President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Pace of industry recovery boosts steel buyers’ sentiment

Steel service centers still don’t have a good feel for near-term steel prices

- By John Packard and Tim Triplett

- June 22, 2020

Even in the midst of the COVID-19 pandemic, steel service centers indicate that they are optimistic about increased demand from the manufacturing base. They are also keeping an eye on how quickly steel mills fire up operations again, which could lead to an oversupply in the market. Getty Images

Steel producers and distributors were frantic back in March when the government ordered the shutdown of nonessential businesses to stem the spread of the coronavirus, slowing orders to a trickle. Since then much of the panic has subsided. Just as the doctors now have a better understanding of COVID-19, steel executives now have better vision of the road ahead—and it’s not as bumpy as initially feared.

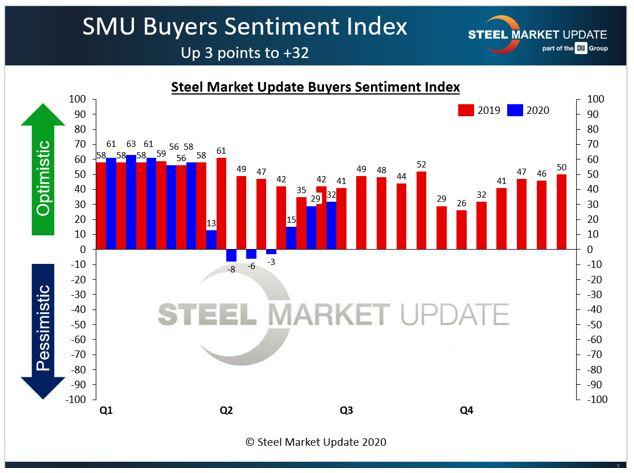

Steel buyers’ sentiment, as tracked by Steel Market Update (SMU), has shown dramatic improvement in the last three months. SMU asks buyers twice each month to rate their chances for success in the current environment and three to six months in the future. Shortly after the virus hit and the economy stalled, current sentiment plummeted into negative territory for the first time since the Great Recession. By the first week of June, it had recovered by 40 points to +32 (see Figure 1).

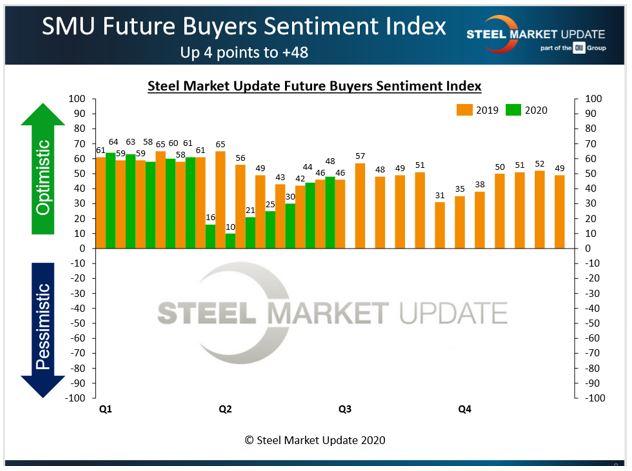

Future sentiment was even more optimistic, rising to +48, a level comparable to the same time last year when the coronavirus was not a factor (see Figure 2). Both current and future sentiment remain below historically typical readings in the +50s and +60s, but the trend is undeniably favorable (barring a second wave of the virus).

Sentiment is tied to the health of steel demand and steel prices. The market’s recovery has been much quicker than many expected, but it is still fragile and could easily suffer a setback. All eyes are on the steel producers, which to their credit were quick to curtail production when the virus undermined demand. Should the mills restart idled capacity too soon and oversupply the market, however, it could force down steel prices, devalue inventories, and turn buyer sentiment pessimistic once again.

Even in June steel buyers were beginning to express a degree of relief, telling SMU that business was returning to normal more quickly than expected. About 12% of those responding to SMU’s June 8 market trends questionnaire said their business had already returned to pre-COVID-19 levels. Another 33% anticipated a return to prior levels by the end of September. In general, about two-thirds expected the crisis to pass by the end of the year, while the other third were more pessimistic and said they believe it will be first-quarter 2021 or beyond before their sales recover.

Steel Demand

Steel demand is on the upswing three months after being decimated by the coronavirus restrictions. The majority of steel buyers (53%) responding to SMU’s market trends questionnaire in mid-June said they were seeing improvement in demand for their products. Another 38% reported that demand was the same/stable. Just 9% said they were still seeing declines in demand from their customers (see Figure 3).

Steel Prices

Steel prices also were improved as of June, but still struggling to maintain any real traction. When the government announced the coronavirus shutdowns, the benchmark price for hot-rolled steel plunged from its mid-March high of $580/ton to its late-April low of $460/ton—a decline of $120/ton, or more than 20%, in just six weeks. Spurred by two price increases from the mills in May, the hot-rolled price recovered to the $515/ton level in the first week of June, but then stalled.

As of June 15, SMU pegged the average price for hot-rolled steel slightly lower at $500/net ton FOB mill, east of the Rockies, with lead times for delivery of three to six weeks. Cold-rolled averaged $685/ton, with lead times of four to eight weeks. Galvanized was selling for $670/ton, with five- to 10-week lead times, while Galvalume was at $705/ton, with slightly quicker delivery. Prices for plate steel had moved up to $620/ton, with lead times of three to five weeks.Steel prices are almost impossible to predict, especially in light of the unprecedented market conditions related to the pandemic.

Not surprisingly, steel buyers could not agree last month on where steel prices were headed. The majority, 54%, predicted prices would stall at the current levels, while 8% expected prices to backslide. Yet a significant 38% said they expected prices to continue rising over the following 60 days (see Figure 4). As of this writing, SMU’s Price Momentum Indicator remained at neutral, waiting for the market to establish a clear direction.

What the Market Is Saying

As of mid-June, mills were beginning to announce plans to restart idled furnaces in anticipation of increasing demand. Many steel service centers are fearful the mills will bring capacity back online too quickly and oversupply the market, putting more downward pressure on prices and profitability. Following are comments from some steel buyers last month:

- “People in general are very concerned with the effect of capacity coming back. At the same time demand has improved significantly. The million-dollar question is if the return of capacity overpowers demand. With customer inventories a bit higher than demand, I figure the average buyer has about a month before they have to play ball again.”

- “Price momentum still rests mostly with the buyers. And with more capacity coming on, COVID-19 cases rising, automotive opening, and scrap supplies rising, I feel we will have a buyer’s market well into Q3 and possibly into Q2 of next year.”

- “I think price momentum is shifting more every day towards the mills’ favor. If, and that is a big if, they can keep the blast furnaces down for another month or two, they will solidify Q3 and maybe beyond.”

- “The integrated mills are stuck. They need higher prices, but demand is probably not strong enough to justify more capacity.”

- “I see a stagnant market for the next 30 days or so, then minor weakening. It will depend on the auto industry staying steady. If sales dip and furnaces are back online, we could see a surplus.”

- “Suppliers are well aware of what will happen if there is an imbalance of supply and demand.”

Steel Market Update Events

Out of an abundance of concern for the health and safety of attendees and employees, SMU has made its annual Steel Summit a virtual event. The conference will still take place Aug. 24-26, but in an online rather than an in-person format. Far more than a series of webinars, the event will use an online platform that will simulate the conference venue and allow attendees to network and communicate with each other in creative new ways.

SMU also is seeking nominations for the SMU NexGen Leadership Award. SMU is dedicated to helping businesses recruit, train, and retain the next generation of talent. Any young, motivated individual under the age of 35 who is currently employed by an organization that uses carbon steel as part of its core business function is eligible for this award, which is co-sponsored by the Steel Manufacturers Association. Nominating is simple. Complete a Word document defining what distinguishes the nominee as a next-generation leader and upload it.SMU hosts a Community Chat every Wednesday at 11 a.m. ET. Each webinar features different guests—analysts, consultants, economists, or industry executives—who share their unique perspective on the coronavirus pandemic and their advice on how to persevere through the difficult times. The webinars are free and open to all. Register for the next event. All the SMU chats are archived under the SMU Community Chat tab.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI