President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Have steel prices hit bottom?

Some U.S. steel buyers see a chance for lower prices still

- By John Packard and Tim Triplett

- October 25, 2019

Demand is down. Scrap prices are down. The business environment is uncertain. U.S. steel mills can’t do much but watch prices continue to fall. Getty Images

Except for a brief uptick this summer, steel prices have been on the decline since March and breached the $500/ton level in mid-October—a psychological line in the sand that leaves steel buyers wondering: Have prices hit bottom? Is it time to replenish inventories?

Flat-rolled steel prices took a steep dive last month, with hot-rolled coil dropping below $500 for the first time since early November 2016. Steel Market Update’s survey of the market placed the average price for spot orders of hot-rolled at $480/ton ($24.00/cwt) FOB the mill east of the Rockies, with lead times of just two to four weeks. Similarly, cold-rolled dropped to $670/ton ($33.50/cwt), with lead times from the mills of three to eight weeks. The benchmark price for 0.060-inch G90 galvanized steel decreased to an average of $739/ton delivered, with lead times of five to eight weeks. The price of steel plate was unchanged in October at an average of $675/ton ($33.75/cwt) delivered to the customer's facility within four to six weeks.

Several factors are weighing heavily on steel prices:

- Steel supplies are outpacing the tepid demand heading into the fourth quarter.

- The monthlong strike at General Motors is having lingering effects on the supply chain.

- Ferrous scrap prices continue to decline.

- And political strife in Washington only serves to deepen the market’s anxiety over trade issues and the health of the U.S. economy.

Ferrous scrap prices declined by $30-$40/gross ton in both September and October. Scrap prices are at their lowest level in years after dropping eight out of the last 10 months. Scrap prices are a function of supply and demand. Demand is down as mills have begun to ease back on production in light of the low-finished steel prices and weak pull-through from manufacturing. Weakness in economies overseas has made demand for U.S. scrap exports unpredictable. As a result, it’s more difficult for the mills to justify an increase in steel prices when their raw material costs are down.

President Trump’s decision to move U.S. troops out of Syria, clearing the way for Turkey’s assault on the Kurds, prompted new trade sanctions against the Turkish government and its economy last month. One of those sanctions was a plan to raise the tariff on Turkish steel exports to the U.S. back to 50 percent from the 25 percent level to which it was lowered back in May. As analysts pointed out, Turkish steel exports to the U.S. have been near zero for the past year anyway, so the change in the tariff is likely to have little incremental impact on the Turkish economy—or on the pressure being applied to the Turkish government to moderate its brutality on the battlefield.

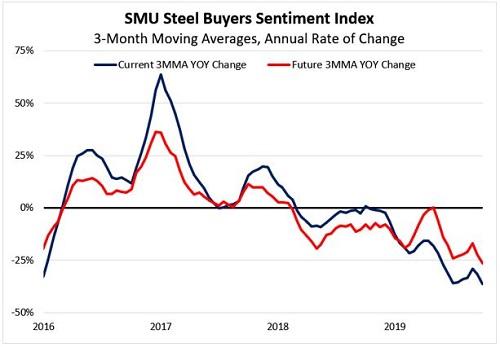

Steel Market Update’s Steel Buyers Sentiment Index has been trending downward since April and declined by 26 percentage points to a reading of +26 in September, reaching its lowest level since 2013. (Based on the annual rate of change in the three-month moving averages, both current and future sentiment have been trending downward since 2017, as shown in Figure 1.) To put the latest figures in perspective, over the dozen years SMU has been tracking industry sentiment, readings have ranged from highs of +78 to lows of -85 during the Great Recession. Not counting the years prior to 2011 that were impacted by the historic recession and thus were highly anomalous, sentiment has generally moved within a 60-point range, from roughly +14 to +74. Therefore, the recent 26-point drop is significant and shows a troubling level of pessimism in the business community.

So, when will flat-rolled prices reverse course? The answer to that question is unknowable, but SMU data and what history tells us about service center spot prices suggest a transition could be in the works.

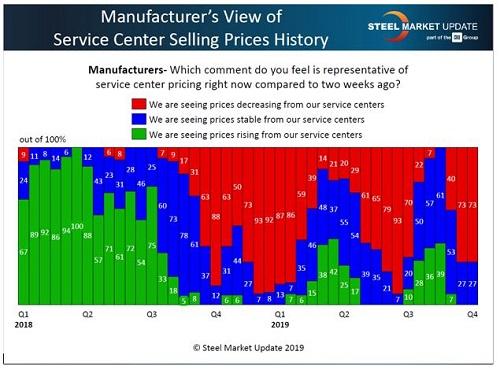

Seventy-three percent of the manufacturing companies responding to SMU’s questionnaire in early October reported their service center suppliers were lowering spot prices below levels seen just a couple weeks before (see Figure 2).

Likewise, service centers reported deepening price cuts as 89 percent said their company was lowering spot prices (see Figure 3). Thus, the steel distributors have moved beyond the SMU “capitulation” level, which historically has been 75 percent. That’s the level at which spot selling prices begin to create issues with inventory and profitability and service centers begin to consider higher prices rather than discounting to win orders. Service centers hit the 75 percent mark twice before in 2019. In both instances the mills announced price increases and achieved modest price recovery before prices began to slide once again. Much will depend on the timing of the next mill price increase and whether the service centers have suffered enough to support it.

What Steel Buyers Say About Prices

Here are some comments that have been collected from steel buyers in recent weeks:

- “Are we close to the bottom? I don’t think so. I think some capacity needs to come out of the market. Demand does not have the legs to push prices up.”

- “We’re not yet at the bottom, but close. We believe we’ll test the $470 level before seeing a bottom. For prices to rise again, the high-volume buyers will come in near the bottom, place huge blocks of tons, lead times will move out, and the mills will raise prices. Our third cycle this year. Will an increase be sustainable? Absolutely not without an increase in demand.”

- “We are close to the bottom, but how close? It’s ugly today and maybe for another four to six weeks. For prices to rise again, we need a market shaker. Maybe the tariffs going back to 50 percent on Turkey? The mills will need an increase soon. If there’s no recession, prices will go up after the December order book is mostly filled.”

- “A reasonable person would have to believe we are close to the bottom, but stranger things have happened, and with reports of discounting to $23-$24/cwt, it suggests that input costs and profitable sales are not the current mill objective. For prices to rise we need to have trade deals in place that won’t continually change like the situation in Turkey. The laws of supply and demand trump all. The mills would have to remove enough tons to gain the upper hand with buyers in order to have any effect on prices.”

- “It’s very confusing. The mills are talking about a price increase coming. Demand is horrible, however, so I expect prices to keep falling into November. For prices to rise, the recession talk needs to subside and demand needs to pick up. The economy is not as robust as expected, and that is affecting all aspects of our business. Demand is the key driver [behind a price increase], and it’s truly in the dumps right now.”

- “I think we are likely close to a bottom. I would expect pricing to start to rebound in February. It really depends on the trade and political environment. Should things settle down, prices will rebound. Impeachment is taking all the oxygen out of the room, with trade wars contributing to the uncertainty. I foresee additional uncertainty as we move into 2020.”

- "Service centers are holding back and not ordering much. This is keeping lead times shorter than normal. I think service centers will have to jump back into the market after the holidays. We might see pricing start to rise again in late Q1.”

- “Close [to a bottom], but no cigar. We see a further drop for December. The mills will only be able to raise prices if they stick together, which rarely happens.”

- "Based on current scrap prices and no change in the same for November, I think the HR index could fall to $470-ish per ton, with extremes to $450 and lower. There’s literally only one solution to get the HR price to sustain and hold above $550/ton: reduced domestic output. Given that we’re now into a lower demand environment, the supply side takes on most of the burden in this market for now. We may continue to experience these micro-cycles where prices drop, price increases are announced, and a buying binge ensues, and then we’re back to crickets. We’ve wrung out all of the excess imports that were possible via tariffs, and the resolution of Section 232s with Mexico and Canada, our largest steel trading partners, cemented this phenomenon, putting in a fairly firm floor level of imports. That leaves only domestic output as the remaining lever the mills can control. Unfortunately for them, it falls mostly onto the integrated mills to cut since their structure is such they cannot tweak output as easily as the EAF mills can.”

Upcoming Events

For those looking to learn more about the steel industry, SMU is conducting “Steel 101: Introduction to Steel Making & Market Fundamentals” in Fontana, Calif., Jan. 7-8. The workshop includes a tour of the California Steel Industries mill.

If you are interested in attending the Steel 101 workshop, you can find more information at steelmarketupdate.com/events/steel101, or you can send an email to info@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI