Principal

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

COVID-19 closes in, stifling growth

Durable goods still holding up, but slump is coming

- By Paul Vivian and Rick Preckel

- May 5, 2020

- Article

- Shop Management

The primary pipe and tube category that Preston analyzes that is of interest to The Tube & Pipe Journal readership is mechanical tubing. This category includes conduit, off-the-welder tubes with wall thickness less than 0.156 in., hot-finished seamless, cold-drawn seamless, and drawn-over-mandrel pro-ducts. The applications are broad, as is the manufacturing base.

This isn’t to exclude other tube and pipe products. Indeed, all pipe and tube products are significant contributors to the U.S. economy. In total this year, pipe and tube shipments from domestic mills will represent about 14 percent of steel manufactured in this country. To put this into perspective, based on data researched by Preston, auto manufacturing will consume a similar amount of steel this year.

Manufacturing Performance

Durable goods manufacturing in March declined by 9.1% according to the U.S. Federal Reserve. Motor vehicles and parts manufacturing was down 28%, while fabricated metal products, aerospace, miscellaneous transportation equipment, furniture and related products, and miscellaneous manufacturing all fell between 8% and 10%. Declines in industrial production and manufacturing were the worst since the January and February 1946 readings, which reflected the demobilization after World War II. New orders for durable goods in March fell by 14.4%. Excluding autos and planes, durable goods orders fell by just 0.2%. While that news was better than expected, it is worth noting that every major category showed a decline except for communications equipment.

The March Manufacturing Report On Business, as published by the Institute for Supply Management, quantified the Purchasing Managers’ Index at 49.1 signaling contraction. The Index declined by one percentage point from the February level. The new orders index indicated continued contraction in March at 42.2%, down from 49.8% in February.

The production index fell by 2.2 percentage points from February to 47.7%. For more information, visit the site at www.ismrob.org.

While unavailable at this writing, April data will look much worse. Keep in mind the earliest stay-at-home orders in the U.S. were issued in California on March 16, and widespread closures didn’t happen until later in the month. U.S. GDP for the first quarter was a negative 4.8%, the worst since 2008.

Domestic Pipe, Tube, and Steel Mill News

Vallourec, Houston, is laying off 900 people in North America, which represents one-third of the company's workforce in North America. This follows public announcements of reductions in workforce by Tenaris, Houston, and U. S. Steel, Pittsburgh.

Evraz Oregon Steel, Chicago, announced that it would lay off 230 employees over the next two months because of a significant business downturn.

Piping systems fabricator Turner Pipe, Paris, La., has announced that layoffs will commence June 5 because of economic conditions associated with COVID-19.

Metal Matic, Minneapolis, a producer of mechanical, drawn-over-mandrel, hydraulic, and boiler tubing, is temporarily laying off 87 workers in Bedford Park, Ill.

Shipping and Imports

Overall pipe and tube shipments for the sectors of the market that we cover decreased in February by about 3.9% from January and were about 19% below February 2019 volumes. Imports decreased in February 2020 from January 2020 and February 2019 by about 28.2% and 50.8% respectively, while domestic shipments increased by about 5.4% from January but declined by 2.7% from February 2019.

Shipments of mechanical tubing products increased by 3.8% from January and 8.8% from February 2019. Imports fell 15.2% from January but increased by 26.1% when compared to February 2019. Domestic shipments improved by 10% and 5.1% in February 2020 as compared to January 2020 and February 2019, respectively.

While final data was unavailable at the time of this writing, shipment levels will be unaffected by coronavirus containment efforts in March but are likely to decline in April as the full effect of the economic shutdown kicks in. Imports continue to be affected by the Section 232 legislation and weakness in pipe and tube markets that typically have higher import share. It is worth noting that imports in the current month typically reflect orders placed three to four months prior. This suggests that import share may increase through midyear before declining. Rapidly declining demand combined with stubborn import levels is likely to result in an inventory build.

Hot-rolled Steel

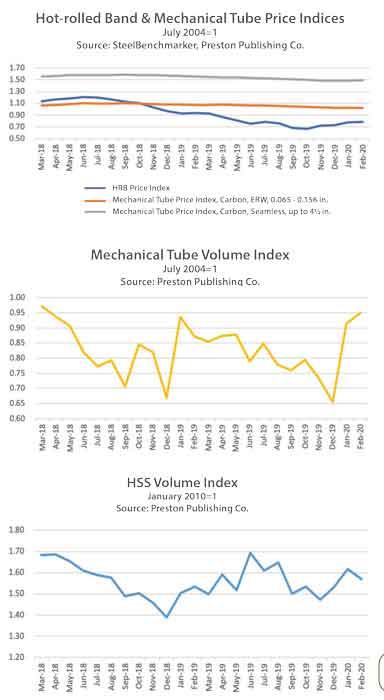

According to data from the SteelBenchmarker, the index for base hot-rolled band (HRB) prices remained flat in February at 0.78. As we noted in last month’s column, demand is now under severe pressure. A number of shutdowns have occurred but the latest data available suggests that our HRB price index in the next issue will be much lower.

About the Authors

About the Publication

subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Zekelman Industries to invest $120 million in Arkansas expansion

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

HGG Profiling Equipment names area sales manager

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI