Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2024 steel prices: Will volatility continue?

U.S. steel market is likely to see more swings in prices, but perhaps not as severe as recent months

- By Michael Cowden

- December 13, 2023

Hot-rolled coil steel prices have been on a roller-coaster ride in 2023. That is likely to continue, but the swings won’t be as dramatic. ictor/E+

As we kick off 2024, I thought it best to try and answer two frequently asked questions—or at least start a good discussion.

Why Have Steel Sheet Prices Been So Volatile Since the Pandemic?

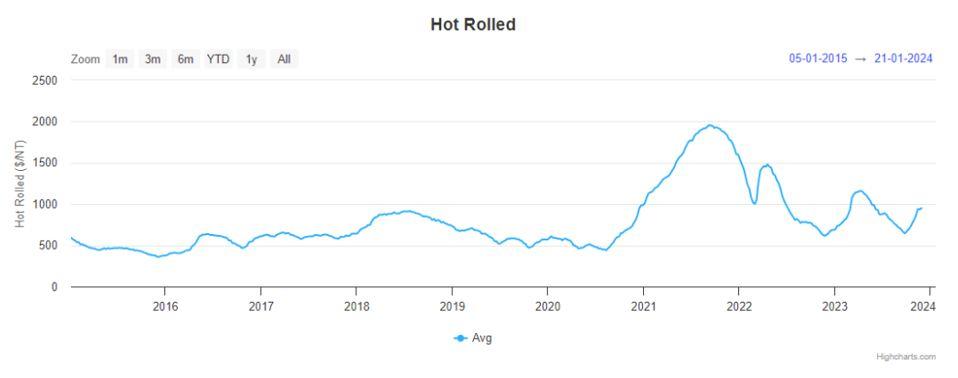

Figure 1 is a quick visual of just how volatile the market has been. This chart, from Steel Market Update’s interactive pricing tool, shows annual average hot-rolled coil (HRC) prices going back to 2015.

You can see that HRC ranged from roughly $500/ton to $1,000/ton from 2015 to 2020. Prices never went much below the $500/ton level because mills were bleeding money when they did, and they never held near $1,000/ton for long without people worrying about demand destruction. Those pricing parameters went the way of in-person dining during the pandemic. But unlike in-person dining, they haven’t come back since.

Taking into account annual average HRC prices for every year going back to 2015 is another way to observe the newfound volatility:

- 2023: $886/ton

- 2022: $1,015/ton

- 2021: $1,612/ton

- 2020: $587/ton

- 2019: $598/ton

- 2018: $829/ton

- 2017: $616/ton

- 2016: $526/ton

- 2015: $452/ton

The volatility over the last three years reflects some truly jarring world events. In 2020, the pandemic initially hammered demand, and prices plunged. Then, in late 2021, we saw a snapback in demand, supply could not catch up, and prices soared. In 2022, supply overtook demand, and prices fell. But the outbreak of war in Ukraine and a resulting panic over pig iron supplies caused a historic price spike.

In early 2023, we saw another huge price spike. It was arguably influenced by a combination of events, such as a lack of imports, overly bearish sentiment late in 2022 about the state of the U.S. economy, and Mexican steelmaker AHMSA unexpectedly halting operations around Christmas 2022. Certain buyers (and mills) realized what had happened at AHMSA and started buying up everything that they could. Also, some new capacity struggled to ramp up. The result was a steel shortage instead of the glut that some had anticipated. By February 2023, U.S. mills were raising prices almost weekly—by as much as $100/ton.

We saw something similar happen this fall with the UAW strike. People expected prices to plunge and then spike after the strike was over. Some savvy buyers decided to buy ahead of that anticipated spike, and when prices fell dramatically in mid- to late September, those buyers, some of whom were very large, figured the upside risk was greater than the downside risk. They pulled forward orders. Then there was a flurry of fall maintenance outages at domestic mills. The result: Lead times stretched into 2024. If you wanted spot tons for the New Year, they weren’t coming cheap.

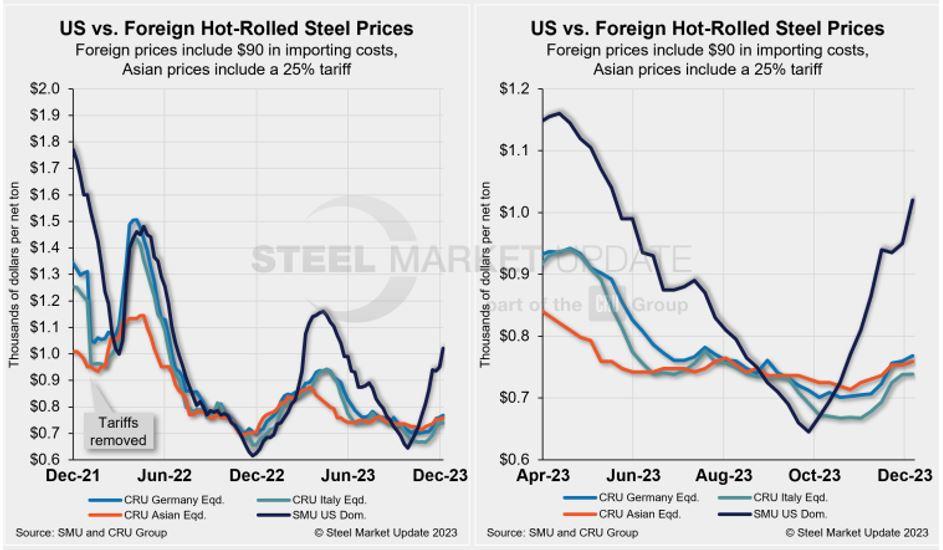

In other words, yes, sentiment has driven some of the volatility. And, yes, U.S. prices tend to be more volatile than prices elsewhere, as Figure 2 shows.

But it’s also true that much of the volatility has been driven by world events—with steel and other commodities merely along for the ride.

What Is the New Floor and Peak for Sheet?

I’m going to set aside 2020 and 2021 because they were so distorted by the pandemic. In 2022, HRC prices bottomed out at $615/ton on average, and we bottomed out at $645/ton on average in late September of this year. Does that mean $600/ton to $650/ton is the new floor for HRC prices?

Figure 1. From 2015 to 2020, steel buyers didn’t have to worry too much about wild swings in the pricing of hot-rolled coils of steel. Since the latter part of 2020, steel buyers have been on a bit of a roller coaster ride.

I think you could make that case. True, prices fell into the $400/ton range in 2015. But there is one big difference between now and then. We have seen more consolidation among integrated sheet mills. Competing integrated mills running flat out created the environment where a lot of the steel was available in that $400/ton range. Basically, the integrated mills kept costs low by maintaining high volumes. That makes sense, but it can be self-defeating if everyone is doing it.

What about new capacity now? Yes, there is a lot of it, and there’s more to come. (All told, more than 20 million tons per year.) But almost all of it is from electric arc furnace (EAF) mills.

Let’s use the analogy that integrated mills are like a light switch. They can only be on or off. EAF mills are more like a dimmer. They can be turned up or down gradually. So more supply and steady demand should lead to lower prices, but perhaps prices won’t fall as low as we’ve seen in the past if the EAF mills—which account for an increasing amount of U.S. steel production—can dial back supply when demand slips.

I know some of you think that sheet prices are fundamentally more sentiment-based than something like plate, which is more project driven. Sheet buyers tend to leave the market and re-enter it all at once. That leads to wild gyrations in prices. I also agree that behavior is unlikely to change.

That said, I’m going to make a prediction: Sheet prices might remain volatile, but they will be volatile within a narrower bandwidth over the next three years than what we’ve seen in the last three.

A Steely Rhyme for the Holidays

In the meantime, I’ll leave you with this poem that SMU reporter Ethan Bernard composed before the New Year. It’s a succinct analysis that bears repeating.

’Twas the night before Christmas, and at our publication

We kept logging steel price increases from across our fair nation.

Up hot-rolled, up cold-rolled, and galvanized coil.

On Galvalume and plate—gushing skyward—like a geyser of oil.

Figure 2. HRC steel prices in Germany, Italy, and Asia have not been as volatile as in the U.S. in 2023.

Blink for a moment and you might miss a hike,

Oh, what a change from the United Auto Workers strike.

Discuss prices at your holiday party, but do practice moderation

As you sip on spiked eggnog and discuss decarbonization.

Will the EU and U.S. agree, or will we see some global sheriff

Ride into Washington and pronounce a world carbon tariff?

Maybe start a little smaller, a more realizable goal,

Hang up our stockings and receive metallurgical coal.

Though it’s true some say Old St. Nick is not real,

The same can’t be said for the much vaunted “green steel.”

Lower and lower the carbon goes, the greener it gets,

Are we reaching net zero soon, is anyone taking bets?

Carbon capture, hydrogen, the only limit’s the sky

As long as we don’t end up getting taken over by AI.

Here at SMU, we wish you all a joyful holiday season.

Join us soon in Tampa, in Florida, the weather sure is pleasin’.

There’ll be much to learn and discuss, old and new friends aplenty,

It will be 2024, a real blank slate, let’s finally forget 2020.

Don’t Forget the Tampa Steel Conference

We’re on track to beat last year’s record attendance at the next Tampa Steel Conference, which SMU organizes along with Port Tampa Bay. Tampa Steel runs Sunday, Jan. 28, to Tuesday, Jan. 30. You can find the complete agenda and registration information at here.

Our room blocks have sold out. The nearby hotels below still had rooms available at the time this article was written in mid-December:

- The Westin Tampa Waterside

- JW Marriott Hotel

- Marriott Water Street

- Embassy Suites Convention Center

- Hilton Tampa Downtown

- Sheraton Riverwalk Hotel

- Hyatt House Tampa Downtown

- Hampton Inn Tampa

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI