- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Research encompasses alloys for a low-carbon-footprint future

Steel producer embraces today’s trends, plans for the manufacturing needs of tomorrow

- By Eric Lundin

- October 20, 2020

- Article

- Metals/Materials

Although iron replaced bronze as the metal of choice 3,000 years ago, iron’s most commonly used form, steel, continues to provide the backbone of modern manufacturing and infrastructure. An interview with Murali Manohar, PhD, P.E., head of plates, energy & infrastructure products at ArcelorMittal Global R&D, provides insight about what tube and pipe fabricators can expect in the future. Source: Getty Images

Engineers, architects, and designers who need to develop components or assemblies made from metal have no shortage of choices. Many thousands of metal alloys are available and, according to the World Steel Association, steel alone comprises 3,500 grades. With so many choices, do we need more? Indeed, we do. We might not need them right now, but we’ll likely need them as time goes on, as society changes, and as technologies progress.

“We’re preparing for the hydrogen economy,” said Murali Manohar, PhD, P.E., head of plates, energy & infrastructure products at ArcelorMittal Global R&D, East Chicago, Ind. That is decades away, so in the meantime the company continues to conduct research for applications in today’s petroleum-based economy. Few would deny that it’s still alive and well—in the last few years, the world’s petroleum industry pumped about 97 million barrels per day annually. The largest producer, the U.S., produces about 12.5 million barrels per day and consumes about 20.5 million barrels per day. All of these numbers are sure to be somewhat lower in 2020 because of the pandemic, but the prospects for the industry are robust.

The fallout from COVID-19 aside, many other changes are afoot and have been for many decades. One is the goal of reducing U.S. reliance on foreign oil, which has led to increasingly stringent fuel efficiency standards for the automotive industry. The overarching interest in building vehicles with less mass led to the research and development of entirely new generations of advanced, high-strength steels; high-strength, low-alloy steels; and greater use of other metals, such as aluminum and magnesium.

Another is the pressure to reduce society’s collective carbon footprint, which discourages the consumption of gasoline and coal and encourages increased use of alternative energy sources, such as wind and solar power. Widespread use of hydrogen, which produces only heat and water when it burns, is decades away, so in the meantime natural gas is acting as a bridge. Natural gas is helpful in reducing carbon output in that its combustion produces much less carbon dioxide than other fossil fuels. Improvements in extraction technology, along with the cost-effective abilities to store and transport natural gas in gaseous and liquified forms, have created new business opportunities.

How much progress has natural gas made? In terms of generating electricity, it has been substantial. Data from the U.S. Energy Information Association show that natural gas’s share of electricity production in the U.S. has grown from 26% to 34% since 2014, while coal’s share has declined from 40% to 22% in the same period.

“The tube and pipe industry is right in the middle of these transitions,” he said.

Moving Petroleum

While keeping an eye on such long-term goals, ArcelorMittal’s recent research has led to work on new steel alloys that have more immediate uses.“In the last two or three years, the company has instituted a big push for new capabilities in metal fabrication, and our goal is to help fabricators in the industry make full use of them,” he said. Emerging applications that require strong, lightweight materials have motivated the company to develop materials to optimize these applications in many business segments.“The company is still heavily invested in the automotive industry, but the distinction between our automotive and nonautomotive businesses is becoming less clear,” Manohar said. Its automotive business is still very strong, Manohar said, but the company also is exploring emerging energy-related opportunities.

“Our goal is to be ready for infrastructure projects such as pipelines and bridges,” he said.

Moving Petroleum Products in Cold Climates. One area of focus these days for ArcelorMittal is safer, more reliable transportation for petroleum, which includes a focus on cold-climate applications. The engineering and construction of the Trans-Alaska Pipeline illustrate the issues that come with working in cold climates.

The 800-mile-long pipeline, which runs from Prudhoe Bay to Valdez, Alaska, is a marvel of engineering. About 400 miles of it runs through an area that never freezes, so the pipeline is buried in that section. The other 400 miles is in permafrost or discontinuous permafrost, meaning that the soil is subject to substantial localized movements as it freezes and thaws, heaving upward and settling downward. In such areas, the total vertical movement can be as much as 10 ft., according to Manohar.

With more than 30 years in the steel industry, Dr. Murali Manohar serves as a key member of the ArcelorMittal Global R&D team. Leading a team of more than 20 engineering and technical professionals, he is responsible for equipment, research activities, and technical support to customers and corporate business units in the areas of plates, hot-rolled coils for energy, industrial products, and tubular products.

However, the pipeline isn’t subjected to heaving and settling. The 400 miles of pipeline installed aboveground is supported by a series of 78,000 vertical support members that chill the soil in the immediate vicinity so that it stays frozen year-round. The soil doesn’t freeze and thaw, so it doesn’t rise and fall.

Engineering a New Alloy for an Old Application. What if another such pipeline were to be engineered without vertical supports? If so, it would have to withstand regular and extreme displacements as the seasons changed.

One of ArcelorMittal’s recent goals is to develop steel that can be used to make pipe for petroleum pipeline applications with three characteristics: sufficient strength to withstand the necessary internal pressure, sufficient fracture resistance to prevent splits (both starting and propagating), and enough ductility to absorb the strains associated with severe and repeated localized movements.

A look at a decades-old development in metallurgical processing illustrates the difficulties in making steel stronger.

“Until the 1960s, the only way to increase a steel alloy’s strength was to increase the carbon content,” Manohar said. “The drawback is that adding carbon also makes the steel less resistant to brittle fracture.” In layman’s terms, more carbon means more strength, which means more hardness, which means more brittleness. Complicating the picture is the use of such steel in cold climates. “As the temperature drops, the ability to resist brittle fracture also drops,” he said.

In the middle of the 1970s, a new strategy for modifying steel’s strength emerged, Manohar said. Metallurgists found that by controlling the steel’s grain size, they could improve the material’s strength and its resistance to brittle fracture. In other words, it would be tougher. To do so, metallurgists would have to find a way to prevent the individual grains of steel from growing too much.

When working with steel, controlling the grain size is a matter of controlling the processing temperature and the dwell time at temperature before cooling the steel. The cooling process can be a quench—a sudden immersion in a liquid set to a specific temperature after austenitizing—but quenching isn’t the only option. Another way to control grain size is thermomechanical control processing, including accelerated cooling, which is used in the finishing section of the mill.

“Accelerated cooling uses jets of water to cool the steel at the last stage of production,” he said. Such a scheme uses directed nozzles and water that flows at an intermediate pressure, controlled with a feedback system and adaptive algorithms.

Research in this area facilitated greater strength while reducing the carbon content. In other words, it contributed to the development of the aforementioned high-strength, low-alloy steels.

From there, ArcelorMittal’s research focuses on the rolling process, which reduces the steel’s thickness substantially, say from 10 in. to ½ in. thick. The amount of work done in each pass, and the temperature of each pass, help determine the material’s characteristics. This is where ArcelorMittal’s work finishes, but its research continues past this step. The ultimate goal is to learn all it can about the metal’s characteristics after it has been rolled to make tube or pipe.

“Each pipe mill is different, and we want to ensure our materials work on each mill,” he said. In addition to exchanging information and collaborating with several tube and pipe producers, the company conducts research on its own.

To that end, the company invested in two pieces of equipment to roll plate or coil into a tubular form and test it. First is a four-roll plate bending machine, which forms the plate into a cylinder, a crucial part of ArcelorMittal’s research effort, and provides a way for the company to test the steel after it has taken on tube or pipe characteristics. According to Shira Cohen, communications and corporate responsibility specialist for the company, this is the only unit of its kind in the U.S. used by a steelmaker to test energy products; normally it’s each customer’s responsibility to conduct such tests.

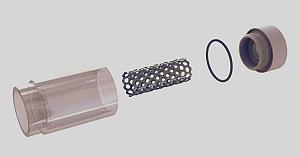

The second piece of equipment is a ring expansion tester, which performs an evaluation similar to hydrostatic testing. It charges the tube with fluid under pressure and measures its deformation, generating a plot that shows the relationship between internal pressure and deformation.

The most commonly used test in the industry is a flattened strap test, which requires cutting a section from the tube or pipe and flattening it. While subsequent testing can provide insights about the material’s minimum yield strength and ultimate tensile strength, the flattening process itself changes the characteristics that are under investigation. The ring expansion test has the potential to be a more accurate test of the pipe going into service because it doesn’t rely on a flattening process and keeps it in its native cylindrical form. It is also thought to represent the pipe’s properties more closely than the less common standard test, the round bar tensile test.

“The ring expansion test can be regarded as the most representative test showing the actual behavior of the pipe, compared to flattened strap or round bar tensile sample tests, which are the most widely used tests in the industry,” according to Manohar.

Building Better Bridges

ArcelorMittal’s work doesn’t end there. Just as it’s working on metals for the natural gas economy, a bridge to the future, it’s also developing metals to build the bridges of the future. This grew out of its focus on other aspects of U.S. infrastructure, much of which is in sad shape.A report written by the U.S. Department of Transportation in 1998 found that the annual direct cost of corrosion was $276 billion. At that time, this cost was 3.1% of the gross domestic product. In essence, this meant that when the economy did well, generating about 3% growth, we lost the same amount in direct costs relative to corrosion, so the actual outcome was neutral.

Although the report included more than just infrastructure, the nation’s transportation system was a significant area of concern.

“We’re promoting corrosion-resistant material for bridges,” Manohar said. “We estimate that we can provide plates for bridges that will last 125 years.”

The alloy for this is a dual-phase stainless steel, described by ArcelorMittal as a cost-effective corrosion-resistant material that fits the description of ASTM-A1010 (higher-strength martensitic stainless steel). Originally trademarked as Duracorr, it was first used for bridges as A1010-grade 50 with special added requirements. To ease application, it was added to the A709 standard for structural steel bridge materials in 2017 as Grade 50CR, which details all material properties required for bridges. Its chromium content is 12%, substantially less than the 20% to 27% used in some 300- and 400-series stainless steels, but still sufficient to support a projected 125-year lifespan, which is impressive.

“The initial cost is higher, perhaps two to three times higher than a similar bridge made of steel, but after the first repainting, it’s less expensive,” Manohar said. The painting isn’t necessary for corrosion prevention, but for aesthetics.

Like steel selection for pipelines, proper steel selection for bridge construction depends on the environment.

“For saline resistance, for offshore and near-shore applications, we’d suggest a high-performance steel like HPS 70W,” he said. The company’s literature states that in addition to a minimum yield strength of 70 KPSI and reduced preheat requirements for welding, it can endure more weathering than a carbon steel. An ASTM description of HPS 70W suggests that it has four times the weathering resistance of low-carbon steel.

Looking to the Future

Certainly the many changes afoot over the next few years and next several decades are going to disrupt the current state of the tube and pipe industry. ArcelorMittal’s work in developing a new steel grade for cold-climate pipelines is just one initiative. It is possible that the technologies used for extracting and processing natural gas will change over time, likewise leading to new challenges and opportunities for tube and pipe producers.Other examples illustrate the ongoing needs for robust yet lightweight steels. Wind towers constructed 25 years from now might be very different from those installed today, especially if the desire for ever-taller offshore towers in ever-deeper waters continues. Also, although conservative political positions in the U.S. favor reducing environmental and business regulations, research will continue improving the alloys used for making automobiles. Many countries and some cities throughout the world are planning to phase out the sale and use of gasoline- and diesel-powered automobiles in the coming decades, so the transition to electric automobiles will continue to fortify the desire to keep them as light as possible and therefore as efficient as possible.

Meanwhile, although the hydrogen economy is a long way off, some practical applications are already here. For example, an ArcelorMittal mill in Hamburg, Germany, will be the first industrial-scale (100,000 tons/year) steel production capability using direct reduced iron, a process that uses hydrogen instead of traditional iron ore with carbon (coke), eliminating the carbon dioxide byproduct.

Those tube and pipe producers and fabricators that stay abreast of such research and the subsequent technological developments will be prepared to take on these new challenges and turn them into profitable opportunities.

About the Author

Eric Lundin

2135 Point Blvd

Elgin, IL 60123

815-227-8262

Eric Lundin worked on The Tube & Pipe Journal from 2000 to 2022.

About the Publication

subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Zekelman Industries to invest $120 million in Arkansas expansion

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

HGG Profiling Equipment names area sales manager

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI