Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabrication ready to take off in 2022

Question remains if supply chains and skilled worker development can catch up

- By Tim Heston

- November 23, 2021

- Article

- Shop Management

2022 could be a big year for fabricators that invest in technology and navigate the industry’s two main challenges: the lack of workers and a volatile supply chain. Getty Images

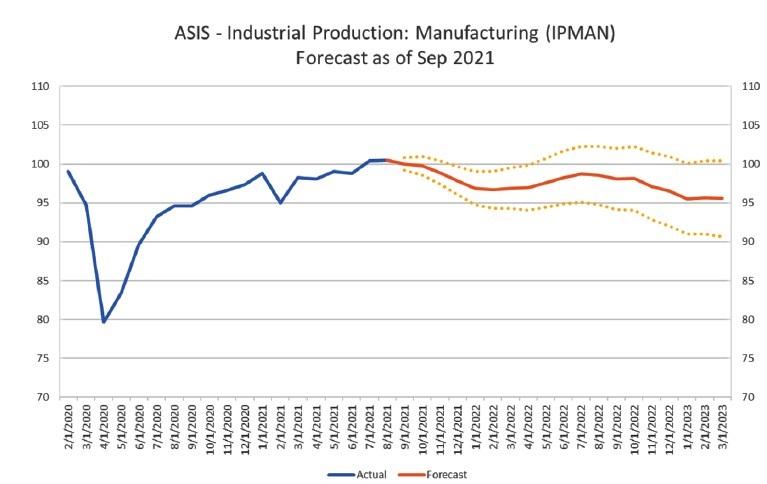

Every month Chris Kuehl, economic analyst for the Fabricators & Manufacturers Association Intl. and president of Lawrence, Kan.-based Armada Corporate Intelligence, publishes the Armada Strategic Intelligence System (ASIS), in collaboration with Morris, Nelson & Associates, Leavenworth, Kan. In it, Kuehl and his team outline a cross section of manufacturing sectors that touch the metal fabrication business. Throughout 2020 and 2021, nearly all of those sectors have experienced quite a ride. Business fell in early 2020, for obvious reasons, followed by a continued, albeit faltering, rebound as the global supply chain stumbled back to life. Parts of the metal fabrication business are running full out, others aren’t as strong as they could be—if only they had the material and people they needed to get the job done (see Figure 1).

“[We’re seeing continued] strong medium- and long-term demand trends across the end markets we serve, plus an increased interest in our services from a broadening range of companies,” said Bob Kamphuis, chairman/CEO/president of contract fabrication giant MEC, during a quarterly conference call with investors in November. “However, our company’s supply chain constraints have resulted in some near-term volume deferments.” This is happening not because of raw material shortages at MEC, but because of shortages at MEC’s customers.

Kamphuis added that the supply chains feeding MEC’s facilities in Mayville, Wis., and throughout the eastern half of the U.S.—including those for raw material—have caused “only minor disruptions. This means we remain ready when our customers are able to ratchet up their volumes again.”

As one of the largest contract fabricators in the U.S. (and repeatedly the No. 1 company on The FABRICATOR’s FAB 40 list of top fabricators), MEC serves nearly all the sectors in Kuehl’s monthly ASIS forecast, and many in this business likely relate to MEC’s experiences.

U.S. metal fabrication is a manufacturing sector tied to the leash of supply chain disruption. The sector continues to pull, eager to take off. That pull likely will get stronger with further infrastructure spending, thanks to recently passed legislation in Washington. The global supply chain just has to catch up, and until it does, inflationary pressures will continue. Considering all this, 2022 is shaping up to be a year that, while volatile, will be full of opportunity.

Big Picture: Growth Within a Flattening Curve

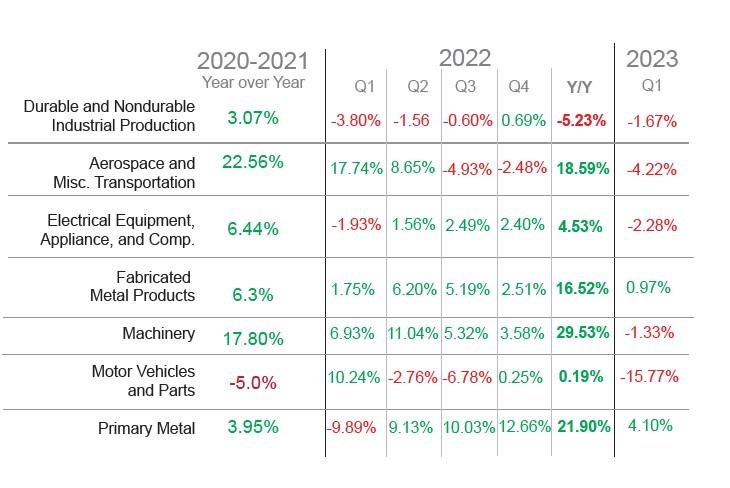

Drawing information from the St. Louis Fed’s Federal Reserve Economic Data (FRED) program, the ASIS report starts with the big picture, the industrial production numbers that cover both durable and nondurable manufacturing. It then dives deep into individual sectors tied to metal fabrication technologies: the primary metals sector that feeds metal fabricators, which in turn feed parts to a variety of industries.

Fabricators themselves are found in an array of categories the government uses to classify manufacturers, including fabricated metal products, a catch-all category that includes architectural and structural metals; boiler, tank, and container manufacturing; along with contract fabricators that feed into other sectors. The ASIS report doesn’t cover every sector a metal fabricator covers—no report could—but it does cover where much of the country’s fabricated sheet metal, plate, and tube is sold. As such, it gives a distilled view of conditions the industry is likely to face in 2022.

And according to the October ASIS report (based on data from September), the markets fabricators play in will fare far better than the manufacturing sector as a whole. Machinery (including agricultural equipment), aerospace, and fabricated metal products in particular could see substantial growth throughout 2022—but that growth will occur in a business environment tempered by supply chain disruptions.

Such tempering is made evident by the report’s forecast for both durable and nondurable industrial production (see Figure 2). The September ASIS forecast (released in October) shows overall production dropping by a percentage point during Q1 2022, holding steady, then dropping by a few more percentage points by the beginning of 2023.

Primary Metals: A Melting Pot of Inflationary Pressures

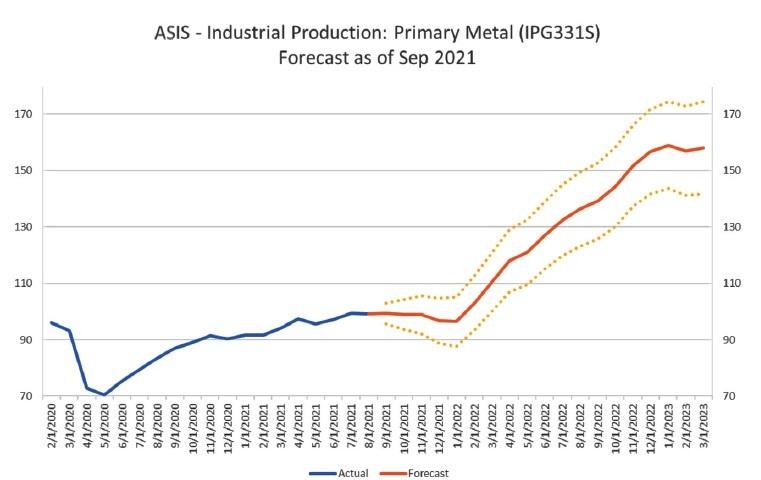

The primary metals sector is set for major growth in 2022 (see Figure 3). That bodes well for business activity down the supply chain, as long as fabricators and others can continue to pass along price increases.

FIGURE 1 This snapshot, a portion of a more detailed forecast published in the Armada Strategic Intelligence System (ASIS) in November, shows sector-specific projections. Graphs in this article are from the ASIS forecast released in October (using data from September), so the numbers differ slightly. Regardless, both October and November ASIS reports show a 2022 full of volatility and opportunity.

“We are still seeing some historically high ranges for everything from steel to nickel, aluminum, copper, and other metals that impact this sector,” Kuehl wrote. “However, [in fall 2021] prices were showing some deceleration trends for many commodities as the supply chain starts to catch up … Some buyers are reporting that they are seeing products with improved availability. But overall, supplies are still tight on a global basis.”

At press time, the U.S. and EU had negotiated a new deal in which tariffs of 25% on steel and 10% on aluminum from the EU will stay in place. But according to Commerce Secretary Gina Raimondo, the U.S. will allow a limited amount of duty-free metals from Europe. What impact this will have on material prices over the long term remains to be seen. Regardless, most industry watchers agree that the demand for metals won’t abate anytime soon.

Brother, Can You Spare a Chip?

Of all the sectors fabricators serve, automotive has stood out as the most tumultuous (see Figure 4). The sector was in significant decline during Q1 and Q2 2021 before regaining momentum late in the year. According to the ASIS forecast, that momentum will continue to strengthen during the first and second quarters of 2022 before slowing again later in the year. Overall, the industry will be in a better place, but it will be quite a ride. Most of the volatility stems from the global shortage of microchips.

“The sectors that rely heavily on chipsets are facing the weakest outlooks,” Kuehl wrote in September. “Most analysts are now circling Q2 of 2022 as the period in which there will be significant normalization of the chipset supply chain.”

The changing numbers in the automotive forecast indicate just how volatile the situation is. Earlier predications had the automotive industry holding steady with little significant growth. At this writing, ASIS is predicting very healthy growth during the first few quarters, followed by a dip later in the year, likely the result of inconsistent supply. Again, it goes back to the microchip and other purchased components. When they arrive, production resumes until the supply chain chokes again, delaying production.

Ready to Fly

The aerospace sector is flying high. As Kuehl wrote in September, “The outlook looks incredibly good for aerospace, accelerating into early 2022 and continuing to remain high throughout the year. This is one of the most positive outlooks in the entire industrial sector.”

ASIS is predicting a greater than 22% year-over-year growth between 2020 and 2021—nothing too extraordinary, considering the lows the industry experienced during the pandemic’s early days (see Figure 5). Still, ASIS predicts that growth will continue into 2022, with huge gains during the first two quarters. By the end of the year, the report predicts aerospace to be up another 22%. Driving growth in part is a surge in air cargo. Airlines are also increasing capacity, especially in Asia.

Appliance and Electrical Equipment: A Bumpy Ride

This category includes lighting equipment, household appliances, and various electrical components associated with power distribution. Companies serving these niches face a similar scenario: Demand is there but the supply isn’t, and inflationary pressures persist with rising material prices. ASIS predicts business to rise for the first half of the year, then fall significantly to end the year essentially flat (see Figure 6).

As Kuehl wrote, “Key materials like microchips are obviously still in short supply. Copper isn’t making the same headlines as other metals, though,” adding that as of September 2021, copper prices had risen 41% year over year.

This category incorporates lighting fixtures and sheet metal enclosures used extensively in commercial construction, a sector that’s being hit by broader workplace trends. Opportunity abounds in construction related to manufacturing, transportation, warehousing, and health care, but other areas of commercial construction, including office buildings, are waning. “Commercial construction has been slow to rebound as reopening and return-to-work is taking much longer than expected,” Kuehl wrote.

FIGURE 2 Growth in overall industrial production, which includes both durable and nondurable goods manufacturing, could remain soft throughout 2022. Still, growth in durable goods manufacturing, including metal fabrication, will likely outpace the broader manufacturing industry.

Machinery Manufacturing Accelerates

This sector, which includes agricultural equipment manufacturing along with many other subsectors, has as of September 2021 one of the most significant growth curves in the ASIS (see Figure 7). “The machinery sector is expected to continue an impressive growth path for three reasons,” Kuehl wrote. First, job shops, factories, and assemblers delayed capex in 2020 and so now are playing catchup. Second, most expect prices to increase, so companies want to buy machines now before that happens. Third, of course, is the lack of labor and the push toward mechanization and automation throughout manufacturing, logistics, transportation, and the rest of the economy.

“Agricultural spending is also accelerating,” Kuehl said, “as global food demand creates significant growth potential for commercial farms.”

Fabricated Metal Products Takes an Upward Turn

The trend lines in metal fabrication reflect an average that, at the individual company level, is highly dependent on a shop’s customer mix. Most fabricators not only feed many other sectors, but also are small businesses with a handful of customers driving the lion’s share of revenue. One major customer goes south, and a fab shop’s finances take a major hit.

Considering all this, trend lines fell in early 2020 with nearly every other sector, but not dramatically so. The average held steady, as some shops struggled while others thrived—again, depending on the customer mix and circumstances around their customers’ supply chains. Starting in April 2022, though, ASIS predicts some significant gains as sales volumes rise (see Figure 8).

Kuehl described a sector in 2022 dealing with supply chain disruptions in automotive and broader shortages in microchips and other components. But fabricators will also benefit from a booming aerospace sector, tech sector, and, especially, corporate spending on machinery and automation. Despite the challenges, 2022 growth in metal fabrication looks overwhelmingly positive.

Opportunity for Those Who Innovate

“One of our biggest priorities is maintaining and expanding our base of skilled employees to help us address our growth potential. We expect that in most of our locations, finding the right people will continue to be a challenge for the foreseeable future. Our HR team is using a variety of creative recruiting strategies while we as a company continue our investment in flexible, redeployable automation and technology.”

MEC’s Kamphuis made this comment to investors in early November, adding that in 2021 alone, the company is making up to $40 million in capex for its new, 450,000-sq.-ft. Hazel Park, Mich., plant.

MEC’s experience reflects larger industry trends. Now more than ever, fabricators need flexible capacity, giving them the ability to ramp up quickly and respond in the face of uncertainty. The goal boils down to increasing the velocity of work, from the initial quote to the shipping dock.

Technology continues to push the industry forward, yet two constraints make growth challenging: the lack of workers and unpredictable supply chains. Shops that navigate both successfully will ride a wave of manufacturing opportunity into 2022 and beyond.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI