President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Are record-high steel prices set to plunge?

Demand for material is weakening across the industry, and imports are hitting U.S. shores

- By John Packard and Tim Triplett

- September 20, 2021

Steel prices are at or near a peak and can be expected to moderate in the weeks and months ahead. Whether they will ease down gradually, giving the market a chance to adjust, or drop like a stone, giving the market a painful blow, remains to be seen.

Steel Market Update (SMU) checked the market on Sept. 13-14, and it showed a decline in hot-rolled steel prices for the first time in more than a year. It was only a $5 dip to an average of $1,950/ton ($97.50/cwt), but it comes at a key moment: cold-rolled and coated products also are seeing flat or declining prices. It’s clear that the market is changing.

Steel users think a decline in steel prices is near. SMU’s mid-September survey of manufacturer and service center executives shows that 80% believe hot-rolled steel prices already have or will peak within $50 of the current average sometime before the end of this year.

To put the historic steel price rise in perspective, hot-rolled has jumped on an almost weekly basis since bottoming out at just $440/ton ($22/cwt) in August 2020, as the economy struggled to recover from COVID-related shutdowns. Spurred on by trillions in government stimulus and vaccinations that allowed people to get back to work, the surging economy quadrupled steel prices over the past year to levels never seen before. Before the $1,995/ton reported by SMU in September, the former high for hot-rolled coil was $1,070/ton in summer 2008.

Some would argue that the steps taken by domestic mills to restrain supplies and keep prices elevated have opened them up to the emerging competition they now face from imports. Steel imports could finish the year up by 20% or more.

In a normal market, most buyers will tell you they favor domestic suppliers over foreign mills because of the shorter supply chain and the lower risk of logistical problems. There’s also the motive of being patriotic and buying products made in the U.S. Steel buyers, however, appear to have gotten over that notion. Nearly two out of three respondents to SMU’s poll said the reward of potentially hundreds in savings per ton is worth the risk inherent in ordering foreign steel.

SMU keeps a close eye on the lead times for delivery of spot orders from mills. Long lead times generally indicate that the mills are very busy processing orders. Busy mills with full order books can charge more for their products. In a normal market, a lead time of four to five weeks is common. At times this year, hot-rolled lead times approached 11 weeks, which helps to explain the record-high steel prices. Lead times began to shorten last month, though, with hot-rolled dipping below nine weeks for the first time since April. If that trend continues, it is a leading indicator of potentially lower prices.

Analysts at CRU, SMU’s parent company, think steel prices are overdue for a correction, possibly a sharp one and possibly soon. Abundant imports, which are as much as $500/ton cheaper than domestic tags, are beginning to hit U.S. shores, helping to ease the supply tightness that has kept prices elevated. While steel demand is still very strong, it is rising at a slower rate. Service centers are beginning to report inventories that are balanced with outbound shipments, foretelling weaker demand from the distribution sector. Planned maintenance outages by various mills in the fourth quarter will keep steel supplies tight in the near term. However, slower seasonal demand and the irresistible bargain offered by imports will serve to quickly bring steel sheet prices more in line with global prices, CRU predicts.

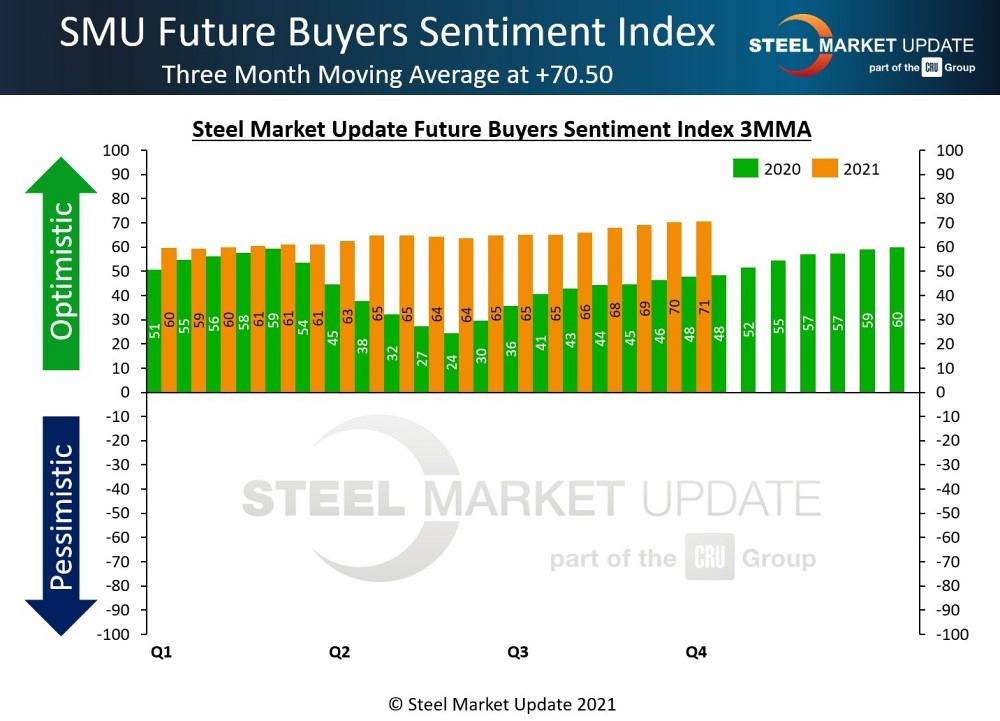

With historic prices have come historic profits for steel producers and distributors. Industry sentiment, as measured by SMU, has never been more optimistic. SMU asked in its poll last month: How do you feel about your company’s ability to be successful three to six months into the future? Nearly 80% view their prospects as good, if not excellent. SMU’s Future Buyers Sentiment Index, measured as a three-month moving average (see Figure 1), is at its highest level since February 2018 and up sharply from this time last year. What does this mean? Most buyers appear unconcerned about the big, sharp price correction that could be right around the corner.

What Is the Market Saying?

Here is some recent feedback from executives of steel distribution and manufacturing companies:

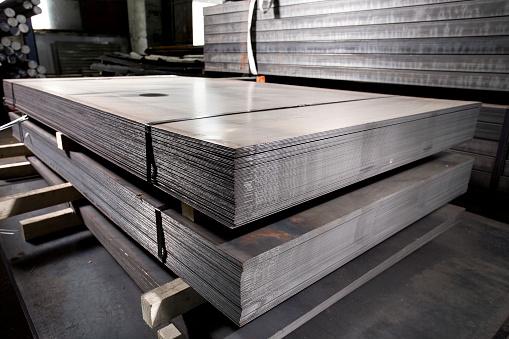

Figure 1. Steel industry observers think that the dramatic climb in material prices might have reached its peak. Now everyone is wondering when will prices start retreating and just how far will they fall. AlexandruRosu/iStock/Getty Images Plus

- “Pricing is getting closer and closer to peaking, but we aren’t there yet.”

- “In reality, prices peaked two months ago. They may tweak up or down a bit for trivial spot business, but for deals of any size, they peaked in late July.”

- “Domestic mills will not allow any inventory build, so prices will remain high until imports flood the market and take the control away from the U.S. mills.”

- “Watch out for imports over the next several months!”

- “Prices ought to peak in the first half of 2022, but I don’t see a collapse coming.”

- “The domestic mills really eroded their loyalty this past year.”

- “The mills’ games continue and will haunt them for 2022.”

Steel Market Update Events

SMU will host its next “Introduction to Steel Hedging: Managing Price Risk” workshop Nov. 2-3. The event will be virtual to eliminate any COVID concerns. You can learn more about the agenda and registration here.

Planning that winter getaway? Why not take in a steel conference while you are at it. SMU and Port Tampa Bay will co-host the Tampa Steel Conference Feb. 14-16 at Tampa’s Marriott Water Street Hotel. This will be a live and in-person event. Don’t forget your golf clubs. You can learn more here.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI