President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Historic steel price rally celebrates one-year anniversary

Steel mills likely to enjoy record profits heading into 2022 as prices reach $1,900/ton

- By John Packard and Tim Triplett

- August 17, 2021

It's been a little more than a year since steel prices began a historic rally. And with prices recently reaching an astounding $1,900/ton, it seems certain that relief won’t come until 2022. Getty Images

It’s time to wish a hearty happy birthday to the steel price rally that was born a little more than one year ago.

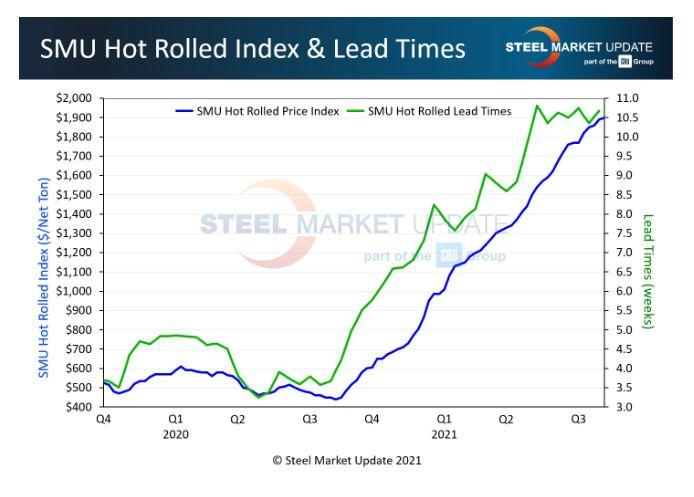

On Aug. 11, 2020, Steel Market Update (SMU) reported the benchmark price of hot-rolled steel at $440/ton ($22/cwt), with lead times averaging about four weeks. SMU’s check of the market on Aug. 9-11, 2021, put the average hot-rolled coil (HRC) price at an astounding $1,900/ton ($95/cwt), with lead times in excess of 10 weeks.

For flat-rolled steel prices to climb steadily week after week for an entire year is unprecedented (see Figure 1). It’s the product of trillions in government stimulus and pent-up demand from a pandemic that is equally unprecedented. So far the booming economy has outpaced the industry’s ability to produce an adequate supply of steel.

In Q2 nearly all the public companies—mills and distributors—reported all-time record sales and profits, with most forecasting the same or better for Q3. When steel prices are four times higher than normal, everyone looks like a genius.

Steel prices in the U.S. are the highest in the world. They are so high that foreign mills can offer delivered volumes ranging from $200/ton to $600/ton cheaper than the domestic mills, depending on the product and country of origin. That spread has enticed more buyers in the U.S. to take a chance and place foreign orders as they search for relief from the short allocations from their domestic suppliers. Finished steel imports were up more than 18% for the first seven months of the year, based on U.S. Census data, and are expected to continue rising in the second half.

Change in the Wind for Steel?

While the evidence so far is mostly anecdotal, subtle signs have emerged that change is in the wind. Some of the service center and manufacturing executives regularly polled by SMU report better availability of spot tons and deliveries from the mills that are not as late. Service center inventories are up a bit, but shipments are down a bit, which may say something about demand. Steel prices are still rising, but perhaps not as rapidly.

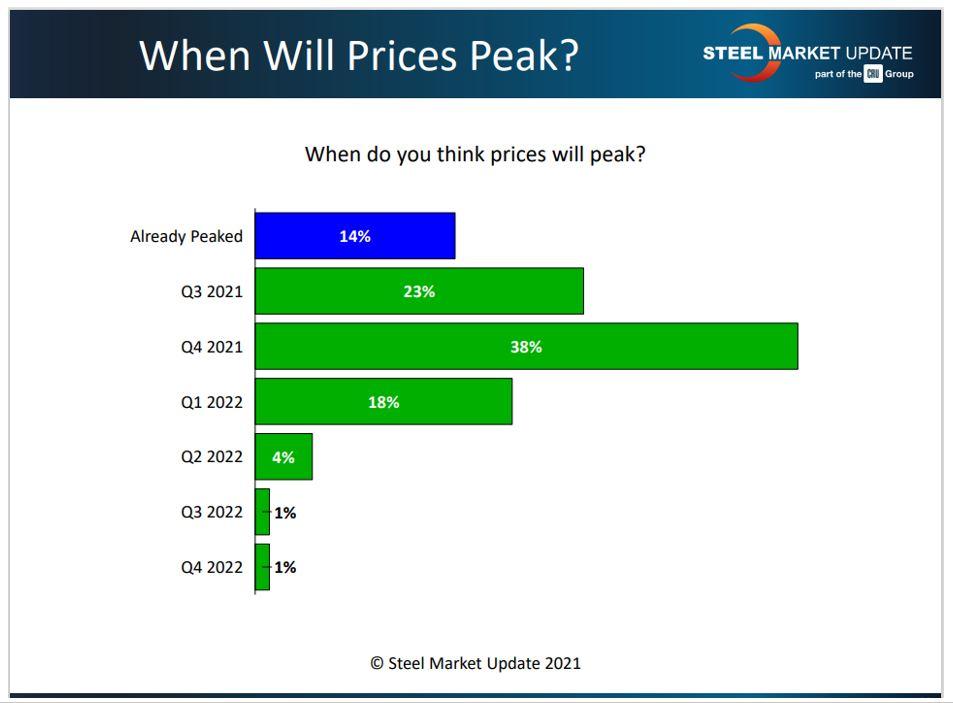

Most buyers feel the rally won’t end until Q4, if not well into next year (see Figure 2). “We are seeing signs pointing towards slower increases, but we aren’t seeing anything signaling a reversal. This runup still has legs, and we will get to $2,000/ton HR in the indices,” predicted one service center exec.

A significant number confirm that they have seen some loosening in the availability of spot tons on the market. “It depends on the mill. In general, automotive-centric mills have some limited availability. EAFs and conversion mills have little or no spot,” said one respondent.

Certainly not every buyer is reporting an improvement in supplies. “We’ve heard rumors and read the headlines, but we haven’t seen any extra tons being floated around,” added another. “We remain in one of three lanes, depending on the mill: (1) on strict allocation, (2) not getting offered anything, or (3) not getting the full ask off contracts (i.e., being kept to the minimums).”

Buyers appear split on the question of whether the new mill capacity and imports that are coming will be enough to change the direction of steel prices this year. HRC capacity from Steel Dynamics Inc.’s new mill in Sinton, Texas, has been delayed into Q4 because of severe weather. Other new capacity projects—including expansions at North Star BlueScope in Delta, Ohio, and Nucor Gallatin in Ghent, Ky.—won’t have much impact on the market until 2022. Thus, many predict it will be Q1 or Q2 2022 before supply begins to catch up with demand.

Figure1. The yearlong steel price rally has resulted in hot-rolled steel prices that are more than four times what they were in the beginning of August 2020.

“I think the market could certainly plateau or ease, but I don’t sense any sort of major correction this year,” said one observer. “More import is coming, but not enough to put a dent in inventories,” another commented.

Voicing a strong opinion, one SMU reader asserted that there’s no chance capacity expansions and foreign steel en route to the U.S. will have any effect on steel prices in 2021.

“The experts/pundits/analysts whiffed on that theory. I have no issue with the fact that their initial thesis got thrown a curveball thanks to COVID—that is not their fault—but their blind insistence and double-down on it was reckless. I mean $600/ton by the end of the year? Yeah, right! And that is what they said back in mid-June! Overcapacity is coming, but it’ll be a second-half 2022 phenomenon, definitely not this year.”

Automotive demand may prove decisive in any price peak. “If problems persist in the auto sector, then it’s very possible,” said one OEM. “This auto supply chain disruption story continues to get worse (chips and COVID restrictions overseas). Frankly, there’s a growing possibility that unless it improves quickly, it could cause things to unravel here sooner than people think.”

Meanwhile, all are on heightened alert for more definitive signs of changing market conditions that may be a precursor to the inevitable price correction to come. “For the first time in many months, we are able to secure more tons than needed. Steel prices outside of the U.S. are mostly heading lower. And the Delta variant is becoming a bigger concern,” said one exec last month. “Customers are now starting to balk at prices, whereas they had been willing to pay any price as long as you could provide the steel,” added another. “I think we are just dollars away from the top, but we will stay at the top for a while before we see a softening,” opined a third.

Such a gradual softening of steel prices may be wishful thinking. Some analysts forecast a sharp correction in the months ahead. Exactly when and how much is anyone’s guess. Until then, steel suppliers will continue to enjoy record sales, profits, and extra-large birthday cakes.

Steel Market Update Events

SMU offers a number of educational programs. The next Steel 101: Introduction to Steel Making & Market Fundamentals workshop, to be done in a virtual format, is scheduled for Oct. 5-6. For more information and to register, click here.

The next Introduction to Steel Hedging 101 course, a workshop on using financial derivatives to hedge price risk, will be offered Nov. 2-3, also in a virtual format. For more information and to register, click here.

For more information about how to become an SMU subscriber and to sign up for a free trial, contact Paige Mayhair at paige@steelmarketupdate.com or by phone at 724-720-1012.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI