President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Is a fundamental change in steel prices in the works?

Steel buyers wonder just where prices will bottom out in 2022

- By John Packard and Tim Triplett

- February 15, 2022

Steel distributors and manufacturers with a lot of steel in inventory have to be sweating bullets with the way the steel prices are falling. Getty Images

Steel just keeps getting cheaper for fabricators and manufacturers—a trend with no clear end in sight. That’s good news for steel users, but not so good for holders of inventory.

A check of the market in the week of Feb. 7 by Steel Market Update (SMU) showed the benchmark price for hot-rolled coil (HRC) dipping below $1,200/ton ($60/cwt) for the first time in a year. As of the second week in February, the average hot-rolled price had declined to $1,190/ton, a plunge of $765/ton, or nearly 40%, since peaking at $1,955/ton in early September 2021. The downward trajectory is almost as steep for cold-rolled and coated steel products as well.

Steel producers and distributors enjoyed record profits in 2021 as steel prices spiked to historic highs when COVID and the government’s efforts to stimulate the economy threw steel supply and demand out of balance. In 2022 as steel prices normalize, mills and service centers can’t expect the same windfall. Their results will depend on how much longer, and how much lower, steel prices decline.

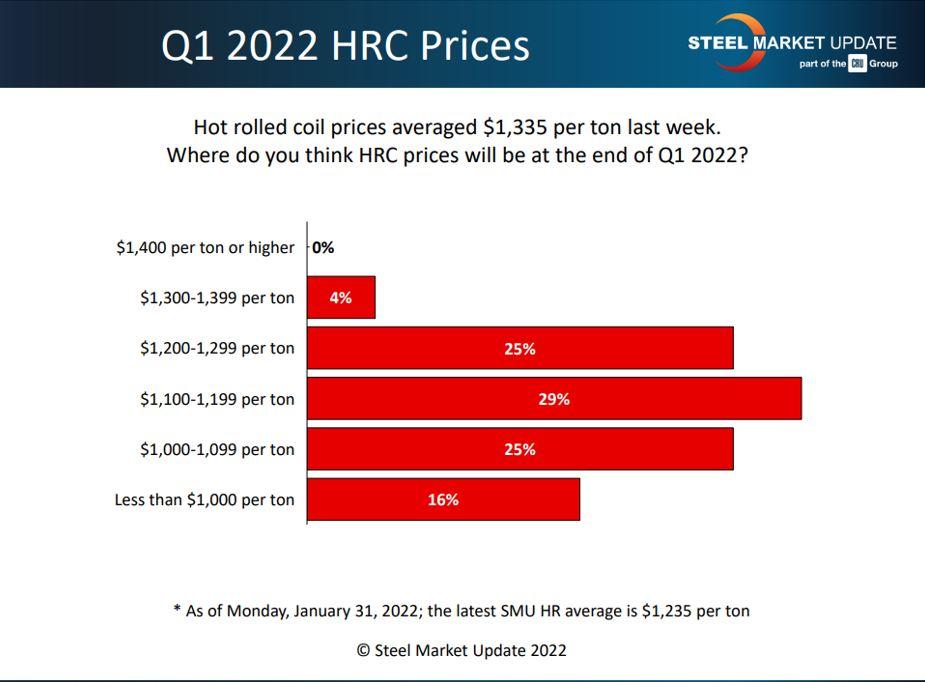

SMU surveys the market each week to keep track of industry trends. In early February our questionnaire asked: Where do you think HRC prices will be at the end of Q1 2022? Predictions were all across the board (see Figure 1), but 40% said they expected the price to be less than $1,100/ton. A weighted average of all the responses put the consensus prediction for the HRC price at roughly $1,125/ton by the end of March.

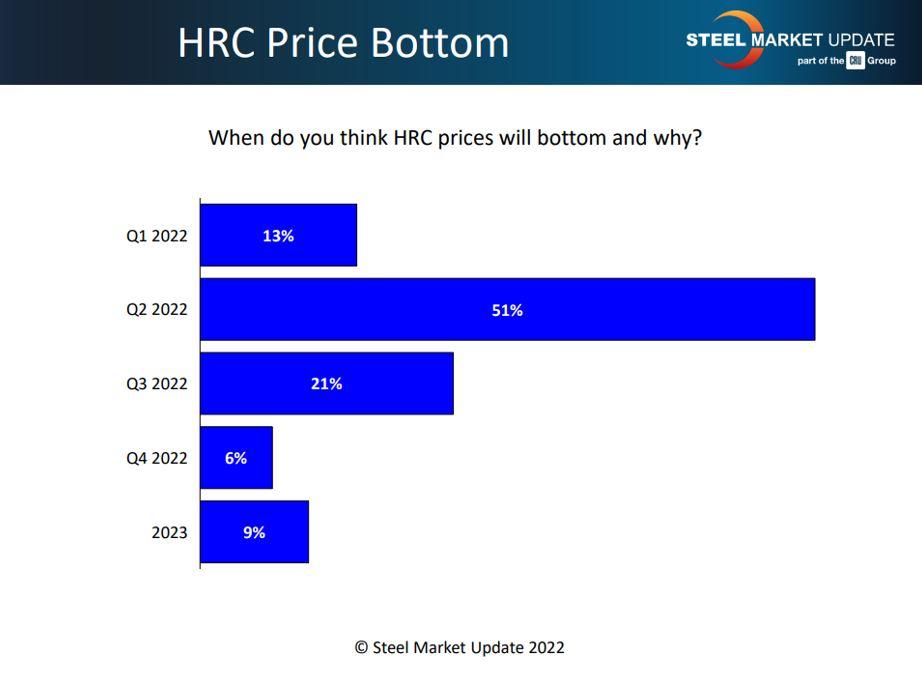

SMU’s questionnaire also asked: When will HRC prices find a bottom? More than half (64%) were betting the downward slide will be over by the end of Q2 (see Figure 2). But another 15% believed it could take until the end of the year, if not into Q1 2023, before prices plateau.

Lead Times as Low as They Can Go

SMU keeps a close eye on the average mill lead time, which typically is a leading indicator of steel prices. Longer lead times mean mills are busier and less likely to feel the need to discount prices to secure orders. During the peak of the market last May, lead times had stretched to 11 weeks or more.

As of early February, lead times had shortened to what is considered normal by historical standards, with hot-rolled lead times less than four weeks and cold-rolled and coated around six weeks. In other words, the time it takes the mills to make steel and process orders can’t get much shorter.

But the downward-trending steel prices are still double the historical norm and have a way to go before they level out. As a result, the next time lead times will have any real predictive value is when they begin to stretch out again. That will signal that demand at the mills is rising and prices are likely to firm up.

Optimists in the Majority

Steel buyers remain a surprisingly bullish bunch despite the plunging steel prices and lingering worries about COVID and the economy. SMU’s survey last month asked service center and manufacturing executives if they were optimistic or pessimistic about their prospects for the first half of 2022. About 70% considered themselves optimists. Is that glass-half-full attitude a good trait for surviving the current market or dangerously delusional?

Pessimistic comments from respondents generally focused on the uncertainty ahead and the difficulty in managing inventories during the ongoing price correction:

FIGURE 1 Steel buyers aren’t sure where steel prices will be exactly by March’s end, but they all agree that they are heading downward.

- “Regardless of economic strength, we are set to lose tens of thousands selling high-cost inventory at dropping market prices.”

- “We’re in a cash crunch due to steel commodity volatility.”

- “Everyone has high-priced steel in stock and will need to work through it before buying new. It will take weeks. Mills and service centers can cut prices, but there are few buyers, so prices will fall further.”

- “The current commodity bubble was created artificially by the steel cartel. The downside to the bubble is always more difficult than the upside.”

- “If you have any chance for survival in the steel industry, you have to be a pessimist.”

Optimistic comments tended to focus on the persistently strong demand:

- “End-use demand remains better than anyone cares to admit.”

- “Overall end-user demand should remain strong during the first half of 2022. A recovery in automotive production may strengthen during late Q3 or Q4.”

- “Customers need to place orders and will take whatever savings they can get.”

- “I am always optimistic about demand being good. It’s the price adjustments that are not good.”

Where is the Bottom for Prices?

Steel executives tend to fall into two camps right now: Those who believe HRC prices will settle out at a new normal close to $1,000/ton, and those who expect prices to return to the historical average around $600/ton. How the correction plays out is hard to predict.

Pointing to new competitors in the market, new leadership, mill consolidation, and the shift from integrated toward minimill production, one industry veteran noted that “to say the market hasn’t fundamentally changed would be naïve.” So a fundamental change in steel prices, if it happens, should come as no surprise.

Steel Market Update Events

Also, it’s not too early to put the next SMU Steel Summit on your calendar. The SMU Steel Summit, the biggest annual steel gathering in North America, is set for Aug. 22-24 in Atlanta.

For more information on these events or to sign up for a free trial subscription to Steel Market Update, email info@steelmarketupdate.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI