Contributing editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Tariffs stop short of helping stamping manufacturers

- By Kate Bachman

- March 27, 2018

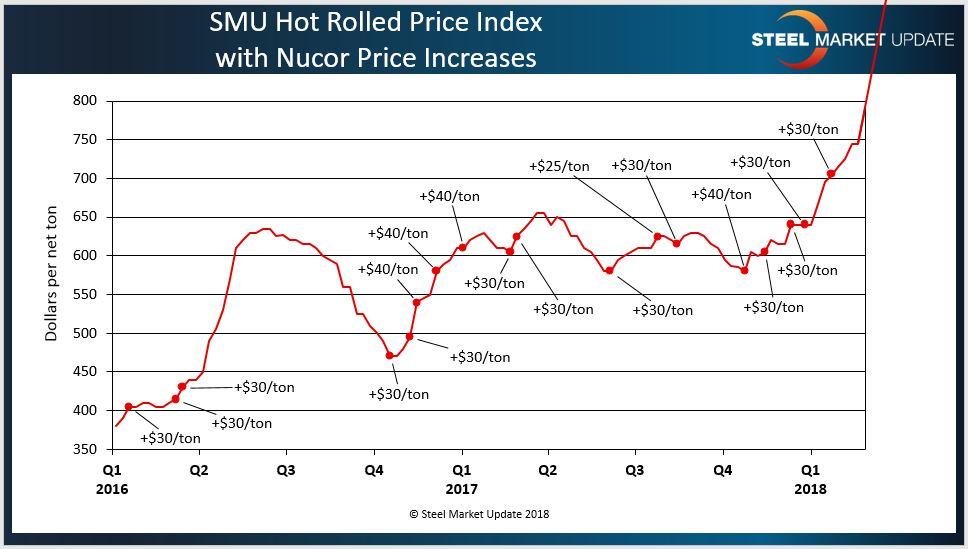

U.S. steel prices have risen from $400 a ton in 2016 to $700 a ton in first-quarter 2018. Graph courtesy of Nucor.

I was at the FMA Annual Meeting in Phoenix with 300 stampers and fabricators when President Trump signed the Section 232 order imposing a 25 percent tariff on imported steel and a 10 percent tariff on imported aluminum.

“This will be good for steel and aluminum, good for manufacturing,” he said.

Trump made no distinction between what is good for mills and what is good for manufacturing, but those two industry segments couldn’t be more diametrically opposed, from a benefit perspective.

The Case and Noncase for Tariffs

Steel industry representatives Chicago Tube & Iron Co. President Dr. Donald McNeeley and Ladd Hall, executive vice president of flat-rolled products for Nucor Corp., spoke at the event to defend their positions that the tariffs are necessary and deserved.

The Section 232 leans on the “defense” defense. The tariffs are to sustain American metals production for defense and in retaliation to “dumping,” particularly by the Chinese, enabled by subsidies and currency manipulation. But although China is the world’s largest steel and aluminum producer, its exports to the U.S. have been reduced to about 6 percent, according to economist/speaker Chris Kuehl.

President Obama imposed a 535 percent countervailing duty on Chinese steel in 2016. Today the top four steel exporters to the U.S. are Canada, Brazil, South Korea, and Mexico.

In addition, Hall claimed that the EU places a 27 percent tax on steel exported from the U.S. into the EU, although I could not find substantiation of that claim. Under global trade rules set in 1994, the EU imposes a 10 percent duty on cars and trucks, the maximum allowed. The U.S. applies a 2.5 percent tariff on imported passenger cars, the maximum it is allowed, and a 25 percent tariff on pickup trucks and work vans, according to The Wall Street Journal.

Hall’s and McNeeley’s courage in walking into what could have been a lion’s den of angry customers notwithstanding, their contention that the tariffs are unlikely to constrain supplies, escalate prices, and cause pain for their customers is not borne out by history, even recent history since the tariff concept was first floated.

Between a Rock and a Hard Place, Again

Attendees had several reactions.

“Prices already have gone up,” one fabricator stated. “I’m requoting jobs every day.”

Another fabricator expressed concern that domestic mills won’t have the capacity to fill the void of imported steel. Yet another suspected that mills would intentionally not ramp up production to tighten supply and jack up prices.

A fabricator relayed that he had ordered 90,000 pounds of plate steel earlier in the week. “Our service center sent us 10 plates and said they’d be sending a revised quote tomorrow.”

One attendee worried that the transgressors will circumvent the barriers by going through exempted Canada and Mexico, or by manufacturing components from the cheap steel and aluminum themselves, and then dumping those in the U.S., which would apply price pressures on U.S. fabricated components.

Another fabricator asked, “Wouldn’t it be better and create more jobs if we could use that cheaper steel to make lower-costing products? If foreign countries retaliate by placing tariffs on U.S. government-subsidized crops, stampers and fabricators supplying the agricultural segment are likely to face even tougher economics because farmers will be in a poor buying position.

Immediately following the signing, Cleveland Metal Exchange announced a surcharge increase in April. U.S. Steel announced that it started up a blast furnace at Granite City Works to expand supply. Nucor announced a new rebar mill in Florida.

Do They Go Too Far, or Not Far Enough?

The rock/hard place scenario in which U.S. stampers not only have to purchase higher-priced raw materials and dies, but also compete with foreign stampers using lower-priced metals and dies, leads one to wonder: Do the tariffs go far enough? What if they were extended all the way through the supply chain, including metal stamped components and goods? My nonscientific survey of several attendees said that would help.

Interestingly, on March 13, Trump proposed another round of tariffs—this time up to $60 billion specifically targeting Chinese-made telecommunications imports—in response to its intellectual property theft. Will metal stamped products, other than solar panels and washing machines, be next?

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Kate Bachman

815-381-1302

Kate Bachman is a contributing editor for The FABRICATOR editor. Bachman has more than 20 years of experience as a writer and editor in the manufacturing and other industries.

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Are two heads better than one in fiber laser cutting?

Fabricating favorite childhood memories

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI