President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Could steel prices soon hit $1,000/ton in the new year?

Metal fabricators could see steel price relief a few months into 2021

- By John Packard and Tim Triplett

- January 4, 2021

Because of increased demand for steel and supply shortages heading into 2021, hot-rolled steel prices have climbed to levels not seen in more than a decade. Getty Images

Flat-rolled steel prices finished 2020 on an incredible high—a seemingly impossible recovery from the incredible low seen in the spring when the coronavirus sickened the U.S. economy.

As of mid-December, the benchmark price for hot-rolled steel was fast approaching $900/ton, double the low seen in mid-August. For a market to rebound so far in just four months is unprecedented. Hot-rolled coil prices continue to set records in terms of the speed of this price cycle, reported CRU, Steel Market Update’s parent company.

The basic explanation for this unexpected turnaround is a lesson in the laws of supply and demand. Steel consumption has bounced back at a faster pace than available supply. Not only has demand risen, but these gains have come at a time when inventory levels were historically low and needed rebuilding to support the rising demand.

The steel mills were quick to idle furnaces and curtail production in the second quarter when the government ordered the shutdown of nonessential businesses to curb the spread of COVID-19. Since then they have been strategically judicious in how quickly they bring that idled capacity back. In addition, various mills experienced unplanned outages that further disrupted production. Combined with duties and tariffs that have discouraged imports, steel supplies tightened to the point where some OEMs and fabricators were willing to pay a big premium to secure desperately needed raw materials.

Steel prices have gotten so high that foreign material is now competitive, even with the tariffs. Many buyers have begun seeking alternative sources outside the country to meet their steel needs. Steel Market Update’s survey of the market Dec. 7-9 revealed that roughly one-third of buyers had already ordered foreign steel and one-third planned to purchase foreign, while only one-third intended to continue sourcing domestically.

“Foreign steel is growing in popularity,” said one respondent. “Some players are desperate and must buy at almost any price. I haven’t seen a market like this in over a decade.”

It’s just a matter of time before steel supplies, and therefore prices, begin to normalize. The question is when. The new year should bring increased steel production that eases the tight supply. Recent capacity additions include the November startup of the new electric arc furnace (EAF) at Big River Steel in Osceola, Ark., which doubles the mill’s capacity. U.S. Steel announced in early December that it was restarting the No. 4 blast furnace at its Gary Works facility in Indiana. Similar announcements by other mills are expected to follow.

CRU estimates that mill capacity increased nearly 18% by fourth-quarter 2020 from second-quarter levels. However, over the same period, apparent net consumption rose 21%, helping to explain the supply-demand imbalance that has driven steel prices so high. CRU forecasts that supplies will rise at a faster pace than demand in 2021 and that steel prices will peak in mid-Q1. In the meantime, there remains the potential for hot-rolled sheet to surpass the rare $1,000/ton mark last seen in 2008.

Blockbuster Deals

Blockbuster deals changed the steel landscape in 2020. Mining company Cleveland-Cliffs acquired two of the market’s biggest integrated mills—AK Steel and ArcelorMittal USA—making it the largest producer of steel sheet, plate, and slab in North America. U.S. Steel, the old-line integrated steelmaker, acquired Big River Steel, the newest and most modern EAF minimill, with the intent to pursue a unique “best of both” strategy.

These marriages of raw materials supplier, traditional blast furnace steelmaker, and scrap recycler have further blurred the competitive lines in the marketplace, making 2021 that much less predictable.

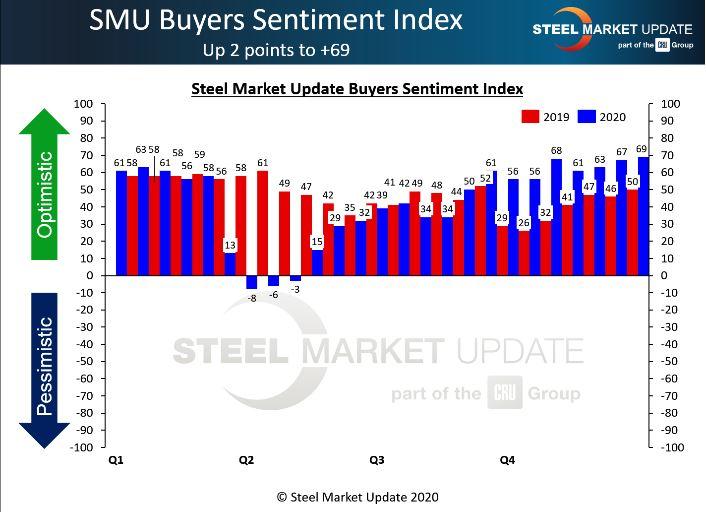

Every two weeks SMU asks steel buyers how they view their company’s chances for success in the current environment and three to six months in the future. SMU’s Current Sentiment Index registered a very robust +69 in mid-December (see Figure 1), while Future Sentiment was not far behind at +65 (see Figure 2). To put those figures in context, Current Sentiment plummeted to -8 and Future Sentiment to +10 in the second quarter shortly after the pandemic hit. The surprising rebound in optimism to near record levels mirrors the leap in steel prices and profitability. The optimism also may be a sign of relief over the imminent deployment of the COVID-19 vaccines.

What Steel Buyers Are Saying

When surveying steel buyers about their current and near-term feelings about the market, they are also asked to provide any feedback they might have. Here are some recent comments:

- “It’s going to be a record year on the upside and the downside.”

- “The domestic supply/demand imbalance coupled with the foreign supply/demand imbalance warrants these prices. Add higher raw material costs for electric arc and basic oxygen furnaces, and you have a perfect storm.”

- “This is 2004 and 2008 combined. Everyone is scrambling for steel, so they are doubling up on orders. Even OEMs have customers that are placing multiple orders because they are hedging their bets on who can get them the end product faster. Once that end product ships to them, they will cancel their order with the other OEM, and then this will ripple back through the steel supply chain. I truly see a possible 2008 price curve setting up. Remember, scrap and iron ore were also extremely elevated during 2008. Look at what the analysts are projecting for 2021. It all looks very familiar.”

- “The tightness in supply is what will hinder us in being successful. We can’t make a sale if we can’t get steel. It’s extremely ugly out there in the trenches.”

- “Once we get clear of the availability issues, which I expect will continue through February 2021, we will be in pretty good shape.”

Steel Market Update Events

SMU is working in partnership with Port Tampa Bay to host the 32nd annual Tampa Steel Conference on Tuesday, Feb. 2. The 2021 event will be on a virtual platform similar to the SMU Steel Summit Conference produced in 2020. The daylong program will include a variety of topical speakers as well as a speed networking session. Visit www.tampasteelconference.com for more details and to register.

SMU also will be hosting a number of steel training workshops in 2021, including the popular Steel 101: Introduction to Steel Making & Market Fundamentals Workshop and three new workshops on hedging steel price risk. For more information about SMU training workshops, email info@steelmarketupdate.com.

Not a Steel Market Update Subscriber?

SMU provides real-time pricing, news, and analysis of market trends affecting North American flat-rolled steel, plate, scrap, and related markets. To sign up for your free three-week premium trial, email paige@steelmarketupdate.com or call 724-720-1012.

Steel Market Update’s mission with its newsletters, website, conferences, and educational programs is to inform, educate, and motivate those in the flat-rolled steel industry. For more information, visit www.steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI