Contributing editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Notable quotes via CAR MBS 2022, Part I

How vehicle electrification is creating revolving roles and musical chairs for automakers

- By Kate Bachman

- September 22, 2022

The Center for Automotive Research’s Brett Smith queries panelists Reinhard Fischer of Volkswagen, Bob Kruse of Faraday Future, and Sandy Stojkovski of Vitesco Technologies North America at its August CAR MBS. Center for Automotive Research

If you want to know what is really going on in the automotive industry, where it is moving, and how fast, there is no better way than attending the Center for Automotive Research Management Briefing Seminar (CAR MBS). With automakers and industry insiders as speakers, you can get intel straight from the source—from the drivers’ mouths, so to speak.

At CAR MBS 2022, held in August in Traverse City, Mich., most sessions pivoted around, or intersected with, the automotive industry’s shift to vehicle electrification. The International Energy Agency released a new report which estimates that, globally, battery electric vehicle’s (BEV) market share increased from 4.11% in 2020 to 8.57% in 2021.

At the session, Now That We Are All in on BEVs, Who Makes What?, Perspectives on Shifting Technologies, Roles, and Responsibilities – Part I, panelists weighed in on the shift’s impact on the supply chain, considering that an EV has different—and fewer—components. Panelists were Volkswagen Senior Vice President, Strategy, Reinhard Fischer; Faraday Future Senior Vice President, Product Execution, Bob Kruse; and Vitesco Technologies North America (formerly the powertrain division of Continental) CEO Sandy Stojkovski.

STAMPING Journal brings you their words, verbatim.

Making the Transition

Reinhard Fischer, Volkwagen: Part of the transition of our portfolio to all-electric is the transformation of our factories. It’s a huge task. Our forecast is to start phasing out the assembly of ICE vehicles by 2030. But it’s not like you can stop assembling ICEs one day and start assembling BEVs the next day. It’s a transition, not a switch.

The market demand for ICE is going to go down, but it’s going down slowly. So you need to find the right balance between. To switch over from building ICE components to EV components, it’s a huge investment that the whole industry has to make. It’s a huge investment for the supplier base to make.

Sandy Stojkovski, Vitesco: We have a long history of supplying legacy products. It was about three years ago that we announced our new direction, our 2030 strategy. We were incredibly clear, almost brutally clear, internally and externally, that we were all in on vehicle electrification.

This has implications on our manufacturing footprint; which plants can convert their floor space to the next generation is a task. One of our big success stories is our big plant in Seguin, Texas. They have shown outstanding capabilities at manufacturing electronic control units at scale and quality. Now we’re going to convert some of that space to the recently awarded battery management system products. So, step by step, we’ll convert that.

That also has impacted our investments. While we still invest a small amount of our overall R&D capital into legacy products, our focus is on electrification.

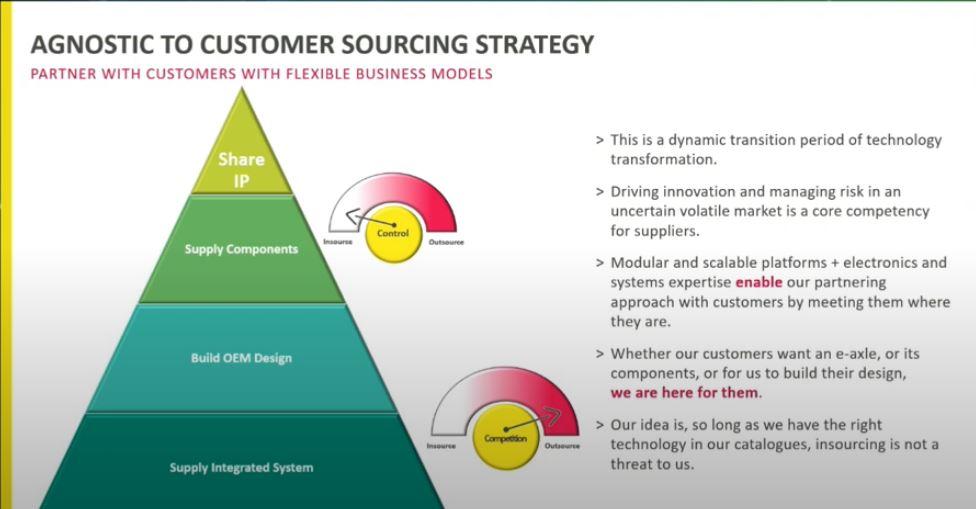

Vitesco views this time as a dynamic transitional period and has developed a model showing stages of how a supplier can be involved. Vitesco Technologies

This has implications on our manufacturing footprint; which plants can convert their floor space to the next generation is a task. One of our big success stories is our big plant in Seguin, Texas. They have shown outstanding capabilities at manufacturing electronic control units at scale and quality. Now we’re going to convert some of that space to the recently awarded battery management system products. So, step by step, we’ll convert that.

That also has impacted our investments. While we still invest a small amount of our overall R&D capital into legacy products, our focus is on electrification.

Bob Kruse, Faraday Future: It’s a little different for Faraday Future. We’re an EV startup. So we don’t have a lot of legacy-stranded capital that we have to worry about. But, being a startup, a lot of it is done in partnership with suppliers.

The world is changing. Everybody is gearing up and moving their capital to where they think it can make the most difference. The legacy OEMs, they’ve got to figure out what the right balance is for what they do in-house and what they leverage.

How EV Manufacture Differs from ICE Vehicles

Stojkovski: I think there’s an overall shift from having dozens and dozens of ECUs [electronic control units] around the vehicle to domain controllers and then master controllers. And that all fits within the electric vehicle architecture approach.

Fischer: We have a completely new assembly line for the ID.4 in Chattanooga, Tenn., because the way you build an electric powertrain is completely from how you produce it for an ICE car.

In an electric car, you get the opportunity to unify the electric architecture and have one that composes all the different elements of the car. That’s why we want to be in control of the electronic architecture.

Insource or Outsource?

Kruse: Some of it we design and have contract manufactured, like our power electronics, electric machines … other parts, like anti-lock brakes and airbags, we can get from the traditional automotive suppliers.

Fischer: The differences [between ICE vehicles and EVs] drive a lot of the questions. The big one is: “Make or buy? What do we build inhouse? What do we outsource?” If we outsource, our suppliers need to make sure that their components fit into our electronic architecture.

I don’t think it’s a contradiction. In fact, Volkswagen has always had strong and innovative relationships with its global suppliers - for decades. And that’s going to continue. It’s just a matter of making sure the electronic architecture in our BEV lineup can integrate everything.

Stojkovski: According to S&P Global’s estimates of what’s insourced and outsourced for some of these key components, DC onboard chargers and inverters show a high level of outsourcing as compared to motors, which have the opposite trend. A key point is that who makes what for the rest of the battery electric components depends absolutely on OEM’s strategies. So, as a supplier in the industry, we have to be able to address that.

As we think about insourcing versus outsourcing, you could say insourcing is an OEM’s attempt at having more control over their situation. It helps them perhaps meet commitments to labor, to gain initial value creation and scale, and understand the technology. Maybe it’s just a way to get the technology that they need in the early phase of the adoption cycle.

Whereas at the opposite side of the continuum, outsourcing is more focused on seeking to gain the benefits of competition, access to market-driven innovation, gaining the economies of scale that can be had from suppliers who can serve multiple customers, and mitigating risk. In this case, you’d say the OEM doesn’t have to deal so much with the technical or quality risks of the product, the volume risk, if perhaps the volumes don’t come, and the component costs from the supply base.

And so, this insourcing/outsourcing, control/competition pendulum … I think we’ve seen this movie before.

At one point there is a desire to insource, and at another point there is a desire to outsource. And so, we see this as a transformative time for the technology and therefore a transformative period of time for the business model. As a supplier, we want to be flexible and meet our customers where they’re at.

We made an announcement a few weeks ago that puts into context our thinking, as a global supplier, around what we should do in this situation. On July 12, we announced a partnership with Renault to develop power electronics and electric and hybrid motors together.

Scale for Cost Efficiencies

Stojkovski: We have components that we supply to eight vehicle manufacturers. The scale we can get supplying one component over eight vehicles is probably on par with—or larger than— what an OEM could get across their own volumes.

Fischer: We’re going to see a long-term a big benefit from our investment into one operating system that operates every car in the group, because that’s where scale is coming from.

You’ll be able to differentiate brands and models with the design of the car, the interior, the software, the experience. You can take the electric motors and different types that have different characteristics—let’s say comfort, or sporty—so that you can use those elements and have one common platform that can be scaled to build millions. You share the body shop and paint shop.

Kruse: Because we’re a low-volume manufacturer, we’ve developed our variable platform architecture where we have one 350-HP motor that we use three times: twice in the rear and once in the front to get 1050 HP. We can then configure it so it’s only one or two. It’s very modular. And then, because of the electric vehicle architecture, it’s easy to scale that for track width and wheelbase, so we’ll develop different vehicles on top of that. That gives us about a 60% reuse or greater from model to model.

Made in U.S., North America

Kruse: Our assembly plant is in Hanford, Calif. outside of Fresno. We’re starting to build our production intent vehicles. We’ve put in a sophisticated, modern paint system. Our closures lines are going in, followed by the final assembly line getting built for our body shop. All of our automation is in the body shop. The general assembly portion of the plant is more of a craft center shop. So, it will be a fully functioning, modern automobile plant.

We do a lot of our engineering and design in-house. But we do contract manufacturing where our intellectual property (IP) is. Our motors have a lot of IP that is contract manufactured. We actually build and assemble our own inverters in Hanford, Calif., then we send them to China where they’re integrated into propulsion systems, and then they come back. Most of our electronics are internally designed, and there are lots of contract manufacturers that can assemble circuit boards for you.

Fischer: From now on, all the ID.4’s will come out of Chattanooga, Tenn. We’re also in plans to electrify two other plants in Puebla and San José Chiapa, Mexico in this decade. So we will engineer and assemble locally in North America, especially for the U.S. For us that’s important.

Stojkovski: During COVID, manufacturers had to choose where to put their resources. Battery electric vehicles ended up at the top of their priority list. We find this in their product plans, and in their sourcing decisions. So, even in this [U.S.] market, we now find clients’ investments are large enough to justify local-for-local manufacturing.

Price Parity Is in the Battery

Fischer: The battery is the most expensive part of the electric car. Every dollar, every cent that you can optimize the price of a battery helps you with the pricing of the car, and your bottom-line profitability.

Kruse: We have not released who our battery strategic supplier is. But we have an advanced cell-to-pack technology that we’re using. As we go to commerce, I expect we’ll say more about our chemistry, our structure, and our battery supplier.

Stojkovski: Some of our key electrification products are the master controller, electric axle drive system, battery management system, integrated high-voltage box, high-voltage DC/AC inverter, and thermal management, so we cover the entire suite of high-voltage technologies. The one thing we do not get into are batteries.

Commitment to Zero Emissions

Kruse: Sustainability for Faraday is also our long-term strategy. It’s key to both our own operations and our supply chain. Typically, at the end of life of an EV, you still have 80% or so of battery life left. So, there’s a life after personal transportation that the battery can have. And then, all of the elements—it doesn’t matter which chemistry you’re using—can be recycled and reclaimed.

Fischer: The Volkswagen Group has communicated this with our commitment to the Paris Climate Accord. Internally, we call this our go-to-zero strategy. The objective is by 2050, we want to be CO2 net neutral. By 2040, we need to have a CO2 net product offering in the market. We’re working toward that. On top of that, we’re looking at the complete supply chain; the lifecycle of the car.

We just announced an agreement with Redwood to recycle the batteries if they’re not reusable for a second purpose.

Stojkovski: “Powering clean mobility” is our mission statement. Vitesco Technologies is all in on BEVs, and the way we do that is with a strong partnership with our combustion side of the business.

We’ve also taken very seriously the notion of lifecycle engineering for overall CO2 into our product design, and that is no small activity. It’s not something you do at the end. It’s something you do in the beginning and throughout.

When Is the Tipping Point?

Fischer: I think the thing we’ll see a year from now is an avalanche of new, exciting cars. When you look at all the announcements from OEMs, the pipeline is full. The Volkswagen Group brands plan to introduce more than 25 new BEV models to the American market through 2030.

Kruse: At Faraday Future, we’re in launch of our first vehicle, the FF91. It’s a top-of-the-line, leading-luxury vehicle. It will be followed by the FF81, which is a Model X competitor; the 71, which is a Model 3, Model Y competitor; and then we have a smart, last-mile delivery vehicle that we can do on the platform. A year from now, we will have delivered on our promise. We will be in commerce and have customers.

The electric vehicle has lots of enablers. It’s got very short overhangs; lots of interior passenger room. Combine that with maximum torque at zero RPM, and the ability to get your energy for vehicle transportation at home while you sleep or through the charge network while you drive.

It’s a totally different experience, and if you talk to early adopters of electric vehicles, they’re not going back. They’re here to stay and we’re way past the tipping point.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Kate Bachman

815-381-1302

Kate Bachman is a contributing editor for The FABRICATOR editor. Bachman has more than 20 years of experience as a writer and editor in the manufacturing and other industries.

Related Companies

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI