- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Global shifts in economies make U.S. manufacturing significantly more cost-effective

- By Vicki Bell

- October 13, 2014

- Article

- Shop Management

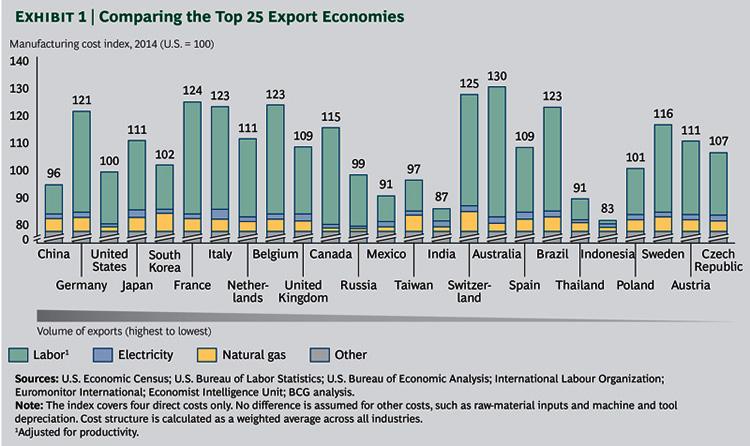

The Boston Consulting Group's recent report, "The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide," offers tangible justification for a resurgence of U.S. manufacturing. Areas traditionally thought to be low-cost—Latin America, Eastern Europe, and most of Asia—are losing ground to those thought to be high-cost—the U.S., Western Europe, and Japan—in terms of cost-competitiveness. In fact, China now has only a 4 percent advantage over the U.S.

As noted in the report, "Years of steady change in wages, productivity, energy costs, currency values, and other factors are quietly but dramatically redrawing the map of global manufacturing cost competitiveness. The new map increasingly resembles a quilt-work pattern of low-cost economies, high-cost economies, and many that fall in between, spanning all regions."

Justin Rose, a Chicago-based partner at BCG and one of the report's authors, recently participated in a Q&A with thefabricator.com about the findings.

thefabricator.com: Manufacturing cost advantages have declined in countries such as Brazil, China, Czech Republic, Poland, and Russia. Do you foresee this trend continuing in those countries? Do you expect it to spread to other low-cost countries, such as India?

BCG: In the long term, yes. But generally this is a good thing – the increase in wages leads to better living standards in low-cost countries, drives consumption, and ultimately creates more economic opportunity globally.

The key for low-cost countries is to balance those wage increases with productivity gains so that those workers are more valuable. The countries which have seen the bigger declines need to reinvigorate productivity growth to stem the loss of competitiveness.

thefabricator.com: The study reports that the U.S. and Mexico are "rising stars" in terms of cost advantage, in part because of lower energy costs resulting from the increase of shale gas production in the U.S. Environmentalists are lobbying to curtail this production. What is the likelihood of that happening, and how much would it affect the U.S. cost advantage if it did?

BCG: Low-cost energy has been a major boon for the U.S. It has created an enormous number of jobs, revitalized many rural areas, contributed significantly to stabilizing state and local budgets, and created greater energy security for the country. However, we also believe that the impact on the environment and on local communities needs to be accounted for and minimized as much as possible.

We believe there is enough headroom in the energy cost advantage that we can find a win-win path – meeting high-quality environmental standards, supporting the local communities where fracking [hydraulic fracturing] occurs, and still maintaining the vast majority of the economic benefits.

thefabricator.com: Labor also is mentioned as key to the growing U.S. competitive advantage, yet U.S. manufacturers continue to report difficulty finding qualified workers. Do you think this affects a company's decision to locate offshore? How does a company that wants to reshore, or to open a new plant in the U.S., go about ensuring a qualified workforce?

BCG: We hear this issue raised frequently. And we see shortages in some skilled trades and in some areas of the country; however, our analysis does not suggest a systemic shortage of skilled labor nationwide.

When we look at wage growth by job, we see few where there have been large spikes recently – which you would expect if labor was scarce and companies were competing heavily against each other. Where we do see spikes, it is typically in smaller cities or rural areas where the depth of the labor pools are smaller.

However, there is a broader point as well: the difficulty in finding skilled labor is an issue we see globally in Japan, Germany, China, and other major manufacturing economies. We recently concluded our annual survey of manufacturing executives and they report that they are 4.5 times more likely to move production to the United States to access skilled labor than they are to move production from the U.S. That is a pretty dramatic difference – and strongly suggests to us that the overall skill of the U.S. labor pool is still quite strong versus other countries.

thefabricator.com:

In light of the "dramatic and sustained shifts in wage and energy costs," and "reason to expect that volatility will continue, and that relative cost competitiveness will remain dynamic," how does a company plan for the future and make the best possible location decision?

BCG: Manufacturers considering where to build new capacity–even when considering only developed countries–must take into account an expanded list of considerations. For example, manufacturers need to think about the economics of the decision not just today but in the future. What is the lifetime of investment; what is the expected total cost of ownership; and what are the key assumptions that are sensitive to change?

Companies also should work to preserve future option value for unanticipated changes, such as the flexibility to expand or reduce manufacturing footprint quickly and ability to ship to a multitude of global markets cost-effectively.

About the Author

Vicki Bell

2135 Point Blvd

Elgin, IL 60123

815-227-8209

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI