Contributing editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Getting work from the New Domestics

Best prospects, foot-in-the-door strategies

- By Kate Bachman

- July 15, 2008

- Article

- Shop Management

It's not news that rapidly rising fuel costs are driving a shift in consumers' automotive buying patterns. Honda Civic®'s pushing Ford's F150® trucks out of the top spot in May is significant and symbolic. As Detroit Three sales have slumped and the foreign automakers' sales have risen with the cost of gasoline, many stamping suppliers are looking to the latter for business opportunities.

Several economic factors favor that effort. The lowered value of the dollar, high fuel costs, and shipping delays have made it cost-advantageous for foreign automakers to open or expand automotive manufacturing facilities in the U.S.—so-called New Domestics or transplants.

Jim Schwartz, general manager of marketing at Eagle Wings Industries, Rantoul, Ill., a Tier 1 supplier to Mitsubishi and Tier 2 to other Japanese automakers, said that the climate is favorable for supplying the New Domestics. "There's a big push for localization right now," he said. "A lot of the transplant companies still rely on components shipped from Japan. Some of those components might be a common part shared with a vehicle in Japan, but sometimes it may be because some automakers haven't aggressively searched for local companies to supply them here.

"With the decline of the dollar and increased transportation costs, it's becoming more favorable for these companies to re-source this work to U.S. suppliers," Schwartz said. He added, "Being close to the OEs is really a big advantage for domestic suppliers, especially in response time, because if there is a quality issue, you can respond quicker and there's not as much product in the pipeline."

So how do you position your company to gain entry to get that work, either directly from the automakers as a Tier 1 supplier or as a tiered supplier?

Requirements, Preferences

A few of the requirements for the New Domestics are not surprising, such as the need to manufacture tooling and parts to metric scale. Considering that lean originated with the Toyota Production System, the acute emphasis on lean by Japanese automakers is to be expected. It may not be as well-known that some German transplants require their U.S. suppliers to be equipped with transfer presses.

Suppliers purchase materials for components for the New Domestics through the automakers' purchasing consortiums.

"With all of our customers we're on a steel-buying plan," Schwartz said. "Honda has one, Toyota has one through their buying plans, they're able to keep the costs of the steel lower, because of the volume. They're domestic mills, mostly." He likes it. "It's good for us, because we don't have to worry about going to our customer for material increases every time the price goes up."

On the other hand, many of the expectations of the New Domestics are similar to those of the Detroit Three, such as high quality standards and just-in-time (JIT) delivery. The difference is that many of the New Domestics are located along the so-called Automotive Alley, along I-65 and I-75 from Indiana and Ohio to Alabama, so being close to the transplants may mean relocating.

Some differences that were distinct when the transplants first located domestically—such as the methods for designing and measuring part dimensions—have blurred as the plants have replaced their original Japanese or German employees with Americans and have become more Americanized.

Honda associates meet with suppliers on parts development for the 2008 Accord. Honda has more than 650 suppliers in North America. Photo courtesy of Honda.

The New Domestics are no less cost-driven than the Detroit Three, Tier 1 suppliers reported. "What's important for the Big Three is important for the New Domestics," said Bill Kent, spokesperson for PK U.S.A., Shelbyville, Ind., a Tier 1 supplier to Japanese transplants.

"Cost is huge," Schwartz said. "Our Japanese customers require cost-downs every year. They run a very tight ship and they are very cost-conscious. You have to be very lean to work with Toyota."

The main differences between the domestic and foreign automakers materialize in their methods of doing business and in cultural aspects—and in the fact that none of the transplants are located in Detroit or Chicago.

Business Approach Differences

Partnerships. "The biggest difference between the domestics and the New Domestics is the partnerships that are built in the New Domestics," Kent said. "You're into the relationship for the long term. If a problem arises, you're not automatically dropped as a supplier; your customer helps you solve the problem. As a result, you and your customers work together on cost efficiencies, cost reductions, and productivity improvements," he said.

Honda of America Mfg. Inc. spokesperson Ron Lietzke, Marysville, Ohio, concurred. "During new model activity, we expect the supplier to work directly with us in evaluating parts fit and how to improve consistency.

"And there has to be a willingness to take on new challenges and try new processes. For example, in the last decade, Honda has increased the amount of high-strength steel in our cars and trucks to meet fuel efficiency and safety targets. Some of the recent models have more than 50 percent high-strength steel," Lietzke said.

Because high-strength steels are harder to form, stamp, and weld, mastering the inherent challenges required innovation and hard work by the suppliers working with the automaker's staff, Lietzke said. "So a willingness to look long-range, to implement new technologies and new processes is an important characteristic we look for in our suppliers," Lietzke said.

The expectation for partnership extends to the supplier's management. "The leadership of the company is expected to participate at the floor level," Lietzke said.

Q, D, C. When asked about supplier requirements, the New Domestics answer in initialisms comprising Q, D, and C. Honda of America's yardstick (metricstick) to measure potential suppliers is called QCDDM—quality, cost, delivery, development, management. "Generally, what Honda is looking for is someone with very good business characteristics with regard to quality, delivery, efficiency, and the whole idea of continuous improvement in their operations," said Lietzke.

"Honda will buy from the most competitive suppliers to fulfill end customer satisfaction," he added. "Our suppliers are not simply selling their parts to us; they are selling their parts to our customers through us."

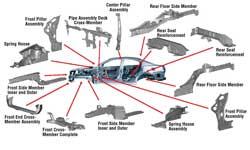

Click on image to view larger Nearly 80 percent of an assembly plant's components are outsourced, according to business news site Goliath. Illustration courtesy of Eagle Wings Industries Inc., Rantoul, Ill.

PK U.S.A.'s Kent echoed that requirement. "We look at the metrics, of course—cost, quality, on-time delivery. Our customers look at those metrics, and that's how they rate us."

"We participate in value-added exercises [VAVE] with Mitsubishi," Schwartz said. "They meet with us, usually monthly. We'll go through a whole host of things to reduce costs."

Responsiveness. Define responsive? "Immediately. That day, the next day. If our customer makes immediate changes in their production schedule, up or down, we have to be able to respond immediately," Kent said.

Schwartz added, "Hopefully you're within four or five hours away from the plant."

"It's up to the supplier to have the right proximity," Honda's Lietzke said. "It's important to be able to be very available to come to the spot and resolve any issues or problems. So if you're in California trying to service our plant in Marysville, Ohio, that probably wouldn't work very well.

"Now having said that, sometimes, using new technologies such as laser scanning and modeling software, you can accommodate some of that and work long distance during new-model tooling development. But at the end of the day, when those dies are put into the press, the entire team needs to be available to make sure those parts come together and fit," Lietzke said.

Time Sensitivity. "For Japanese companies, timing is absolutely crucial," Schwartz said. "They're very schedule-driven. They want something down on paper. You may be doing a schedule that's a year and a half long. It can be a 'living document' that's subject to change, but there should be something in your project management that triggers any issue that looks like you're going to have a problem so that countermeasures can be taken to get back on schedule."

Flexibility. "The Civic is very much in demand, and we're trying to figure out, with our suppliers, how to increase production by using our flexibility," Lietzke said. "And that impacts the entire supply chain—not only our plants' but also our suppliers.' Having the flexibility and capacity to change production from one model to another is important, because we produce multiple models in our plants," Lietzke said.

Financial Stakes. Often a financial connection exists between the foreign automakers and affiliated suppliers. Just as the Detroit Three had at one time owned supplier companies such as Delphi, the New Domestics have majority ownership in supplier companies as well. Naturally, those financial stakes are motivation to channel business to them.

Eagle Wings, a Japanese-owned company built to support Mitsubishi in the U.S., vies to achieve Tier 1 status with other transplants. "For a supplier that is not connected financially, you really have to be competitive to go in and take work away from their family of suppliers," Schwartz said.

"For the most part everybody is on a level playing field with similar technologies and similar equipment; everybody is JIT," Schwartz continued. "So basically they're looking for something that makes you stand out from everybody else. 'What can you do better than my current suppliers? Can you do the same thing cheaper?'"

Cultural Differences

Despite the financial ties, not being the affiliated supplier is not a barrier to entry. PK U.S.A., originally established by Isuzu to supply its U.S. facility, is now a Tier 1 supplier to the Honda group, Nissan, Subaru—and, most recently, the Toyota group.

"In the Japanese automotive world, you have to build your relationships with your customers. It takes time, it takes effort. Having a Japanese coordinator only helps," Kent said. "You develop those relationships, you develop those ways of doing business, and it opens the door for further chances for additional business. We didn't do Nissan business until the 1990s. And now we have so many customers, it's amazing," Kent said.

Japanese automakers consider prospective supplier companies' employer-employee relationships too, Kent said. "They look at our safety record, employee involvement, participation—how you treat your employees is very important. When I've met with Toyota, they've asked what our voluntary turnover rate is. We have very low turnover—6 to 8 percent a year. It shows a level of stability," he said.

Just being a Japanese-owned company helps to bridge cultural barriers, Schwartz said. "At times when we try to get our foot in the door of a Tier 1 or OE, and when they find out that we are Japanese-owned and have a long history of supplying as a Tier 1, the doors swing open more easily than before."

Language. Because Eagle Wings' top-level managers are Japanese, communication between Japanese transplant management and Eagle Wings management is easily facilitated. "From a communication standpoint, I think it provides a comfort level," Schwartz said. "One hurdle an American-owned company would have to overcome is the language barrier. Although you're dealing with Americans a lot of times, there still are situations, especially as you go higher up in the management ranks, when you're dealing with Japanese. It would be in a supplier's best interest to have an associate in their quality or engineering departments who is Japanese or who speaks Japanese, so they can relate one on one," he said.

Foot-in-Door Strategies

1. Time Your Approach With Model Changes. "The best opportunities are during full new-model changes, because that's when there's a new maker layout for the product and the opportunity for new suppliers and new technologies," Lietzke said. "A lot of our products have five-year cycles between major model changes. Advanced planning based on a detailed timeline of activities goes into this, at least two or three years ahead of the model launch. We produce multiple models in our plant, so at any time we're likely to have new-model activity on one of those models." Also be sure to

2. Watch for Model Demand Increases. Obviously, automakers and their Tier 1 suppliers faced with suddenly increased demand for a particular model are likely to need help from suppliers to ramp up production. When Honda spokesperson Lietzke says, "The Civic is very much in demand, and with our suppliers, we're trying to figure out the best way to increase production," that should sound like the dinner bell ringing to a hungry stamping supplier even if you

3. Supply Tier 1 Suppliers. Your best prospects may be firmly established, foreign-owned Tier 1 suppliers that subcontract to Tier 2 and Tier 3 American-owned suppliers for support stampings. "One way to learn how the main customer operates is to work through the Tier 1 suppliers," Kent advised.

Also, most Tier 1 suppliers control purchasing from their facilities. Which leads to No. 4

4. Look for North American Purchasing Offices. The more domestically located purchasing offices an automaker has, the more accessible it is likely to be. Which reinforces the need to

5. Relocate, if Necessary. It can be especially advantageous to relocate to capitalize on new plant openings (see sidebar). Automakers in expansion mode are likely to need supplier and vendor support nearby, as do their Tier 1 suppliers. PK U.S.A. will be accepting supplier and vendor proposals to feed the Senatobia, Miss., plant it is building to supply Toyota's new plant in Blue Springs, Miss. Contact early and often. It helps to

7. Know Where the Engines Are Built. The more critical components that are produced domestically, the better your prospects. A good indicator is where the engines are produced. Honda's engines are produced in Anna, Ohio, and other domestic sites; BMW's are manufactured in Germany. Also

8. Look for a High Degree of Transparency. How transparent is the automaker's supplier application process? Most automakers have a supplier application form on their Web sites, and they advise interested suppliers to contact their sales, new business, or purchasing departments.

Honda's supplier application process is listed in detail on its Web site (see How to Become a Honda Supplier sidebar).

9. Offer Something Unique. "If a supplier has some unique technology or unique expertise that can add value to the product—in strength, in cost, in efficiency, reducing steps—all of those are very important," Lietzke said. Especially if you

10. Make Critical Components. Oh to be a lithium battery manufacturer right now.

New or Expanding Automaker Plants

- Honda has announced that the plant scheduled to open in Greensburg, Ind., later this year will produce the Civic sedan.

- Toyota is scheduled to open its eighth North American auto manufacturing plant in Blue Springs, Miss., in 2010.

- VW's premium brand, Audi, has announced that it is studying the possibility of building a facility in the U.S.

- BMW announced in March it is expanding its Greer, S.C., facility.

- Nissan's Canton, Miss., plant announced it is adding a third shift to boost production of its Altima®.

How to Become a Honda Supplier

Here is an abridged version of the steps outlined at www.hondasupplyteam.com; click on the link, How to become a supplier.- Initial contact. Honda may contact local suppliers or suppliers contact Honda's purchasing offices nearest their locations. If Honda has interest, a meeting will be arranged. The supplier presents a written overview of its operations, experience, parts, and customers.

- Preparation investigation. Honda learns more about the parts the supplier proposes to supply—size, weight effect on adjoining parts, tentative price, lead-time, and to what extent the supplier has studied Honda parts.

- Quotations. Honda issues a drawing and accompanying specifications and requests a more specific quotation.

- Initial plant visit. Honda visits the supplier's plant to assess the company, operations, management policies and philosophies.

- Prototype development. Supplier provides prototypes with self-testing and evaluation date, an outline of the production capabilities, and schedules.

- Testing and evaluation. Honda conducts extensive testing of the parts.

- Mass production quotation. Supplier provides a detailed price breakdown: raw materials, labor, tooling, packaging, and delivery expenses.

- Tooling. Honda issues tooling orders.

- Trial run. Supplier carries out mass production trial run.

- Quality assurance visit. Honda visits supplier's facility again for an overall evaluation of the process.

- Agreement. General agreement for purchase of parts is signed.

- Purchase order. Mass production begins.

About the Author

Kate Bachman

815-381-1302

Kate Bachman is a contributing editor for The FABRICATOR editor. Bachman has more than 20 years of experience as a writer and editor in the manufacturing and other industries.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI