Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Sheet metal prices pull back from Q4 peak

Is it hot-rolled coil (HRC) in the $800/ton, the $700/ton, or the $600/ton range?

- By Michael Cowden

- February 14, 2024

Steel buyers haven't been as active in recent weeks as it appears they are waiting for hot-rolled coil prices to continue their decline. industryview/iStock/Getty Images Plus

There seems to be a bit of high-stakes chicken going on in the domestic sheet metal market. Prices have been moving lower for most of the year, but it doesn’t seem that big buyers are stepping into the market to restock.

What does it take to get buyers who can place orders for tens of thousands of tons (the kind of orders that stretch out lead times and provide a baseload of business for a mill) off the fence now? Is it hot-rolled coil (HRC) in the $800/ton, the $700/ton, or the $600/ton range?

Then there is the matter of lead times. Like sheet prices, they’ve also pulled back. One major steelmaker has been posting lead time sheets with a lot of dates in them. That would normally be unremarkable. But look back to October, and the same steelmaker had no dates listed in its published lead times. Just about everything was “closed” or “inquire.” In other words, time is back in lead time. People know they can get steel in a reasonable timeframe if they want it, so they feel more comfortable waiting for prices to come down.

That wasn’t the case for much of the fourth quarter. Recall in late September, the industry saw HRC prices fall to a 2023 low of $645/ton on average. Savvy buyers realized that, despite the ongoing United Auto Workers (UAW) strike, the downside risk to price was less than the upside risk. They also decided to get ahead of an anticipated price spike following a tentative agreement.

As a result, steel buyers loaded up on steel. That, along with fall maintenance outages, stretched out lead times, sent spot prices soaring during a time of year—November and December—which is usually slower.

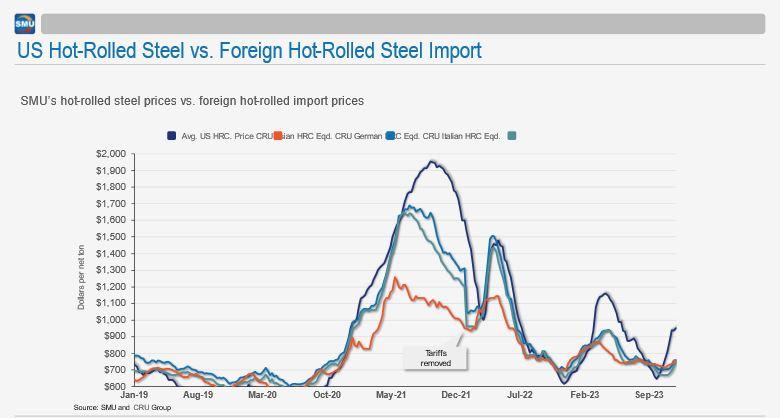

Some of those same buyers also might have taken note that U.S. HRC prices were at or below those of the rest of the world. As you can see in Figure 1, U.S. HRC prices have bounced up since the pandemic.

The U.S. typically dives briefly below world prices as it did in August 2020, late November 2022, and late September 2023. Then we shoot way above global prices again.

We’re now in the returning-to-earth phase of the cycle. We talk a lot about whether the Federal Reserve will pilot a soft landing or a hard landing when it comes to raising interest rates to reduce inflation—all without causing a recession. It’s a good analogy.

I don’t know whether U.S. HRC prices will see a soft landing or a bumpy one as they approach world prices, but it’s probably safe to say this: It’s a good buying opportunity once U.S. prices near world prices. Again, it should be noted that domestic prices rarely stay on the ground for long.

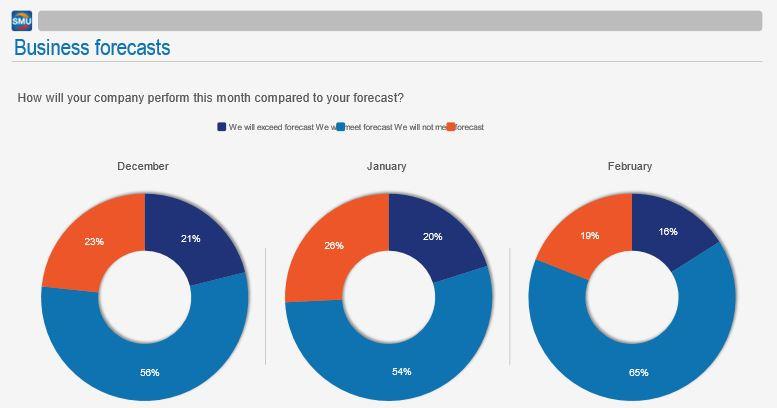

To be clear, a firm floor certainly exists. Economic indicators are generally positive. Also, as we’ve noted many times before, most buyers continue to tell us that they’re expecting to meet or exceed forecast (see Figure 2).

Figure 1. Hot-rolled coil prices for domestic steel typically don’t dip below world prices too often. When they do, a quick return to normalcy is pretty typical.

In other words, they’re still moving steel. But we’ve also seen a modest increase in the number of steel buyers decreasing inventories (see Figure 3).

How long can they wait for prices to fall before they risk inventories getting uncomfortably low? And then how quickly will mills roll out price increases after big buyers re-enter the market and stretch out lead times again?

If it seems like you’ve seen this movie before, you probably have. This is the kind of volatility that we’ve gotten used to in the U.S. sheet market in the years since the pandemic. The magnitude of the price swings might have moderated a bit, but it still makes the volatility we saw before the pandemic look like child’s play.

Wildcard: The UAW and Nonunion Automakers

The UAW negotiated new contracts with the Detroit Three automakers last fall, and the union has since made good on its pledge to try to organize nonunion automakers based on the historic gains it achieved with Ford, General Motors, and Stellantis.

The UAW is working to organize workers at Mercedes in Vance, Ala.; Hyundai in Montgomery, Ala.; and Volkswagen in Chattanooga, Tenn. A union official said a “clear majority” of the 4,000 workers at Volkswagen’s big assembly plant in Chattanooga wanted to form a union there.

I’m not going to handicap the odds of traditionally nonunion plants becoming UAW shops, let alone the odds of a strike, but it’s fair to say that labor activism isn’t going away anytime soon. I’d keep an eye on any UAW-related developments while also making sure that big-picture economic indicators continue to point in the right direction.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI