President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Raw steel prices continue to set new record highs week after week

Raw material availability starting to become a bigger issue for fabricators, other buyers

- By John Packard and Tim Triplett

- UPDATED January 31, 2023

- March 18, 2021

When steel coils are leaving the mill now, they are sometimes running behind deadlines. With lead times stretching out to 10 weeks, people waiting on steel are having to wait longer than they are accustomed to.

Signs last month that steel prices were beginning to lose steam proved premature. Price tags for flat-rolled and plate steel products have continued to move upward, setting new record highs week after week. Moving up along with steel prices are the anxiety levels of fabricators and manufacturers who must pay unprecedented prices for their raw materials.

Steel Market Update’s check of the market on March 8-9 showed the benchmark price for hot-rolled steel reaching $1,270/ton ($63.50/cwt), topping the previous high mark set in 2008 by $200/ton.

“This is crazy. I’ll tell you one thing, my customers can’t stay in business at these price levels. We’re having a hard time passing on the increases,” one manufacturer in the Midwest told SMU.

“Restricted supply with the current demand makes pricing anyone’s guess. There is nothing there to stop the madness, although we are reaching a critical cost/affordability point with customers. It could force some customers out of the game,” commented one service center executive.

When COVID hit last spring, much of the economy shut down to stop the spread of the virus. Since then, steel-intensive U.S. manufacturing has come roaring back—though steel producers have been judicious about ramping up production once again. Today, a year after the pandemic began, steel demand continues to outpace supplies. Buyers report extreme difficulty acquiring enough steel to meet their customers’ needs. Mills are scrambling to fill contract orders and have few tons available to offer spot buyers. Many service centers and OEMs have ordered foreign material—which is cheaper compared to the sky-high domestic prices—and a considerable volume of imports is due to hit U.S. shores in the next few months. Yet various mills have announced maintenance outages on furnaces and other equipment that will offset the imports to some degree and keep supplies tight, at least for the short term.

For many buyers, price is secondary to availability. “With basically no spot tons available from mills, it sounds like it’s service centers selling to each other between now and May or June,” commented one respondent to SMU’s March questionnaire.

The market has actually tightened further in recent weeks, observed another service center exec: “The U. S. Steel-announced blast furnace outage and the AM/NS Calvert outage in May are examples of why it’s difficult to get the capacity utilization rate much higher in this environment. With hot-rolled futures now over $1,000 through November, capitulation seems to have emerged and high prices may be here for a long time.” U. S. Steel has confirmed a 25-day outage in May at one of the two blast furnaces at its Mon Valley Works in western Pennsylvania. AM/NS Calvert had not responded to a request for confirmation about an outage there before this article went to press.

To offer some historical perspective, hot-rolled has nearly tripled from a low of $440/ton ($22/cwt) in mid-August last year. The previous high recorded by SMU in July 2008, before the financial crisis, was $1,070/ton ($53.50/cwt). That’s equivalent to about $1,280/ton ($64/cwt) in current dollars adjusted for inflation.

SMU pegged the average cold-rolled steel price in mid-March at $1,450/ton ($72.50/cwt), more than double the low of $635/ton ($31.75/cwt) last August. The former record high reported by SMU for cold-rolled was $1,150/ton ($57.50/cwt) in July 2008.Like cold-rolled, galvanized steel also reached a record price early last month of $1,450/ton ($72.50/cwt). That’s up from the pandemic-driven low of $630/ton ($31.50/cwt) last July and far exceeds the previous high of $1,020/ton ($51/cwt) in June 2008.

SMU’s average price for steel plate in mid-March was $1,120/ton ($56.00/cwt). Plate prices dropped from around $1,000/ton ($50/cwt) in January 2019 to a low of $590/ton ($29.50/cwt) in August 2020. While it has recovered sharply like the flat-rolled products, the price of plate remains well below the price of sheet, which is highly unusual. That speaks to the sketchy health of the major plate markets (such as energy and heavy equipment) when compared the stronger flat-rolled markets (automotive and appliance).

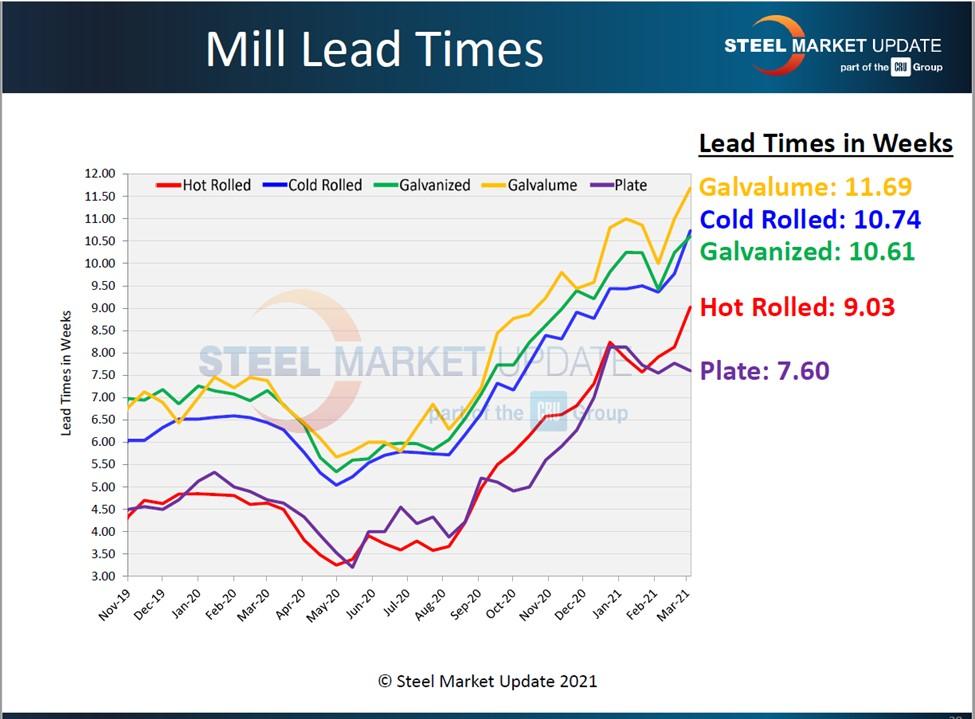

Figure 1. Lead times from the steel mills are increasing, and some steel buyers are reporting shipping delays. This is not a good time for metal fabricators that need steel in a hurry.

How Lead Times Affect Raw Steel Prices

One key indicator of steel demand is the lead time for spot orders from the mills (see Figure 1). The longer the lead time, the busier the mill. SMU data last month hinted at a possible plateauing in delivery times for orders placed with the mills. In fact, the opposite occurred, and lead times stretched out even further.

Lead time for spot orders of hot-rolled now exceeds nine weeks, while buyers of cold-rolled and coated products can expect to wait more than 10 weeks, which is double the normal wait time. Despite widespread expectations that mill lead times are overdue to reverse course as supplies catch up with demand, delivery times remain painfully long.

Buyers report that shipments from the mills are routinely late, beyond the promised delivery dates, adding to the difficulty they face in servicing their customers’ needs. “Not only are lead times extended, pretty much all the mills are running tardy too,” complained one service center executive, calling it “a nice little one-two punch by the mills to keep this rally alive and well.”

Another buyer also was critical of suppliers: “Stated lead times are longer than normal, and then most mills are running late two to four weeks on top of that. So, we’re paying outlandish prices for poor service and have seen more quality issues of late. They are relaxing their quality management parameters to get product out the door. Not a good strategy for them long term.”

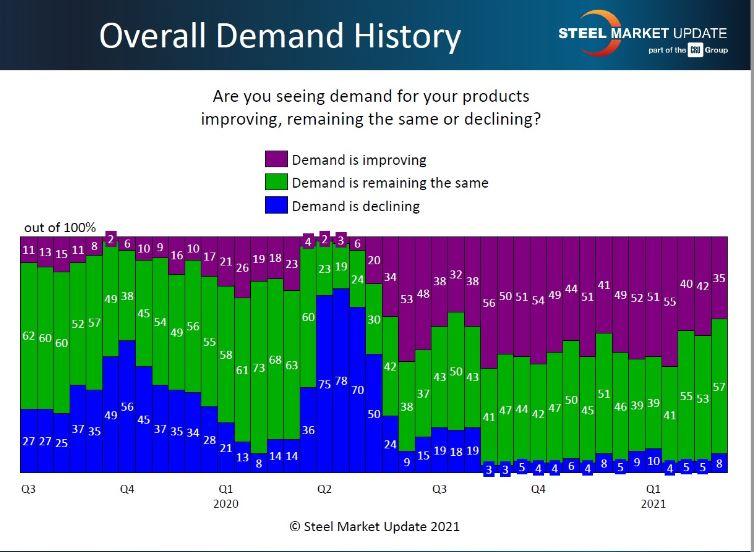

Of course, steel prices are a function of steel demand. SMU has been watching carefully to see if the record-high steel prices have begun to cut into order volumes. Certainly, some buyers are staying on the sidelines, postponing purchases today in anticipation of cheaper prices tomorrow. But SMU data shows little or no drop in demand in the marketplace (see Figure 2). Given the historic stimulus package just passed by Congress, and the boost it will no doubt give the economy, it may be well into the second half, if not into next year, before steel demand and prices begin to moderate.

Raw Steel Prices Q&A

SMU continually surveys the market. The following questions were posed to steel buyers recently. (Each question is followed by one comment that characterized the prevailing view in March.)

At what level do you think steel prices will peak? The most common belief last month was around $1,300/ton.

“If you look back at the SMU survey from mid-December, 93% thought we’d peak below $1,000. None of us truly knows—including the glorious analysts.”

When do you see prices peaking? About 60% see the peak by the end of April and 40% in May or later.

“If the steel mills have any hope of winning ‘Buy American’ loyalty, they should hold prices steady and restart any facility they don’t have producing. Otherwise there will be tremendous manufacturing/OEM pressure on the Biden administration to repeal the Section 232 tariffs.”

Figure 2. Steel demand has remained fairly consistent since the early days of the pandemic in the spring of 2020.

Have you seen any indications the record-high steel prices might be near a tipping point? Less than two-thirds see signs of a correction.

“Ongoing production issues at various producers continue to extend this market. There’s no reason to think we'll see a reversal of any kind until the supply/demand dynamic shifts back.”

Do you fear that imports and capacity additions over the next few months could oversupply the market and cause a sharp drop in steel prices? Only one-third anticipate a sudden correction in steel prices.

“There will be, of course, a correction coming, no doubt about it. But I don't think it'll be as quick/severe as we’ve seen in the past, and I don’t think it’ll really be a major problem until 2022. Everyone just needs to be smart and disciplined.”

SMU Conferences and Workshops

Presuming COVID inoculations continue apace, the annual SMU Steel Summit Conference will be in person Aug. 23-25 at the Georgia International Convention Center in Atlanta. Visit here for more information.To sign up for a free trial of SMU’s newsletter, contact paige@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI