Principal

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Tube and pipe shipments, overall jobs increase

Overall manufacturing continues to shrink in latest data

- By Paul Vivian and Rick Preckel

- October 29, 2023

The durable goods manufacturing output index increased in August by 0.1% after gaining 0.7% in the prior month, according to data from the U.S. Federal Reserve. Durable goods output is 0.6% above year-ago levels.

In August, tubing-intensive sector performance was mixed, with declines in the output of motor vehicles and parts (-5.0%); fabricated metal products (-0.4%); and electrical equipment, appliances, and components (-0.5%). These setbacks were offset by gains in machinery (+2.0%), aerospace and miscellaneous transportation equipment (+3.3%), furniture and related products (+1.3%), and miscellaneous manufacturing (+1.5%).

Primary metals output, affecting the availability and cost of pipe and tube raw materials, improved by 1.6% in August.

The September Manufacturing Report On Business®, as published by the Institute for Supply Management® (ISM®), indicated continued weakness in the manufacturing sector. In the latest report, the institute noted that the Purchasing Managers’ Index (PMI®) improved but stayed in contraction for the eleventh consecutive month, increasing 1.4 percentage points to 49.0. The September New Orders Index improved by 2.4 percentage points from the August level but also remained in contraction at 49.2.

The Production Index reading of 52.5 is a 2.5-point increase above August’s figure of 50.0 and led to a decrease in the backlog reading for September to 42.4 (down from 44.1 in August). Timothy R. Fiore, CPSM, CPM, chair of the ISM, noted, “The U.S. manufacturing sector continued its contraction trend but at a slower rate, recording its best performance since November 2022, when the PMI also registered 49.”

The five manufacturing industries that reported growth in September were nonmetallic mineral products; food, beverage, and tobacco products; textile mills; primary metals; and petroleum and coal products.

On the flip side, the 11 industries reporting contraction in September were printing and related support activities; furniture and related products; plastics and rubber products; paper products; fabricated metal products; wood products; computer and electronic products; machinery; electrical equipment, appliances, and components; chemical products; and transportation equipment. For more information, visit www.ismrob.org.

Domestic Pipe, Tube, and Steel Mill News

U.S. Steel announced that it was idling blast furnace B at its Granite City, Ill., steel plant. The company said it was a temporary measure in anticipation of reduced automotive steel demand.

In addition, U.S. Steel announced a formal process to assess its alternatives after receiving approaches for parts or all of the business. Later, Cleveland-Cliffs went public with its cash-and-share bid, which values the company at about $7.25 billion. ArcelorMittal and Stelco are also reportedly interested.

Shipping and Imports

Preliminary overall pipe and tube shipments in August for the sectors of the market that we cover increased from July by about 1.0% as imports weakened, primarily in the oil field pipe segment. These shipment numbers are subject to change as shipment data is finalized.

Compared to a year ago, preliminary August shipments were 3.1% lower, with similar percentage decreases in domestic and import supply. Manufacturing and construction product shipments in August increased by 6.9% from July, with import supply gaining the most from a percentage standpoint. Domestic shipments also improved. Manufacturing and construction product shipments were 0.7% below year-ago levels.

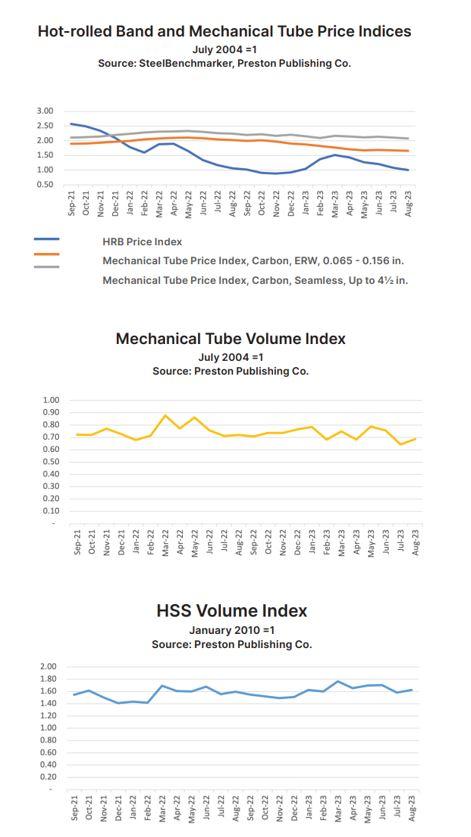

In mechanical tubing products, those most closely associated with manufacturing activity, August preliminary shipments increased by 6.7% from July but were 4.7% below year-ago levels as manufacturing activity continued to decline.

Outlook

The Fed kept the prime interest rate static at the September meeting and is evaluating a move at its November meeting. Economic headwinds include a restart of college loan payments, rising energy costs, slowing consumer spending on goods, and high interest rates that are weighing on capital goods purchases.

In addition, the UAW strike, in its fourth week as of this writing, already has caused $6 billion to $8 billion in economic losses to date, according to some estimates. Still, September job additions totaled 336,000 against forecasts of 170,000, and job additions for July and August were revised upward by a total of 119,000. Finally, the Hamas attack on Israel in early October, just days ago as of this writing, could have a further inflationary impact on fuel prices. After the September jobs report, analysts have raised the odds of an interest rate hike in November. On a bright note, according to a Bankrate survey of economists, the odds of a recession in the next year are the lowest since Q1 2022, at 46%. Flat-Rolled Steel According to data from the SteelBenchmarker, the index for base hot-rolled band prices moved down to 1.00 in August from 1.08 in July. Data suggests that prices have continued to drop.subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscriptionAbout the Authors

About the Publication

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Zekelman Industries to invest $120 million in Arkansas expansion

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

HGG Profiling Equipment names area sales manager

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI