of Scaling Up

Steel described four market differentiators Cadrex brings. First is manufacturing expertise across a wide range of processes. Second is the technical expertise to collaborate with customers on product and process design, then bring that solution to high-growth end markets. Third is the geographic spread. Cadrex facilities are concentrated in the upper Midwest, but its footprint spans from Seattle to Monterrey to Boston. “The final piece is pure scale,” Steel said. “We’re now a half-billion-dollar producer, and we’re 100% focused on North America.”

These differentiators have created some significant cross-selling opportunities, and the organization already has had some early wins. According to Steel, existing customers, now realizing the available capacity of the larger organization, have increased the quantity and variety of orders. In other cases, previously outsourced processes like machining are being brought in-house.

Steel added that such differentiation also will help with hiring. The industry is dominated by small companies, each of which can have only so many career opportunities. Some thrive in such an environment, but it’s not for everyone.

“Providing opportunities will help us retain the talent we have,” Steel said, adding that the company already offered a transfer opportunity to someone who was thinking of moving away from a small family business. Since Cadrex acquired that business, the situation has changed. “He was at a single-location fabricator in the Midwest. Now, he’s part of the Cadrex team. He’s now planning to relocate to a location that will be a better fit for his personal life, and we’re not losing his talent, developed over decades of experience.”

A Multitude Into One

To deliver on all this, Cadrex leaders have been meeting off-site. “To develop our culture, we need to create shared experiences,” Steel said, “to set the foundation about where we want to be.” Outside Tenere, which has a history of PE ownership, “We’re bringing together nine founder-led businesses. We’ve got a lot of different viewpoints, and we all need to start from a baseline: that desire to meet our customer needs better than the competition, and a desire to win in the market. Once we establish that culture, from leadership to the front lines, we need to develop systems and processes to allow us to operate as one company.”

Then there’s the operational merger, which is already well underway. Unifying back-end IT systems, like ERP and Microsoft 365, is in the works. Cadrex’s six core markets—ICT, medical, renewables and energy, automation and robotics, aerospace and defense, kiosks and gaming—will “drive how we shape the customer-facing organization,” Steel said.

Regarding internal operations, Steel and the leadership team have analyzed the wide-ranging operations under the Cadrex umbrella, from precision machining aerospace parts to server racks to gaming and kiosk assemblies. Though they all have their unique attributes, they usually fit into one of two categories. One focuses on precision components that are then shipped to customers who integrate them into larger assemblies. Cadrex’s other business focuses on finished or near-finished products that involve multiple layers of design and planning with highly complex, multilevel bill of materials (BOMs). “Here, we’re mechanical solutions providers,” Steel said, adding that the business focuses on long-term contracts.

Steel described a “gray line” between these two kinds of businesses, and certainly, some work shares attributes from both. Regardless, Steel said, recognizing the different nature of each kind of business will help merge the operations to best serve customer needs.

Rethinking Supply Chains, New Opportunities

The past few years have been rife with uncertainty—war and unrest, tense relations with China, and of course a choked global supply chain thanks to the pandemic. Investors are looking for industries that sail steadily through the storm—hence the recent PE investment in Cadrex, which now is setting out to capture business as manufacturers rethink and restructure their supply chains.

The most dramatic evidence of this is at Cadrex’s new facility in Monterrey, Mexico. The company recently moved into a new business park that would give the plant floor—with sheet metal fabrication, stamping, and machining capacity—room to expand.

“The people running that industrial park said they had planned to fill it over the next eight years,” Steel said. “The entire park filled up in eight months. The amount of manufacturing moving back to North America is driving that.”

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI