- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

TPJ’s 2012 Industry Award Winner: Chicago Tube & Iron

Service center, fabricator, survivor, innovator prepares for second century of challenges, growth

- By Eric Lundin

- March 5, 2012

- Article

- Shop Management

Launching a small business is a tricky venture; sustaining one even more so. Approximately 44 percent fail during the first generation of ownership; 40 percent fail in the second generation; 15 percent fail in the third. It goes without saying that the 1 percent of companies that survive into the fourth generation are blessed with dynamic leadership that focuses on customers’ needs now while keeping abreast of trends that will affect the company in the future.

TPJ’s 2012 Industry Award winner, Chicago Tube & Iron (CTI), is one of the 1 percent of businesses to survive, and even thrive, in its fourth generation of ownership. Not only does the company have a 100-year heritage, but it has achieved a profit during every year of its existence.

When it was founded in 1914, its business model was mainly a matter of taking large deliveries of tube and pipe from mills and selling small quantities to manufacturers and utilities; it also did a little fabrication work on the side. Now it is a modern service center, fabricator, and power boiler manufacturer with engineering services.

Its business model hasn’t changed much since it was founded, but the many technological innovations over the last 100 years have changed nearly everything else about the company. Sawing has given way to six-axis laser cutting; cutting tolerances have fallen from ± 1⁄8 in. to ± 0.005; the company’s diesel-powered tractor-trailers have replaced the original delivery system, a horse and cart. Even secretarial work, which in the early days was little more than answering telephones and filing, has given way to word processing, spreadsheets, e-mail, and so on.

“We’ve been involved in fabrication since our founding,” said the company’s president and CEO, Don McNeeley. “Fabrication today is quantum physics—six-axis lasers with sophisticated programming. Fabrication in 1914 was a blacksmith shop; we forged with hammers. Chicago Tube & Iron’s history is the history of the American Industrial Revolution,” he said (see graph).

A History of Innovation

The world was a different place when CTI was founded. Chicago’s population was just over 2 million (today the Chicago metropolitan area has 9 million residents). Little more than a decade had passed since Henry Ford founded the Ford Motor Co. and the Wright brothers achieved the world’s first powered flight. Cities were still compact; urban sprawl and the rush to the suburbs would come much later. It was in this environment that the Haigh family founded the company to serve the growing manufacturing industry. Then, as now, shipments from steel mills were entirely too large for manufacturers, creating an opportunity for a service center.

The company grew steadily and methodically. Every time a residential building in its vicinity was put up for sale, CTI purchased it. If it didn’t need the space right away, it rented the residences to its workers; when it needed the space, it waited until the leases expired, then razed the buildings. Eventually it had a dozen buildings spread across 16 acres.

As the company grew, so did its customer list. What started out as a short list of Chicago companies is now international. It has fabricated diverse parts for applications such as power generation (conventional, such as power boilers for fossil-fuel plants, and nuclear, specifically fuel rods for the U.S. Navy); military equipment (155-mm tank barrels and aircraft pitot tubes); communications equipment (rooftop antennas for cell phone systems); and fire suppression systems (for motorsports and construction). The company has fabricated architectural and structural components such as the Golden Gate Bridge (Oakland); Centennial Olympic Park (Atlanta); the Harold Washington Library, which is the largest public library building in the world (Chicago); and The Rookery, which was designated a Chicago landmark in 1972 after being added to the National Register of Historic Places in 1970. Its crowning achievement was launching some of its fabrications into outer space; CTI landed a contract to fabricate components for Space Shuttle landing gear.

What Keeps a Business Thriving? While no single person is responsible for a company’s culture and direction, there is little doubt that McNeeley is instrumental in the company’s success. After a short-lived minor-league baseball career, he took a position filling orders at CTI in 1972. His background wasn’t anything special—he was a high school graduate from a blue-collar neighborhood in Chicago—but it wasn’t long before he caught the attention of CTI’s owner at that time, John Haigh, who encouraged McNeeley to continue his education. Haigh probably had no idea how seriously McNeeley would take his advice. After completing a bachelor’s degree in business, he earned three additional degrees—an MBA, an M.S. in organizational behavior, and a Ph.D. in business economics.

McNeeley’s other vocation, adjunct professor at Northwestern University, Chicago, is evident when he describes how the company has grown and changed over the years. He charts a typical company’s growth on a standard two-axis graph; the two axes are age and profitability. The growth is zero when the company is young, rises to a plateau at middle age, and returns to zero in its old age. The peak is a point of inflection, or a turning point, which is a concept McNeeley learned from J.P. Kotter, one of his professors at the Harvard Business School.

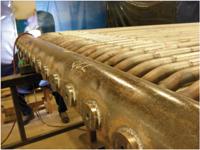

Creating a boiler system is a lot more than cutting, bending, and welding. Careful measurements, layout, and fixturing are necessary before striking the first arc.

McNeeley set his sights on the points of inflection; this is where he tries to disrupt the pattern, breaking free of the growth-plateau-decline curve by launching a new initiative. McNeeley strives for growth-plateau-growth. The disruptions come in two flavors: technology- and strategy-driven.

The CEO explained that disruptions aren’t small, incremental steps. When one service center adds inventory, the competitors follow suit. When one service center adds more saws, the competitors do too. He looks for big, bold moves that fundamentally alter the company’s business model. He discussed the company’s history by describing three points of inflection.

Stacks to Racks. Located in downtown Chicago for 90 years, the company eventually was spread out over six city blocks. In the early days most of its customers and all of its employees were local, so it was the right location, but inefficiencies developed over the decades.

“We had 12 warehouses, 24 foremen, 24 assistant foremen, and 35 overhead cranes,” McNeeley said, discussing the hassle of working in 12 separate structures. “We segregated the material by building, so we’d move the truck to the material.”

It was actually more complicated than that. It wasn’t that long ago that service centers stacked their inventory throughout the facility. Murphy’s law was at work; it seemed that the material needed to fill the next order was always at the bottom of the stack.

In addition to these internal challenges, many of the company’s customers drifted to the suburbs over the years. As the population of Chicago grew, traffic became increasingly congested, adding to the time needed to transport each order. The upshot is that, for most local orders, the delivery time was two to three days.

A move in 2005 to Romeoville, a suburb 30 miles outside of Chicago, put everything under one roof, sweeping aside all these problems at once. CTI installed a vertical rack system so that every inventory item is in a compartment with like items, readily available, not buried under other material; the driver parks the truck once, not several times; transportation distances are shorter; and traffic flows a lot faster out in the suburbs. Now the company makes most deliveries the next day, and in some cases on the same day.

The rack system also instituted a fundamental change to the company’s accounting. One of the service center industry’s metrics is sales per square foot of inventory space; the rack system changed the metric to sales per cubic foot.

Boiler Systems. CTI has long provided material for heating systems; boiler tube was one of the original products the company inventoried in 1914. By the late 1920s, the company was offering a product that was unique at the time: bent pipe for boiler applications. This continued for decades, until the company realized that it was losing some sales to competitors that offered subassemblies welded in accordance with boiler code.

CTI knew it had to start offering this service, and it knew the three choices it had in acquiring new expertise: subcontract it, buy it, or learn it. McNeeley pointed out that subcontracting means having less control over quality, lead-times, and costs. It also leaves the contractor vulnerable, because the subcontractor can steal the customer. Buying a separate company wasn’t a bad strategy, but CTI didn’t want to bite off more than it could chew. It elected to develop the expertise in-house, and in 1989 it shipped its first subassembly made to code.

In addition to fabricating boiler systems, Chicago Tube & Iron provides engineering services for projects such as this header, which the company redesigned to overcome problems with premature failure and leaks. The header and hand holes are made from 8-in. Sch. 160 A106 Grade B pipe for a waste-to-energy facility.

Eventually the company dedicated space and other resources to create a separate business unit, the Industrial Boiler Division. Bending and welding are the two main processes involved. The scope isn’t even recognizable when compared with its original projects. Its smallest clients are commercial buildings that use boilers for heat; its largest are power utilities that use massive power boilers to generate electricity. A typical project requires six or seven truckloads of steel and 10,000 labor-hours.

Additionally, the company opened a separate facility, CTI Power Division, dedicated to making assemblies to ASME code.

Fabricating Services. CTI has provided value-added services since the company was founded. Those efforts were small and grew slowly. When it made a decision a few years back to expand its fabrication service offerings and create a new business unit, the General Line Fabrication Division, it knew the change might do more than just raise a few customers’ eyebrows. CTI didn’t want to compete with its customers, and equally important, it didn’t want to appear to compete against its customers.

In reviewing many of its customers’ capabilities, CTI noticed that most of their machines were below a specific price threshold, so it elected to buy equipment many of its customers couldn’t justify. CTI made its intentions clear to its customers: It would purchase equipment outside its customers’ interest or beyond their ability to justify, thereby not competing in their space.

“We do walk a fine line, but we’re extremely sensitive to the perception that we could be in competition with our customers,” said Bruce Butterfield, general manager of the Industrial Boiler Division. “We have the ability to go out and spend $2.5 million on an unbelievable piece of equipment, and we’re giving them an opportunity to reduce their costs. We can help bring lean manufacturing to their facility, or we can help reduce their inventory costs by providing a finished part, in a kit, that they can take straight to their welding station. We had a customer making some frames by doing some cutting and mitering, and it was taking them about eight man-hours to put each one together. We did some engineering work, created a part with tabs and slots, minimized the fixturing, and we deliver kits that go straight to welding. We reduced their time to one man-hour,” Butterfield said.

Equipped with six tube lasers, 15 benders, 17 saws, 18 welding units, seven threading machines, propane torches, and an oven, CTI can provide bending on workpieces up to 6 in. dia., laser cutting, gas metal arc welding, gas tungsten arc welding, hot bending, heat treating, and so on. By cooperating with its customers, CTI has created a situation in which requests for bid flow in two directions. CTI’s customers can bid on jobs beyond their capacity and subcontract the work to CTI, and when CTI receives a request for quote for a job appropriate for one of its customers, it sends the bid downstream. As long as the customer respects that understanding that CTI will be the supplier of the raw material, CTI benefits once. If it provides the material and some of the fabrication service, it benefits twice.

Steve West, general manager of the General Line Fabrication Div., pointed out that CTI’s customers also benefit twice when they outsource a difficult or cumbersome job that CTI has the equipment to handle efficiently.

“As we came out of the 2009 doldrums, many of our customers were wondering how they would ramp back up,” West said. “The comeback created more opportunity for us to do first-, second-, and third-tier operations for them, so they can take an employee off of receiving or cutting and assign them a job that provides more value, so they also get more output per man-hour.”

CTI’s caution in choosing the right value-added services paid off, according to McNeeley. “We didn’t lose a single customer when we added all these fabrication processes,” he said.

McNeeley is extremely candid when describing how the expansion of fabrication services played out on CTI’s balance sheet in 2009.

In addition to rotary draw bending, Chicago Tube & Iron provides tube and pipe rolling. A typical application is a length of 2-in. by 4-in. aluminum tubing rolled the hard way to make a support for a street lighting fixture.

“If we hadn’t moved up the food chain of fabrication, not only would Chicago Tube not be the company it is today, it wouldn’t be a company at all,” he said.

Creating Jobs, Creating Careers

“First and foremost, we create jobs,” McNeeley said. “Laser operator, for example—that’s a job that barely existed 10 years ago.” The CEO has an abiding interest in purchasing more equipment, thereby creating more jobs. “If we buy a laser machine, we create four jobs,” he said. CTI’s executive team has been doing this in a big way. It invested $80 million in facilities and equipment over the last six years, all funded by cash flow, not loans.

CTI’s recent acquisition by Olympic Steel, a strategic move, is likely going

to help create even more jobs. The main reason for the acquisition had to do with complementary products and services.A billion-dollar company that specializes in stocking sheet, plate, and structural

sections, Olympic complements CTI’s emphasis on tube, pipe, and fabrication. This enables both companies’ customers to do one-stop shopping. The acquisition also gives the executive team at CTI access to substantial financial capital, enabling them to make even bigger, bolder moves.“Now we can think in terms of putting in not one machine at a time, but several machines at a time,” McNeeley said.

These aren’t just jobs, though. These are careers. The positions pay well, and McNeeley makes tuition reimbursement, the vehicle that propelled his career, available to every employee. He sees it as an investment, not a cost.

CTI’s culture takes care of the employees in other ways too. Monthly training, combined with cross-training on key equipment, allows employees to improve and expand their skill sets. Regular housekeeping and safety audits keep the shop floor running smoothly and reduce mishaps. The company reports that it has reduced the number of accidents by 50 percent in the last four years.

The Next Point of Inflection

When asked about the next point of inflection, McNeeley was ready with an answer. His concern isn’t an emerging technology, a disruptive business practice, or a sudden change in customers’ needs. He’s focused on something much more general, a two-pronged problem that already has had an effect on manufacturing and related industries, and likely will do so for years to come. He’s keeping a close eye on the forces that affect the future of manufacturing.

“Of all the manufactured goods consumed in America, what percentage is produced in America?” he asked. “Seventy-five percent. Manufacturing is much more vibrant than the media tells people. The news media tracks manufacturing vibrancy by employment levels, but that totally ignores the technological productivity improvements. Consider the steel industry. It had 600,000 employees in the early 1970s, and it has 100,000 now, but it’s putting out 30 percent more steel,” he said.

“Over the next 10 years, we won’t make 75 percent of the manufactured goods we consume,” McNeeley continued “It will be 95 percent or 40 percent. If it goes to 95, the questions will be: Where will the tool- and diemakers come from; where will the welders come from; where will the people with math skills come from?” McNeeley feels that these jobs are likely to go unfilled because the media’s attention is solely on employment numbers, leading many to think that manufacturing is already in serious decline in the U.S., scaring off many potential employees.

The government is likewise culpable, according to McNeeley.

“CTI pays taxes, and a big portion goes to support the school system, and the school system produces a product that in some cases has little market value,” he said. “For example, if the market demand is for green widgets, why produce blue? The market demand today is for math, science, and technical skills, yet our academic system is not producing to demand. Subsequently we have to pay to train people to work here, so that is in effect double taxation.” He cited compliance with ever-more-stringent accounting rules, notably those associated with the Sarbanes–Oxley Act, as consuming a substantial amount of money that could be better spent on equipment and training.

“The next point of inflection is going to be a matter of dealing with these effects,” he said.

New Digs

If you’re outgrowing your present location, how do you find the best locality to break ground for a new site? If you’re Don McNeeley, Ph.D., adjunct professor of economics at Northwestern University, Chicago, you don’t do all the legwork yourself. You put together a team of graduate students to analyze your customers’ locations. Trucking tube and pipe over great distances gulps up fuel and time, so if your customers have moved away from you over the years, you should follow them. This is what the students found and what CTI planned to do.

McNeeley also thought about how a move would affect his employees. Would a move make the company profitable yet make the employees miserable? McNeeley had a second group of students map out his employees’ home locations.

When the two groups of students compared their findings, it became clear that the customers and the employees had been drifting away from downtown Chicago. Moving the company would actually benefit both groups. To determine the best location for the company, the first group drew a perimeter that would minimize delivery times for the customers; the second drew a perimeter that would minimize commute times for the employees. The perimeters overlapped in a suburban area about 30 miles southwest of downtown, which is where CTI moved in 2005.

Lessons From the Professor

Don McNeeley has merged his two vocations to the extent that Professor McNeeley makes a point from his business class, and President McNeeley explains how it plays out at CTI. Not a day goes by that the executives, managers, and line workers don’t pick up an insight or a perspective plucked from Professor McNeeley’s classroom, delivered without pretense or fancy academic jargon in President McNeeley’s down-to-earth style.

- “Willingness, capital, and talent are the three ingredients for success in any endeavor,” Professor McNeeley said. President McNeeley explained that the company saw an opportunity to add laser cutting services, and it had the willingness and capital to purchase a machine, as well as several potential operators it could train.

- The professor was concerned that many of CTI’s customers, who are metal fabricators, would feel the heat of competition from CTI’s expanding value-added services. The president reviewed CTI’s customers’ capabilities and ensured CTI purchased equipment that wouldn’t duplicate them.

- The CEO mused about trading in the company’s laser machines for new models. The professor cautioned that the manufacturer could refurbish the old machines and sell them at discounted prices, allowing a new competitor to enter the field.

- President McNeeley used to brag that CTI’s employee turnover rate was almost nonexistent. A comment from a customer made him reconsider: “That’s too bad. Where do your new ideas come from?” President McNeeley understands that continuity is good; Professor McNeeley knows that a little turnover doesn’t hurt. “We try to be wary of group-think,” he said.

About the Author

Eric Lundin

2135 Point Blvd

Elgin, IL 60123

815-227-8262

Eric Lundin worked on The Tube & Pipe Journal from 2000 to 2022.

About the Publication

Related Companies

subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Zekelman Industries to invest $120 million in Arkansas expansion

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

HGG Profiling Equipment names area sales manager

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI