President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel price increases losing steam?

Several factors suggest the decline will start at the end of Q2 at the latest

- By John Packard and Tim Triplett

- February 16, 2021

Hot-rolled steel prices that had reached heights not seen since 2008 are expected to start declining by the end of Q2 at the latest. Getty Images

Steel prices have risen relentlessly since bottoming out last summer and hit new record highs in February. But there are signs the astonishing uptrend in steel may finally be losing steam.

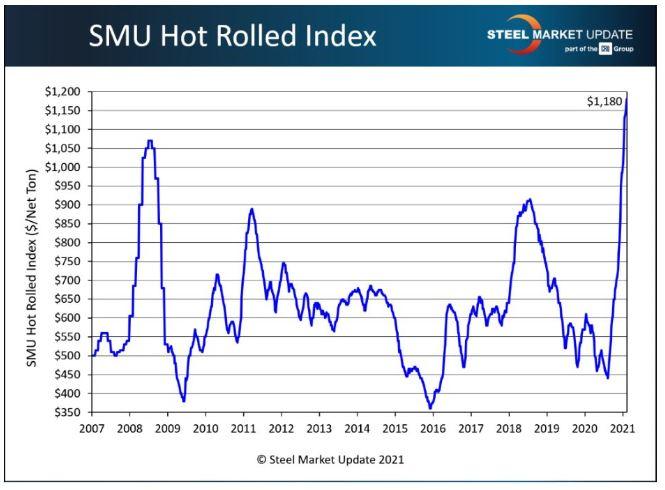

Steel Market Update (SMU) canvassed the market Feb. 8-9, and results revealed the benchmark price for hot-rolled steel at a new record high of $1,180/ton ($59/cwt) (see Figure 1). Prices were up 168% from the August 2020 low of $440/ton. They also were up 9.3% from $1,080/ton in mid-January, when the spot price first surpassed the prior record of $1,070/ton ($53.50/cwt) published by SMU in 2008.

Analysts at SMU’s parent company, the CRU Group, forecast that hot-rolled prices will peak in late Q1 or in Q2 and decline for the rest of 2021. They think prices could fall below $600/ton as supply and demand reach a better equilibrium. Supply is expected to increase more quickly than demand in the second half of the year as mills add capacity and as imports ordered now hit U.S. shores over the summer.

Steel buyers surveyed by SMU in February predicted that hot-rolled steel prices will peak around $1,200/ton and head south beginning in March. But that is just an educated guess. Some market participants have been calling a peak since Q4 2020. They have been wrong to date. Is this time different?

Signs of Cracks in Steel?

SMU has been watching closely to see whether and when the market will reach the tipping point where steel prices begin their decline. The factors below support the case that a summit might indeed be in sight this time.

The upward momentum in steel prices appears to be slowing. Steel price jumps have been more modest recently, with increases as small as $10/ton in some weeks, compared to jumps of $50/ton or more that were commonplace last year.

Lead times for spot orders from steel mills have extended to record lengths in the past six months but appear to be leveling out. Lead times are a leading indicator of demand. The longer the lead times, the busier the mills are, and the less likely they are to discount prices. The average lead time for hot-rolled steel was nearly eight weeks in mid-February, twice as long as the historical norm. But lead times, like prices, aren’t uniformly extended. While most sources reported longer lead times, some said that they were shorter than usual. That might be a blip. But it’s a datapoint worth monitoring.

With U.S. steel prices high, lead times long, and supplies of some items scarce, more buyers have rolled the dice and placed orders for foreign steel for delivery over the spring and summer. The hope is that the domestic price doesn’t plunge in the meantime. Steel imports into the U.S. declined to around 22 million net tons in 2020, a 21.2% decline from the prior year. Part of that drop was the pandemic’s effect on demand; another factor was the Trump administration’s 25% Section 232 tariff. Domestic steel prices have gotten so high that foreign mills can offer savings to U.S. buyers even factoring in the tariff and shipping costs.

SMU’s service center inventories data shows distributors’ stocks at record low levels. Flat-rolled service centers held less than 37 shipping days of supply in January, down from nearly 53 days at the same time last year. Much of that can be attributed to the lack of availability of steel, as distributors have struggled to source enough material to meet customers’ needs. Some of that, however, is undoubtedly by design. Service centers are reluctant to purchase steel today when they believe it will be cheaper tomorrow.

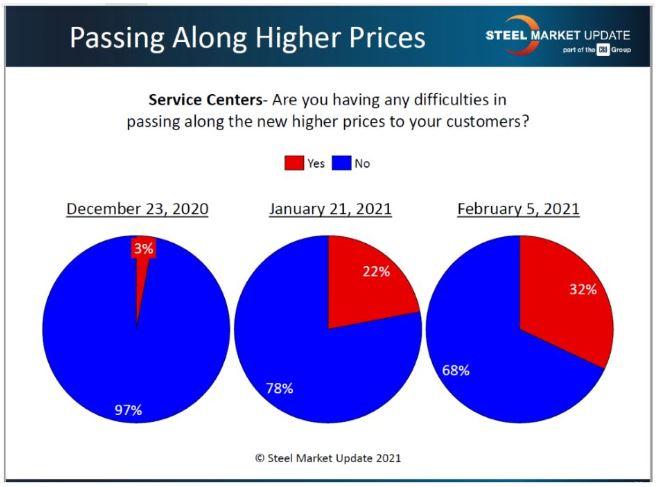

Service centers also report more difficulty passing on higher prices as fabricators and manufacturers dig in their heels and resist further price escalation (see Figure 2).

Figure 1. A survey of steel buyers Feb. 8-9 indicated that hot-rolled steel coil had reached a record high at $1,180/ton.

Steel prices are a function of demand. The American Iron and Steel Institute reports that domestic shipments declined by 15.8% last year to around 81 million net tons. How much of that can be attributed to the pandemic, and how much to other economic factors? One such factor is the shortage of microchips that has disrupted auto production, delaying assembly of some 400,000 vehicles this year—and demand for a substantial amount of steel.

Prices of ferrous scrap, which is remelted by electric arc furnace (EAF) minimills, remained steady or traded lower in February. Foreign demand for scrap exports from the U.S. has eased. Iron ore prices have been up and down. Mills that pay less for raw materials can charge less for finished steel products and still maintain their metal margins.

Steel Buyer Sentiment

Despite the bearish datapoints noted above, steel consumers remain optimistic about their prospects. Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. Most buyers feel positive. The reasons why are varied. Chalk it up to a combination of persistently high steel prices, the change of administration in Washington, the surprisingly resilient manufacturing economy, and progress made against the spread of COVID-19. As of mid-February, SMU’s Future Sentiment Index saw its highest reading in more than two years at +66. Current Sentiment was equally optimistic at +68.

Steel prices may be poised to quit rising, but that does not necessarily mean they are doomed for a big fall. Here are some opinions expressed by service center and manufacturing execs responding to SMU’s questionnaire last month:

- “Buyers hate pricing at $1,200, so we believe we are close to a peak. But we’re not expecting to fall off a cliff.”

- “For the next 45 days HRC mills can charge whatever they want.”

- “I’m not sure it can go much higher, but I thought the same at $1,000 and $1,100.”

- “We believe HRC is peaking now. Demand for HRC is not nearly as robust as cold-rolled and coated. Not weak, but no longer in a frenzy.”

- “I believe the mills will try to get one more increase unless the chip shortage in the auto industry prevents it. But $1,200 is too high. There will be a correction, the question is when and how much.”

- “I see it happening in late April or early May; there are too many other factors not being considered right now that could give this market staying power.”

- “Domestic mills are still pushing the limits with their ‘take it or leave it’ attitude. Total greed at this point.”

SMU Conferences and Workshops

SMU has several conferences and workshops in the works. Registration is still open for the next virtual workshop “Steel Hedging 101: Introduction to Managing Price Risk,” to be held on March 30-31. Presuming COVID inoculations continue apace, the annual SMU Steel Summit Conference will be in person Aug. 23-25 at the Georgia International Convention Center in Atlanta. Visit www.events.crugroup.com/smusteelsummit/home for more information.

Not a SMU subscriber? SMU provides real-time pricing, news, and analysis of market trends affecting North American flat-rolled steel, plate, scrap, and related markets. Subscriptions are economical for individuals or corporations. To sign up for a free trial of the SME enewsletter, email paige@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI