President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Record opportunities, risks in record-high steel prices

Metal fabricators might not see relief from high material costs until 2022

- By John Packard and Tim Triplett

- May 20, 2021

That stack of sheet metal sitting on your shop floor might be hard to come by in the coming weeks if you don't have a strong relationship with your steel service center. Getty Images

Prices for flat-rolled steel products have been on a relentless uptrend for the past nine months, reaching their highest levels in contemporary history.

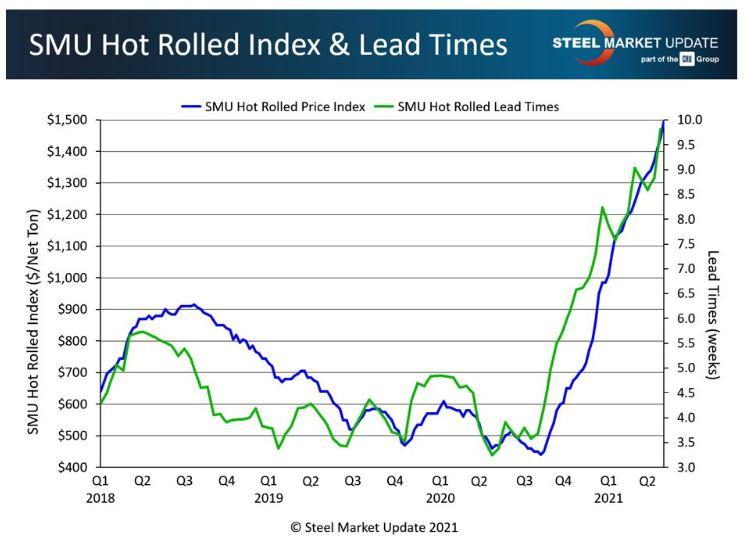

Steel Market Update (SMU) reported a new all-time high for hot-rolled coil of $1,540/ton in the second week of May. That’s more than triple the price at its low point in August last year and 44% above the previous high of $1,070/ton reported by SMU in 2008. And the momentum is pointing still higher. Cold-rolled and coated products have experienced similar inflation. These record-high steel prices have brought record opportunity for steel suppliers—but also record risk.

Demand for steel continues to outpace supplies. Steelmakers curtailed production last spring when the government shut down much of the economy to stem the spread of COVID-19. Since then, producers have been measured in bringing that capacity back online. As for new capacity, Ternium’s new hot-rolling mill in Mexico and Steel Dynamics’ new electric-arc furnace mill in Texas are expected to add nearly 7.5 million tons per year of sheet production to the North American market. But that might not be enough to affect prices until well into the second half of 2021. In fact, some industry observers suggest that new capacity—including expansions underway at Nucor Steel Gallatin in Kentucky and North Star BlueScope in Ohio—won’t have an impact until 2022.

Meanwhile, the economy is riding a sugar high from government stimulus. The major steel-consuming markets—construction, automotive, manufacturing, and even energy to a lesser degree—have rebounded dramatically, boosting sales for steel producers and distributors.

Industry-leading mills and service centers reported record sales and profits in this year’s first quarter, thanks to the convergence of the surprisingly strong demand and unprecedented prices. For steel suppliers, 2021 has been a boom year so far, which begs the question: How much longer can the party last?

In addition to prices, SMU continually monitors lead times for deliveries of spot orders from mills. Lead times are a leading indicator of steel demand; the longer the average lead time and the busier the mills, the less likely they are to discount prices. Because of the scarcity of supply, lead times have never been more extended in the decade that SMU has been gathering this data. The average lead time for hot-rolled in May was nearly 10 weeks and for coated products was around 12 weeks—more than double what is typical. Add to that the extra weeks from late deliveries by the mills because of production backlogs and the shortages of trucking and rail capacity, and some buyers who place orders today might not see their steel until the fourth quarter. And who knows what steel demand and prices will be like at that point?

Having said that, those who don’t commit to orders now could find themselves without enough steel to keep production lines running in the months ahead. Steel buyers are in quite a dilemma.

Fabricators and manufacturers have become even more reliant on their relationships with service centers as a critical source of supply, but service centers can do only so much for them. Inventories among U.S. service centers remain extremely lean (see Figure 1). SMU’s proprietary data at the end of April showed the average service center carrying less than 41 shipping days of supply. April inventories represented 1.94 months of supply on average, or more than six inventory turns per year.

Service center execs tell SMU that lead times are so long with so few tons available on the spot market that they are having difficulty meeting even the basic needs of their best customers. Many report they have had to turn down business from less-frequent customers because they simply can’t find the steel to sell them.

History shows that steel prices can’t stay at record highs indefinitely. Supply will eventually catch up with demand. What happens then? Will prices see a sharp correction or a gradual decline? Nearly all the service center and OEM executives responding to SMU’s recent polls have predicted steel prices will experience a gradual decline over the coming months.

Figure 1. The dramatic uptrend since last summer shows the relationship between hot-rolled lead times and prices, which are both at record highs. Source: Steel Market Update

Analysts at SMU’s parent company the CRU Group, on the other hand, maintain the market is in for a sharper correction sometime later this year. They think supplies will increase as idled capacity is restarted, as new production comes online, and as more imports arrive on U.S. shores. They also think that additional supply could collide with slower inventory building and lower automotive production. As a result, CRU Group analysts predict steel prices will return to their historical cost-plus model rather than being determined by a supply deficit, which is occurring now.

Industry experts don’t know for sure which scenario will play out, but a correction of even a small percentage translates into large dollars when steel costs more than $1,500/ton. Caution is warranted despite an economy that’s booming with billions—and perhaps trillions—more in government infrastructure spending on the way. Remember, the higher prices fly, the harder they can fall.

What Steel Buyers Are Saying

Here is some feedback from the steel-buying community, collected over recent weeks:

- “Demand for our products is outstripping the steel mills' ability to increase capacities.”

- “Supply is extremely limited and tight.”

- “We are scrambling hand-to-mouth to keep some of our customers fed.”

- “It’s a hustle. I never thought I’d work so hard as a buyer to convince suppliers to take my business.”

- “I think it is a lock that we hit $1,600/ton. And so far, every time I’ve made a prediction, it has only gone higher.”

- “Throw a dart? I really have no idea how high steel prices can go.”

Steel Market Update Events

SMU’s Steel Summit Conference in Atlanta Aug. 23-25 will be a live, in-person event, barring an unexpected setback with COVID. Those whose companies still ban travel will have an option to attend the event virtually. Visit www.events.crugroup.com/smusteelsummit/home for more information.

For more information about how to become an SMU subscriber and to sign up for a free trial, contact Paige Mayhair at paige@steelmarketupdate.com or call 724-720-1012.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI