Contributing Writer

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Job shop estimating: Watching the clock in the fabrication sequence

Step 5: Preparing the "time study"

- By Gerald Davis

- April 24, 2013

- Article

- Shop Management

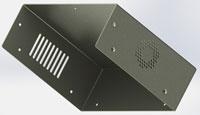

Figure 1a: This sheet metal chassis is 0.062-in.-thick (14-gauge) 5052-H32 aluminum—10.179 in. by 9.207 in. as a flat pattern—plated with yellow chromate. It has swaged into it several hardware fixtures. Tolerances indicated on the drawing show ±0.012 in. fold-to-fold and ±0.008 in. for everything else. An estimator for a job shop might propose the following fabrication outline for the part: 1. SHEAR—Shear 0.062 5052-H32 48" x 14" (5 per strip 10.179 x 9.207) 2. PEGA—Punch per CNC program fab-May-05—Do not knock out parts 3. BELT—Grain 180-grit Class IIB both sides of each strip of 5 parts 4. BTEX—Knock out parts—use abrasive wheel to remove KO tags 5. BRAKE—Form per print 6. CHEM—Plate with yellow chromate 7. HDW—Install captive hardware 8. QA—Final inspection

This edition of Precision Matters continues our detailed examination of estimating as a business process. The previous edition discussed the estimator’s outline of the needed manufacturing steps as well as the benefits of having that estimator’s “work order” dovetail with the shop’s production work order system.

At this point the estimator has a clear idea of which fabrication processes will be subcontracted, as well as those that will be completed in-house. We are now interested in completing the details for the in-house operations. These details will include expenses for machine and shop labor. Both expense types typically are calculated as time multiplied by hourly rate.

For the sake of discussion, we’ve dissected the estimator’s job into a dozen tasks. In reality, these tasks may overlap or evolve in different sequences. As a review, here is a brief outline of how we’ve dissected an estimator’s job:

- Process identification

- History retrieval

- Compatibility check

- Work order prep

- Time study

- Material planning

- Fixtures/special handling

- Costing

- Pricing

- Presentation

- Review

- Optimization

People Versus Machines

We’re not talking combat. We’re making a distinction between what it costs for labor—people—and what it costs to have the machine perform an operation. For many manufacturing operations, the distinction is pointless. As an example, consider a person who removes burrs or flashing from a workpiece. The “machine” in this case is a simple hand tool, or perhaps no tool at all. For our purposes, such operations would have a machine rate of zero.

The distinction between labor rate and machine rate when estimating hourly expense is more significant when the fabrication process is largely automated. In such workcells, the labor rate is applied to the time that it takes to set up the machine, load it with raw material, unload, and then queue the finished workpieces for the next operation. Figures 1a and 1b are examples of parts that will require labor time for handling the workpieces and various bits of machinery to shape the metal.

If the shop has the right machinery, the part shown in Figure 1b might be produced robotically —largely unattended by humans. A completely unattended operation might have a labor rate of zero—something like a vibratory tumbler, perhaps.

Time Is Money

To convert time into money, the estimator multiplies the estimated time by an hourly rate. (Hourly rates for labor and machine time will be discussed later.) These rates generally are given to the estimator and are not values that he or she has much control over.

For the convenience of discussion of time studies, let’s pretend we are estimators at a sheet metal job shop, which just happens to reflect the author’s background. Having said that, this concept of time and motion studies applies across any industry.

Our job shop offers a variety of manufacturing services—shearing, punching, deburring, bending, riveting, welding, etc. Each manufacturing operation has expenses that include machine hours and labor hours.

Each operation requires setup and then a run cycle to complete the parts. The labor hours are estimated separately for setup and run time. The machine hours cover the entire span of shop time that the machine dedicates to this project.

Figure 1b: This sheet metal cover also is made from 14-gauge 5052-H32 aluminum and gets yellow chromate. It also gets painted. Unlike the chassis, this cover has no captive hardware. It does have some countersunk holes. An estimator for a job shop might propose the following fabrication outline for the part: 1. SHEAR—Shear 0.062 5052-H32 48" x 12" (3 per strip 12.320 x 8.192) 2. PEGA—Punch per CNC program fab-May-06—Knock out parts 3. BTEX—Remove burrs from profile 4. DRILL—Countersink 9 x 82° x 0.237 dia. 5. BRAKE—Form per print 6. CHEM—Plate with yellow chromate 7. PAINT—Black powder coat—E141-BK19 8. QA—Final inspection

Stop Watch Versus Calendar Time

Estimators and production schedulers look at time with slightly different objectives. For the purposes of establishing a cost estimate, the estimator simply looks at total time. Production schedulers make an effort to group similar projects together, optimize material usage, and maximize throughput for as many projects as possible. The estimate may show 4.6 hours to do the work. The schedule to complete that work may span several days.

When calculating expense for labor and machine time, the estimator looks at shop time as if the shop were open 24/7, with no delays for material, labor, or machine time. When establishing the project lead-time, the estimator must consider how this project will mesh with other projects that are currently in or scheduled for production. To do that well, the estimator must make some allowance for delays in availability of material, machines, and labor.

Converting shop hours into lead-time is difficult to do with a formula. Lead-time is a function of the current status of production and the ability of the shop floor to minimize the queue time between operations.

Our imaginary job shop has a history of production performance. Recent history shows that a “typical” job takes 15 workdays to move from CNC prep to the shipping dock. We also have a history of subcontracting. From that experience, we can generalize and safely plan five to 10 working days for subcontracted operations. Our shop does not work on weekends; 10 workdays will span at least two calendar weeks.

Your shop is undoubtedly different, but the quoted lead-time should be based on recent performance, not necessarily on a blanket statement that never changes. Just saying “seven weeks” is not good practice.

Cooking up Setup Time

It’s time to make the pancakes. What would you include in the setup time for this culinary exercise? Finding the pots, pans, spoons, measuring cup, and bowl? Fetching the eggs, milk, flour, salt, and butter? Mixing the ingredients and heating up the stove takes time too.

When it comes to the “run time” for this batch of pancakes, the first one or two are usually “tryout” pieces and get tossed down the cook’s throat. Once the pan is up to temperature, each pancake takes about the same amount of time to dollop, toast, flip, toast, and plate.

Suppose we pay the cook $20 per hour. The setup is a half hour. Each pancake takes 0.017 hour to cook. (That’s 1 minute divided by 60 minutes per hour.)

How much does it cost to set up for a batch of pancakes? $10 is the answer I got.

If we order the cook to make one pancake, how much would it cost? $20 per hour for the cook multiplied by 0.017 hour per pancake gives you 34 cents. However, that’s just the cost for one pancake. Remember, the cook eats the first two tryout pancakes. So we have three pancakes multiplied by $0.34 for cooking and $10 for setup, and that results in $11.02 total labor per cake in a batch of one pancake.

Of course, if we ask for 20 pancakes, the price per pancake drops. The labor setup cost would drop to $1.18. How did I get that? Each batch has two practice pancakes for a labor expense of $0.68. The $10 setup divided by 20 delivered pancakes is $0.50 for labor. Add the practice time and the setup time for $1.18. To that setup expense add in the $0.34 labor per pancake to calculate $1.52 total labor per cake in a batch of 20 pancakes.

Does this stand up to the smell test? Are pancakes really cheaper when you make 20 in a batch instead of one at a time? I believe it does smell delicious and makes sense too.

How long will it take to make 20 pancakes? Let’s calculate 23 pancakes multiplied by 0.017 hour per cake plus a half hour of setup, and that comes to 0.84 hour—a little more than 50 minutes for scheduling purposes. If we can get the cook to show up, we can ship same day.

That was a great example, but how did that reveal the process for estimating the amount of setup time? Consider what would happen if we asked our cook to duplicate the previous example. A batch of one pancake would be delivered, and then a batch of 20 pancakes would be delivered.

Because the pots, pans, and stove were already set to go for the second batch, the actual setup time was significantly less for the second order. In fact, the practice cakes might not be needed at all. Our estimate for the second batch probably would be excessive.

The estimator cannot rely on this good circumstance. The time standards can be based reasonably on starting from the same point for each batch—a cold stove in a tidy kitchen, as it were. That’s the first tip we’re offering for setting time standards.

Closed Loop Between Estimating and Production

For our first estimate before making any pancakes, we used 30 minutes as a guess for the setup time and one minute for the cooking time per pancake. We will observe our cook for a period of weeks. We will use a stop watch and record how long it took to get the first two practice pancakes down his throat. Some batches might take five minutes, others 50. We’ll be able to determine a reasonable setup time based on experience. That’s our second tip with regard to setting time standards.

It’s the same thing with the run time. Even though the pan’s manual says that the pan can cook 85 cakes per hour, we have developed a stove setting and amount of lard needed to get the good golden lovelies that we’re famous for. When set up properly, the typical cake rate is indeed 60 per hour.

So, for those of you in the pancake job shop business, you’re good to go (see Figure 2). With the rest of you, I’ll go out on a limb and presume that you already have established time standards for all of the services you offer. You probably have slightly different views on setup and run time, and you may not make a distinction in rates for different operations. We’re offering a benchmark, not necessarily a recommendation.

As mentioned in previous articles, review of performance is a vital part of the estimating system. As completed work orders get processed, the estimator should get some feedback as to how well the estimate matched reality.

Values to Use for Labor and Machine Rates

If you’re hoping I’ll tell you that you should be charging $45 per hour for a particular job shop operation, you’re going to be disappointed. Your shop’s financial advisers and legal team are the only ones who can responsibly set these rates. The estimator will be told what values to use.

So, to those who are in the business of establishing these rates, forgive me for treading into your territory. It benefits the estimator to understand what is included or excluded from the given hourly rates. My recommendation to you is to discuss the details with your estimator to clear up any confusion caused by reading this article.

We’ve already discussed the difference between direct and indirect expenses. (Indirect expenses exist just to keep the facility available and ready, and direct expenses are those that are clearly attributable to a specific project, such as raw materials and expended labor.) For this discussion, we’ll arm our estimator with an hourly rate that will cover the indirect expenses for the shop. If possible, we’ll use annual historical data to determine how many hours the shop normally operates in a year. For that same time period, we could sum the indirect expenses as coded in the general ledger’s chart of accounts for expenses such as insurance, shop lighting, compressed air, and heating and air conditioning. A component of the shop labor could be included in this to cover housekeeping chores like sweeping and routine shop maintenance. Dividing this total by time gives an hourly rate.

The specific expenses that are included in the rate for indirect labor are likely to vary from shop to shop. Each manufacturing trade has its unique set of expenses. Even within a trade, each business has unique expenses—and unique competitive advantages—that make it imprudent for a magazine article to presume to detail. Suffice it to say, this “overhead” rate will be important to help the estimator cover shop expenses.

To establish a specific labor rate for each operation offered as a service by the manufacturing line, we might start with the indirect labor rate and add to it a constant to cover extraordinary wage, training, or other human resource benefits that are unique to this operation. Thus, the rate for the labor of setup might be different from the labor rate for cycling the machine. The labor rate for a technology-intensive process is likely to be different from that for operating a hammer.

What Should I Charge?

When establishing the machine rate for each operation, we tread into the shop’s financial strategies. Call the boss. We’re out of our area of responsibility. For the purposes of our discussion, our shop expects each machine to generate positive cash flow and to contribute to the profitable and smooth operation of the business.

The machine ties up capital. It transforms cash into an illiquid asset. In effect, the business “loans” money to the machine for the life of the machine. The machine has to pay back that loan before it dies. At least, that’s the plan.

The purchase cost of a machine includes its price, in addition to any interest, freight, rigging, millwrighting, foundation work, electrical hookup, training, and other expenses that are specific to getting this machine ready as a service offered by the job shop.

As the machine ages, it loses value. The business reports this drop in the value of the asset in the form of a depreciated value for the machine. For accounting purposes, the machine’s value will depreciate to zero. How fast it does that depends on certain accounting decisions. Our example shop has opted to depreciate its machine over a period of five years for tax purposes.

The shop might make a strategic decision to include the depreciation expense when calculating the machine rate. This basically calls for the machine to cover the cost of its replacement during its lifetime, while also covering the owner’s operating expenses and financial goals.

While that might seem luxurious, consider what a financial person might do with $100,000 in cash. One option is to purchase a certificate of deposit that after five years pays $3,000 in interest, and he gets the original $100,000 cash back. We’d want our machine investment to perform at least that well—hopefully, much better!

Our Hour Strategy

While the strategic decisions are being made, we must guess how many hours this machine will operate in its lifetime. That is not the same as how many hours this machine will exist. It will operate only a fraction of each day. Maybe that fraction is something like 19⁄24, but unless it works around the clock without stopping to wait for people, it will not have a 100 percent capacity utilization.

After determining how much capital the machine has tied up, we can divide that by the number of hours the machine will work in its lifetime. That is the rate of return per hour that this machine has to capture. This represents a significant portion of the machine rate that our estimator will use.

We would be delighted to hear from you to help us improve this discussion of estimating. If you have any observations on this subject matter, please let us know.

Gerald would love to have you send him your comments and questions. You are not alone, and the problems you face often are shared by others. Share the grief, and perhaps we will all share in the joy of finding answers. Please send your questions and comments to dand@thefabricator.com.

About the Author

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI