Contributing Writer

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Pressure growing on Commerce Dept. to ease steel tariff exclusion requirements

Court decisions shine critical light on past actions to deny exclusions for metal fabrication companies

- By Stephen Barlas

- May 10, 2021

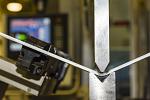

As steel consumers look for some steel price relief, the U.S. Department of Commerce is watching pressure grow for it to be more open-minded about granting exclusions to the Section 232 tariffs on imported steel and aluminum. Getty Images

Could some steel price relief be coming to metal fabricators? They have been hoping President Joe Biden’s administration will reverse or revise some of the rules around the Section 232 tariffs on imported steel and aluminum, but they have seen little movement on the matter.

Since 2018, when the tariffs were enacted, steel importers have been going to the United States Court of International Trade (USCIT), making various arguments for either ending or limiting the tariffs. In April the court drilled the first significant, though limited, hole in the tariffs with its decision in PrimeSource Building Products v. United States. PrimeSource had argued that President Donald Trump’s Proclamation 9980 (Jan. 24, 2020) extending the tariffs to “derivative” products made of steel such as fasteners should be set aside because it was not issued in a timely manner. The court agreed, although it did back the Trump administration on some other issues surrounding the Section 232 tariffs that were bound up in the PrimeSource case.

This wasn’t the first time the USCIT slapped the wrist of the U.S. Department of Commerce with regard to the steel and aluminum tariffs. In what was probably a more significant decision, the court last August criticized the Commerce Department’s denial of requests by fabricators to be granted exclusions from the steel and aluminum tariffs. That exclusion process has been fraught with problems, including denials by the Commerce Department that were not well-founded, according to the metalworking industry in a complaint backed by the USCIT in the August 2020 decision in JSW Steel (USA) Inc. v. United States. A similar outcome was found in a case brought by Boruman Mannesmann Pipe U.S. in June 2020. A third case—Evraz Inc. NA v. United States—that focused on the Commerce Department’s exclusion process is still being litigated.

“All these cases challenging the denial of Section 232 exclusions point to the boilerplate language used by Commerce in its decision memos as evidence that the exclusions were not properly considered,” said Eric Emerson, a partner with the law firm Steptoe & Johnson in Washington.

That raises the question of whether Biden’s Commerce Department will alter Trump administration procedures for handling exclusion requests. That decision would be made by the Commerce Department’s Bureau of Industry and Security (BIS), which still lacks Biden appointees at its top levels. The top official at BIS at the moment is Jeremy Pelter, the deputy undersecretary. In response to an emailed question, a spokesperson for Pelter replied: “BIS has revised the exclusion process based on public comments through several rulemakings. The Commerce Department understands the challenges posed by tariffs, and we are committed to a fair and efficient process for exclusions from tariffs.”

Metal Product Manufacturers Support Proposed National Institute of Manufacturing

The supply chain issues hurting U.S. manufacturers might provide some political impetus for a bill from Sen. Gary Peters, D-Mich., to create a National Institute of Manufacturing.

Peters, who chairs the Senate Subcommittee on Surface Transportation, Maritime, Freight, and Ports, held hearings on April 27 on the state of automotive innovation, current industry challenges, and opportunities. He heard from one witness, Ann Wilson, senior vice president, government affairs, Motor & Equipment Manufacturers Association (MEMA), who emphasized the need to better coordinate U.S. manufacturing policy. “Tackling that important objective is helpful to MEMA members,” she said.

Peters introduced the bill in the last session of Congress, but no action was taken on it. So far, it doesn’t appear that the bill has any other co-sponsors, which typically isn’t a good sign for the future of the proposed legislation. However, a number of industry groups support the legislation including the Association of Equipment Manufacturers.

Peters questioned witnesses about a U.S. Government Accountability Office report that concluded that it is unclear how much the federal government spends on manufacturing programs because 58 federal programs spread across 11 different departments and agencies offer manufacturers some level of help. Without definitive accounting of all of those programs, no one really knows the accurate level of federal support.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Stephen Barlas

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 05/14/2024

- Running Time:

- 62:12

Cameron Adams of Laser Precision, a contract metal fabricator in the Chicago area, joins the podcast to talk...

- Trending Articles

What software automation means for custom fabrication

Why employee-owned companies make sense in manufacturing

Nucor’s weekly steel price announcement continues to rattle markets

Press brakes, panel benders, and flat blank calculations

Washington artist creates life-size elk sculptures

- Industry Events

Laser Welding Certificate Course

- May 7 - August 6, 2024

- Farmington Hills, IL

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,